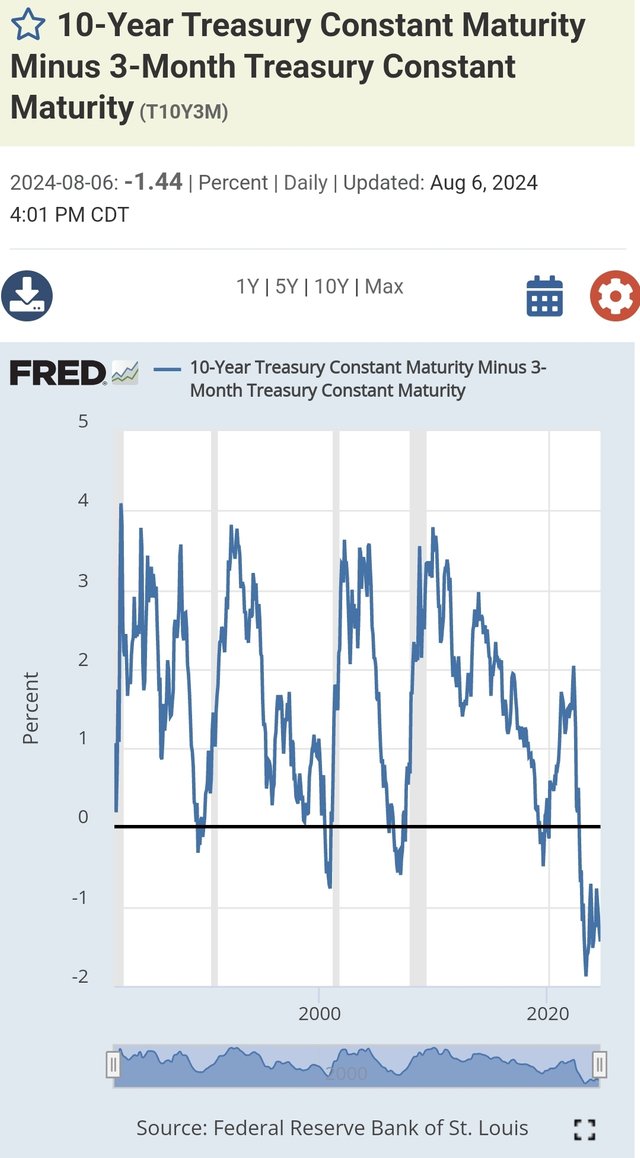

Take a look at the chart. The right before recessions occured, the yield spread between 10y-3m U.S. treasury securities has recovered from negative to positive.

In this cycle, it's still negative. So, it'd be difficult to occur a recession right now. I think if the Fed starts to cut the interest rate this September, the yield spread(10y-3m) will be rapidly recovered.

Because, if the interest rate starts decreasing, existing long-term bond prices will increase due to increasing demand from highest coupon rates.

On the other hand, new issued long-term bonds have low coupon rates. So, they will have less demands before, which means the coupon rates of long-term bonds may not much fall than expected.

Short-term bonds tend to similarly follow the interest rate. So, that's the reason why the yield spread(10y-3m) has recovered after the interest rate cuts.

But, no one knows what will be happening. I just hope that there won't be a recession before 2026.

This comment is for rewarding my analysis activities. Upvotings will be proceeded by @h4lab and @upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post has been upvoted by @upex with a 100.00% upvote. We invite you to continue producing quality content and join our Discord community here. Visit https://botsteem.com to utilize usefull and productive automations #bottosteem #upex

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

good

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit