.png)

Introduction

In this section, I would be elaborating on the topic of fundamental analysis and its importance to a trader. Without much ado, I will set the ball rolling.

Fundamental analysis refers to one of the procedures of analysis used by a trader in predicting the price movement and direction of the price as well in finance trading. The fundamental analysis makes good use of the economic calendar of an asset to help analyze and predict the future direction of the price of the asset.

This method of price analysis is very used often by most traders in finance trading. The fundamental analysis is proven to be the most widely used trading analysis in the past, but currently, technical analysis has taken over although some traders still prefer the fundamental analysis.

The fundamental analysis is also known as the macroeconomics event analysis and it implies mainly the use of financial occasions that have a high effect on reactions of supply and demand and results in the determination of the price movement of an asset.

There are certain factors that influence the forces of demand and supply but the major factor is the financial events of the asset. We know that an asset's price or commodity relies on the forces existing on supply and demand. Some of these factors influencing the forces of demand and supply includes; political events, interest rates, GDP, inflation, calendar of events, etc.

These factors are those that fundamental traders use in an asset's analysis thereby coming out with a prediction of the future price or behavior of the asset. With all the benefits of the fundamental analysis mentioned above, there are limitations as well. One of them is that the fundamental analysis method does not take into consideration certain variables that are useful in effecting change in the direction of the asset's price.

Another limitation of the fundamental analysis method is the fact that it requires very high detailed information about the factor that influence the forces of demand and supply in predicting the price of an asset. For example, very high detailed information about the calendar of events of an asset is needed in order to predict its future price trend.

Do you think it's important for a trader?

Yes indeed, the fundamental analysis method of predicting the future price movement of an asset is really important to a trader and my justification comes as follows. Every trader must know and understand knowledge or concept of how to use the fundamental analysis method in predicting crypto assets price.

The fundamental analysis method helps traders to exit the market at any time especially when he/she sees that the market isn't favorable. When this happens the trades exit the market and wait until it is favorable then they enter trade again.

Fundamental analysis again aids traders to be aware of any changes that occur in the market as a result of the rise or fall of one of the financial events in the market. Traders make good use of the news to be fully aware of any added cryptocurrency in the market/exchange platform which can influence the price change of the asset.

Again, we should be aware that any sudden news about a token can affect the price of the asset at that moment or in the near future and for that reason, it helps traders to have knowledge about what's going to happen to an asset's price in the coming days or at that day. Looking at the situation in 2021, when Elon Musk (the father of Dogecoin) came out to publish an announcement that he is going to invest in Dogecoin and as a matter of that many investors started buying Dogecoin which as a result surged the price of Dogecoin higher at that time.

This sudden surge in the price of Dogecoin was a result of the high force of demand for Dogecoin which made its price rise. It should also be noted that the fundamental analysis is best used by daily traders because they can exit at any moment due to the fact that any news of an asset that pops up can immediately change the market of that asset.

Technical analysis is also one of the methods of predicting the future price as an asset. Currently, we can say that it is the most widely used method by most traders in predicting and analyzing the future trend of a crypto asset.

Technical analysis is also one of the methods of analysis used by traders in predicting the fire price of an asset but over here it imploys the use of technical tools, graphs/charts, etc to predict. Unlike in the case of fundamental analysis whereby previous or historical data is used in predicting the price, over here the previous behavior of an asset price is indicated by charts/graphs which is it includes volume, indicators, candlesticks, support and resistance lines, etc.

Basically, the technical analysis employs the use of charts or graphs to predict the price movement and direction of an asset on the market. Also, there are several technical tools that traders use in predicting the prices of assets and these tools include; candlestick, chart, technical indicators, drawing tool, timeframes, etc. These tools can be used together with each other to provide perfect and accurate results.

The technical analysis method is much more creditable as compared to that of the fundamental analysis and this is why most traders are now adjourned to its use. Through the study and analysis of traders, it is noticed that the price of assets in the market can be repetitive, and as such previous movement and direction of an asset is a possible reliable indicator for the future price action of an asset.

The technical analysis is very complicated and one must study how to use it in predicting the future price of an asset. The technical analysis is used by traders to determine when to enter or exit from a market. It also helps traders in pinpointing out good and low-risk entry and exit price levels of an asset.

The technical analysis method is compatible and available for use in all timeframes depending on the strategy of trading or the style of trading the trader uses. In technical analysis, traders utilize technical indicators in predicting the future price of the asset.

The Differences between Fundamental and Technical Analysis

In this section, I would like to enumerate some of the differences between fundamental analysis and technical analysis. They include the following;

First of all, the fundamental analysis uses economic events such as the calendar of events, political events, inflation, interest rates, etc in predicting the future price movement of an asset whilst technical analysis uses tools such as candlesticks, volumes, indicators, etc to study historical trends of assets to predict the future price movement of assets.

Secondly, the fundamental analysis majorly uses historical economic events that will affect the price movement of assets in predicting the future price whilst technical analysis majorly use historical trends to predict the future price movement of assets.

Fundamental analyses are not being affected by news from the market whilst technical analyses are being affected by the news from the market. This indicates that external news influence the high rise or fall in the price of an asset on crypto charts.

Furthermore, the fundamental analysis isn't considerate with some variables such as the number of traders in the market which can have an influence on the price movement of an asset whilst technical analysis does consider all these variables in analyzing the price of an asset.

Moreover, the fundamental analysis isn't easy to read and analyze as compared to that of the technical analysis because the technical analysis utilizes clear charts in its functioning.

In addition, the fundamental analysis requires much time in its analysis as compared to that of the technical analysis because the fundamental analysis requires you making more research about the previous and current news of assets.

Finally, fundamental analysis helps traders to have more information about an asset before investing in it whilst technical analysis permits traders in analyzing the behavior of crypto charts.

In this section, I would be performing a demo trade to explain a sell order trade by placing support and resistance lines in time frames of 1 hour and 30 minutes.

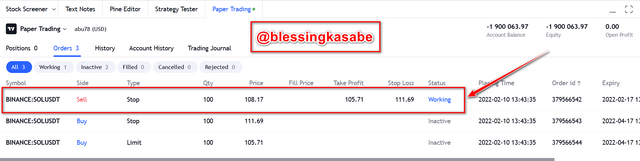

First of all, I opened TradingView platform and then from the chart section, selects SOLUSDT chart and then place my support and resistance levels as shown below. I also set it at H1 timeframe as indicated.

From there I would then switch the timeframe from the H1 to 3o minutes timeframe and then identify the support and resistance levels on that timeframe as well. This can be seen from the chart shown below.

From the above chart shown, we can clearly see that there was a new resistance level created which is indicated with a red line as shown above. We again see that the support and resistance level drawn previously was maintained without much difference in them although the previous support level was almost changing to a resistance.

This implies that when support breaks from a higher timeframe to a lower timeframe, it changes to become a resistance level. I then placed a sell order where stop-loss is placed above the new resistance level and take profit below the current price of SOLUSDT.

After some time, I checked the trade and I have earned a profit of 147.12 USD as we can see from the above screenshot. My trade is almost hitting the take-profit level as shown.

In this section, I would be performing a demo trade to explain a buy order traded by placing support and resistance lines in time frames of 1 Day and 4 Hours.

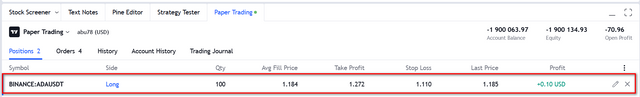

First of all, I opened TradingView platform and then from the chart section, selects ADAUSDT chart and then place my support and resistance levels as shown below. I also set it at H1 timeframe as indicated.

From there I would then switch the timeframe from the 1Day to the 4 Hours timeframe and then identify the support and resistance levels on that timeframe as well. This can be seen from the chart shown below with the new resistance level colored red.

From the above chart shown, we can clearly see that there was a new resistance level created which is indicated with a red line as shown above. We again see that the support and resistance level drawn previously was maintained without much difference in them although the previous support level was almost changing to a resistance.

This implies that when support breaks from a higher timeframe to a lower timeframe, it changes to become a resistance level. I then placed a buy order where stop-loss is placed below the support that turns to the resistance level and take-profit above the current price of ADAUSDT.

After some time, I checked the trade and I have earned a profit of 1.50 USD as we can see from the screenshot below. My trade is almost hitting the take-profit level as shown.

In this section, I would be discussing the concept of "hanging man" and "shooting star" candlestick patterns on crypto charts. Without much ado, let's go straight into business.

Hanging Man Candlestick Pattern

Hanging Man candlestick pattern refers to a type of candlestick pattern that is formed in an uptrend of an asset's price. It is usually seen at the high end of an uptrend of an asset's price. The features of a hanging man candlestick pattern consist of a small body, a long lower wick or shadow, and little to no upper shadow. The following characteristics must be met by a candle to be called a hanging hammer;

it must be formed in an uptrend movement

it must have a smallish body such that the opening and closing prices are closer to each other.

it must possess a long lower wick or tail and should be visible

it must possess little or no upper wick

The hanging man candlestick is also a reversal candlestick pattern that is formed or created in an uptrend of an asset's price which indicates a price reversal of the asset when it is being formed/created. When a hanging man candlestick is formed in an uptrend of an asset's price, then it is an indication that buyers in the market are leaving and the sellers are now taking over the market which results in a trend reversal in the price of the asset.

In hanging man candlestick pattern formation, the longer the lower wick of the candle the higher probability of reversal in the trend of the asset. A good example is indicated in the chart below.

From the above XRPUSDT chart indicated, we can obviously see the formation of the hanging man candlestick pattern formed at the high point of the uptrend and a trend reversal (downtrend ) which follows after the formation of the hanging man candlestick.

Shooting Star Candlestick Pattern

The shooting star is an opposite candlestick pattern of the Hanging Man candlestick pattern and it refers to a type of candlestick pattern that is formed in an uptrend of an asset's price after the formation of a hanging man candlestick pattern. It is also seen at the high end of an uptrend of an asset's price. The features of a shooting star candlestick pattern consist of a small body, a long upper wick or shadow, and a little to no lower shadow. The following characteristics must be met by a candle to be called a shooting star candlestick;

it must be formed in an uptrend and also be single there

it must have a smallish body such that the opening and closing prices are very close to each other.

it must possess a long upper wick or shadow

it must possess little to no lower wick or shadow

The shooting star candlestick is also a bearish reversal candlestick pattern that is formed or created in an uptrend of an asset's price which indicates a price reversal of the asset when it is being formed/created. When a hanging man candlestick is formed in an uptrend of an asset's price, then it is an indication that buyers in the market are leaving or weakened and the sellers are now taking over the market which results in a trend reversal in the price of the asset and thereby closing the gap between the opening and closing price of the candlestick.

In Shooting star candlestick pattern formation, the longer the upper wick of the candle the higher the probability of reversal in the trend of the asset. A good example is indicated in the chart below.

Conclusion

To conclude, I would like to summarize what we have done so far in this article. First of all, we discussed the concept of fundamental analysis and how important it is to traders. We also looked at the concept of technical analysis and its importance as well. Again, we looked at the differences between the fundamental analysis and technical analysis in the crypto analysis.

Furthermore, I performed a demo trade for a sell order using a SOLUSDT chart on an H1 timeframe and 30 Minutes timeframe. After the trade, a profit of 47.12 USD was obtained.

In addition, I also performed a demo trade for a buy order using the ADAUSDT chart on a 1 Day and a 4 Hour timeframe after which I earned a profit of 1.50 USD.

Finally, we discussed the concept of hanging man candlestick pattern as well as the shooting star candlestick pattern. We again indicated their differences and also illustrated them on crypto charts.

I would like to say a very big thank you to professor @pelon53 for this wonderful lecture. I have really understood the concept of "Starting Crypto Trading".

Thank You.