BoJ(Bank of Japan) rose the interest rate yesterday. After that, Lotte holdings has initiated the emergency management measures. Is it coincidental?

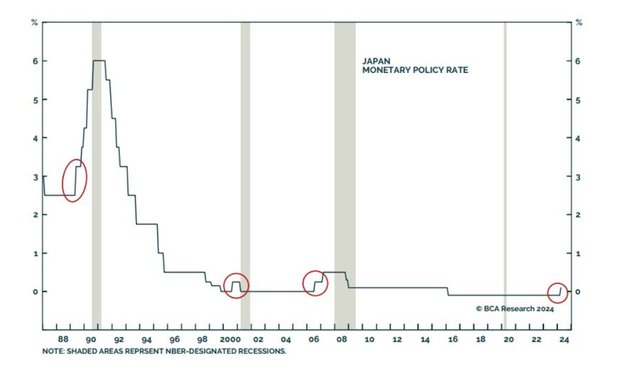

It seems that they're worried about a next recession. BoJ tends to rise the rate before recessions since 1988. Compared to other countries, they have been always late to increase the rate.

If this pattern repeats, it will be hard for most asset markets in the beginning of the next year. Nevertheless, I expect this Q4 semtiment will be better than now. If the crypto market is recovered somewhat, I'll be increasing my cash ratio, then, preparing risks related to a next recession, a price correction, and a consolidation.

If there's a recession, I think the crypto market will likely follow the COVID-19 pattern, which means after a crash, it will draw a V-recovery. Then, this market cycle will likely end Q2 ~ Q4 next year.

The most important thing is enduring the price volatility. But, before risks turn out, increasing cash ratio could be a nice method for enduring a difficult period.

This comment is for rewarding my analysis activities. Upvotings will be proceeded by @h4lab and @upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @upex with a 100.00% upvote. We invite you to continue producing quality content and join our Discord community here. Visit https://botsteem.com to utilize usefull and productive automations #bottosteem #upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit