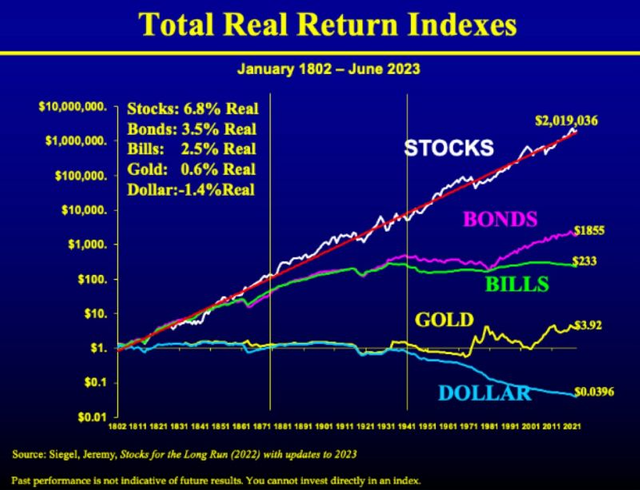

USD is the best fiat currency in the world. Nevertheless, over time, the USD value decreases. But, the performance of stocks can't be compared to cash, bonds and gold, etc.

This chart indicates 200y data. But, it doesn't include the BTC(Bitcoin) data. The below table shows that the BTC has a better performance than USD during the last 10 years.

I'll buy some BTC again in the next cycle's bottom. BTC has been proving the best anti-inflation currency in the world during the last decade. It will be the best currency in 21 century.

This comment is for rewarding my analysis activities. Upvotings will be proceeded by @h4lab and @upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @upex with a 100.00% upvote. We invite you to continue producing quality content and join our Discord community here. Keep up the good work! #upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @happycapital. you discuss a very important issue.Your point about the USD being the best fiat currency is valid, as it has been a dominant force in the global economy. However, as you rightly mentioned, the value of USD does decrease over time due to inflation. Stocks indeed outperform cash, bonds, and gold in the long run, making them a better investment choice.

The historical data over 200 years offers valuable insights, but it's important to note the absence of Bitcoin (BTC) data. Over the past decade, BTC has demonstrated exceptional performance compared to USD. As your table suggests, BTC has outperformed many traditional assets, proving to be a strong hedge against inflation.

Your plan to buy BTC during the next cycle's bottom is strategic. BTC has indeed shown resilience and growth, emerging as a significant player in the financial world. Its decentralized nature and limited supply make it an attractive option for those looking to protect their wealth from inflation.

The last decade has seen BTC establish itself as a leading anti-inflation currency. With increasing adoption and recognition, BTC has the potential to become a major currency in the 21st century. It's crucial to stay informed and make well-timed investments to capitalize on BTC's potential.

In summary, while USD remains a strong fiat currency, BTC's performance over the past decade showcases its potential as a superior anti-inflation asset. Your decision to invest in BTC during the next cycle's bottom could be a wise move, given its track record and future prospects.

best regard.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit