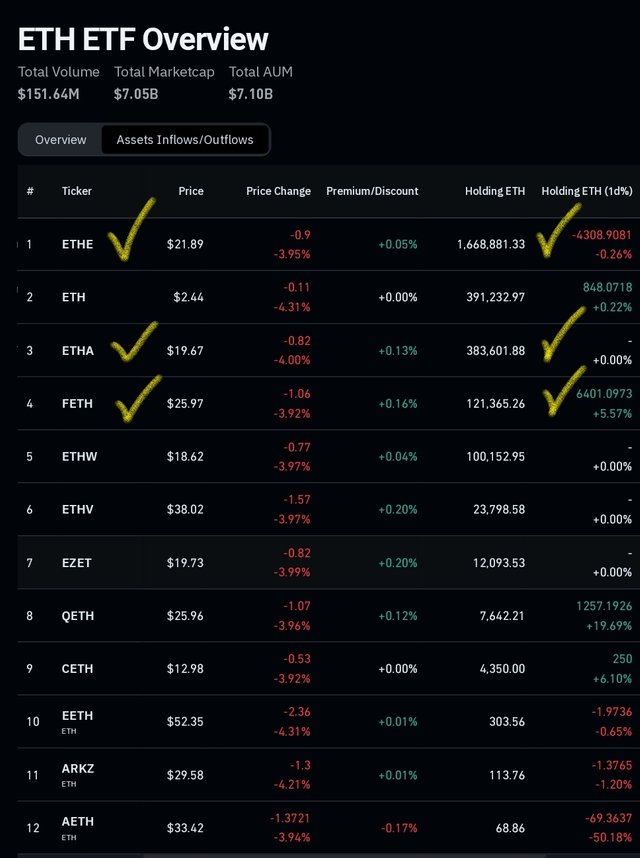

Once spot ETH(Ethereum) ETFs started trading at July 26th, Grayscale's ETHE was holding around 2.61m ETH. As time goes by, their ETH holdings have been decreasing due to 2.5% management fees.

On the other hand, other ETF managers provide much cheaper expense ratios less than 0.25%. So, I think investors are moving their investment from Grayscale's ETF to other ETFs.

But, ETH holdings of ETHA by BlackRock, and FETH by Fidelity are still less than Grayscale's ETFs. Nevertheless, I expect 2 months later, maybe this December, either BlackRock's EHTA or Fidelity's FETH will surpass Grayscale's ETFs. I assume that it will be a turning point for the next 3rd altseason

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

加密货币往往更多是为了割韭菜

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit