Hello Everyone! |

|---|

Asalam Alikum! This is Asad Fazal from Pakistan. I hope all members of this community are doing well and enjoying their life with loved ones and family. I pray all of your hopes and wish come true in this year 2023. Today I'm here to participate in the Season 7 Week 3 contest by SteemitCryptoAcademy. The topic decided by the team is Understanding Crypto Trading that is very interesting because we will share and learn from each other about what is crypto trading and what strategies others are using for maximizing their profits. So let's start!

Made on Adobe Photoshop and Illustrator

Explain your understanding on crypto currency trading and tell us what you understand by the word "trading" |

|---|

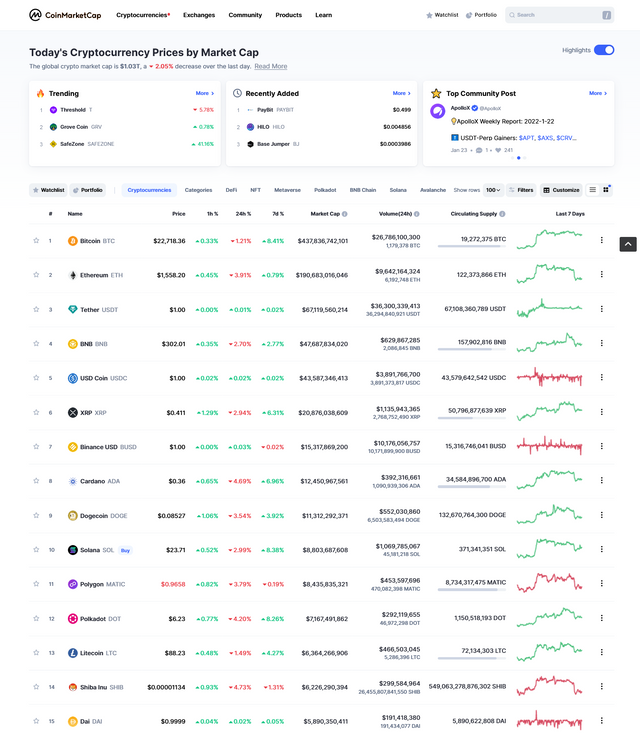

In simple words, buying and selling of digital currencies like Bitcoin, Ethereum, BNB, Litecoin and manymore through a centralized or decentralized exchange is called cryptocurrency trading. It is a type of trading in which we buy digital currencies at low price and sell it at high price to get profits. This is not always that you sell at high price but due to sudden drop in price, people sell their holds of digital currency at low price which makes them loss an amount of their investment.

The cryptocurrency market is highly volatile but on the other hand gives huge profits if invested in right time in right cryptocurrency. Besides, it's a high reward market, it is also full of risks involved. The most scary risk is of losing your investment your money in digital currencies because of high volatility. There is no one in the world who has invested in cryptocurrency only got profit in all trades but most of the trades give loss. In cryptocurrency trading, a trader must have complete knowledge on risk management, emotions controlling, understanding the trends of market, and technical and fundamental knowledge.

There are thousands of cryptocurrencies trading everyday everyminute and even everysecond. We must be aware of which crypto currency has how much risk to trade and what strategy we should apply on it. If a trader is thinking to trade Bitcoin, he must be aware of the risk involved in it because Bitcoin is the highly volatile currency in whole market that moves in $100s or $1000s within few minutes or sometime seconds depending on market condition. Moreover, a trader must also be aware of the risks involved in trading on unregulated exchanges because they can run away with you money easily and you can't do anything after.

Top 15 Cryptocurrencies on Coinmarketcap

Now let's talk about what is trading. In simple terms, trading is buying and selling of goods and services such as stocks, shares, bonds, liquid assets (gold, silver, diamond, real estate), and commodities to gain profit from them in future. Buying and selling of financial instruments can be done once in a day or a week or a month and also multiple times in a day depending on what are your goals and what you want to achieve.

What are the trading principles to always keep in mind as a Crypto Trader and how can you build your own crypto trading strategy |

|---|

In crypto trading there are different principles that every trader must follow. These principles are the key of a successful crypto trading as well as other trading like stock and forex. But one thing is must that I have mentioned above is there is not a single trader who always book profit and never faced loss. So successful trader doesn't mean he will only make profit but the thing is he follows these priniciples and maximize his profits and minimize his losses. Below are the main principles:

1. Research and Learning

First principle is to do your own research instead of blindly following other traders or fake experts. It is important that you must have proper fundamental knowledge and technical knowledge so you can properly check the cryptocurrency in which you are thinking to invest your hard earned money. The market capitalization, history, team, performance, development, trading volume, total supply, circulating supply, and news about cryptocurrency are the main things that are needed to be researched in order to make good profits from any coin.

2. Risk Management

Risk Management is the most important principle not only in trading but in every field of life. A trader must not call himself a trader if he don't know how to manage risks involved in these markets. In crypto, risk management is to know how to set stop loss on each trade and where to take profit not all at once but in parts to minimize loss risk. It is important to put limits on trades because you can't look at trades for all day and leaving them without boundaries can give you huge loss. So risk management is very important in trading.

3. Portfolio Diversification

Third important thing that most of retail traders and newbies ignore is portfolio diversification. It means you need to invest your funds in different coins but not all in one coin. The reason is if the coin goes down your all funds will go down but if the portfolio is divided, only the invested money in that coin will go down but not the whole portfolio. Moreover, a trader must not go all in one go but stay in stable coins for 40% of his portfolio to do DCA in bearish market conditions.

4. Market Trends

Another important principle is to know and follow the market trends because trends will let you know the movement of the market. It tells you if the market will go upwards or downwards in next week, day, hour, or minute. If you follow the market trend you will surely be in profit most of the times.

Building my own trading strategy |

|---|

Building your own crypto trading strategy is only done after testing, analyzing, and doing proper research. In research and analysis, we need to check the historical data of the cryptocurrency and patterns created in the past by coin in different charts like 1month, 1week, 1day, 1hour, 30minutes etc. The crypto market is somehow same as other trading markets and make the same patterns sometimes so historical data is very important to look at.

Second thing is to have technical analysis of the coin which I do with RSI because it tells that either the coin is overbought or oversold. If the coin is overbought then you should not buy it because it's time to sell the coin. And if RSI shows oversold, then you can buy the coin and wait till it gives you profit.

Explain how you can use Fundamental analysis to generate your own Crypto Trading Ideas |

|---|

The fundamental analysis is very important if you need to be a successful trader. It helps to know the underlying factors of the cryptocurrency such as buying and selling opportunities, demand and supply, news, and economic conditions. With the help of fundamental analysis, a trader can easily generate trading ideas that can help him maximize his trading profits.

Now to generate crypto trading ideas, a trader must use fundamental analysis of the coin. It includes who is the founder of the coin, are team members trustable or not, why the coin is created what is the reason behind it, the demand and supply of the coin, economic conditions of the country of the coin, and news related to that coin. These things will let the trader do a proper fundamental analysis and create crypto trading ideas for that coin and for others.

My Fundamental Analysis of Polkadot |

|---|

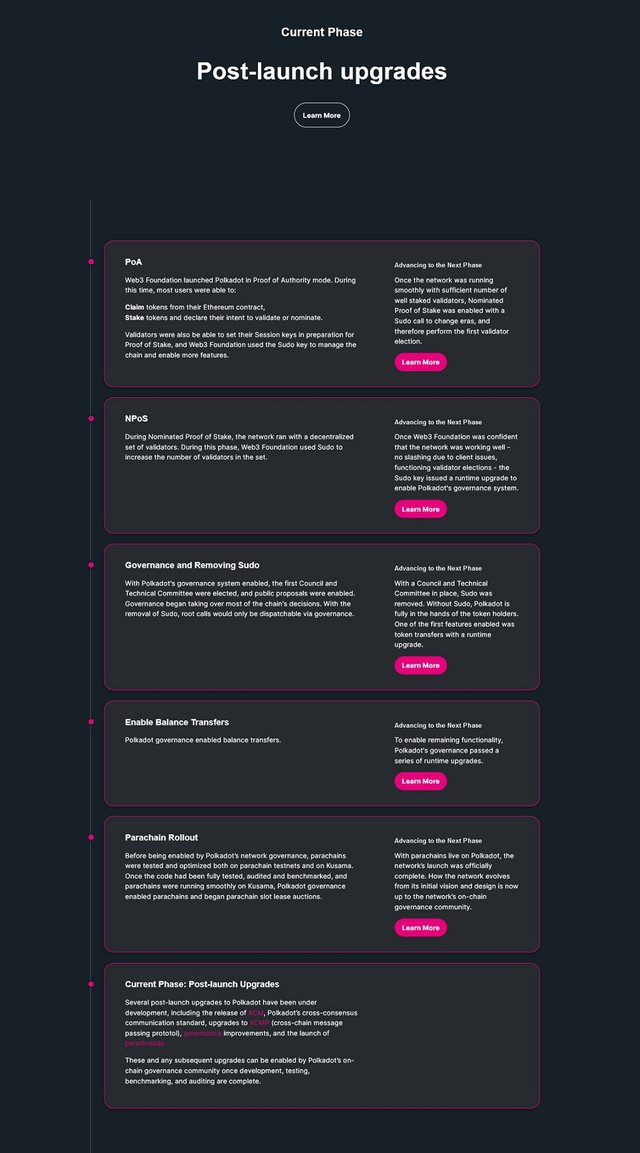

As we have discussed above that doing fundamental analysis includes looking at the owner of the coin and team, for what purpose the coin was developed, what is the roadmap of coin and the team is following their roadmap or not, coin's whitepaper, news, and economic conditions of country of that coin.

Below I have done fundamental analysis of the coin POLKADOT (DOT) that is ranked on 12th on coinmarketcap. Polkadot (DOT) is a decentralized Web3 platform where users are in control but not the central party or authority. It helps to connect the private and public blockchain networks for smooth, fast, and less costly transactions between. Let's have a look at their homepage.

Source Polkadot

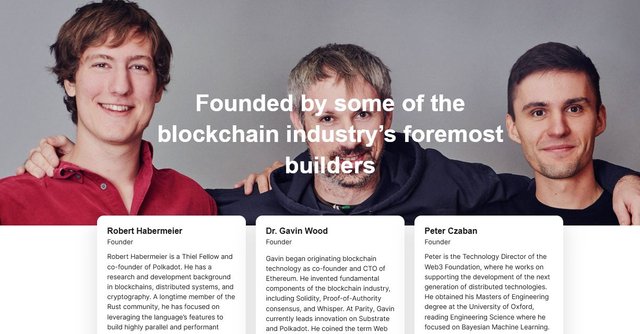

Source Team

The team and founder behind the development of Polkadot (DOT) is an experienced and well organized team who have clear goals and have been working in this industry for years. We can check their twitter and LinkedIn accounts for confirmation.

Polkadot (DOT) is an improved version of Ethereum that was launched in May 2020. It is founded by one of the co-founder of Ethereum Gavin Wood that makes DOT a trustworthy, reliable, and secure platform just like Ethereum. The Polkadot platform is now running by Web3 Foundation (W3F).

Source Roadmap

We can see in the above screenshot that Polkadot's team is continuously working on the development of the network. They are following their roadmap as decided. Currently they are on Post-launch upgrades phase. You can also look at their whitepaper for better understanding of the purpose of Polkadot (DOT). Moreover, you can check the news of DOT at coinmarketcap here.

These are some of the quick points that you can look at of any coin. These things will let you get an idea of the cryptocurrency's future. Why I took polkadot (DOT) example, because their team is continuously building and working on the network. The investors are supporting the platform and there is no bad news in the market for Polkadot (DOT) that means it is a good future coin. But just this is not a thing to do, we have to do technical analysis of the coin before investing in it.

The cryptocurrency market is highly volatile so do trading at your own risk. Above fundamental analysis is my own research and I am not an expert so don't blindly invest in Polkadot (DOT).

Explain how you can use Technical analysis when trading on Crypto |

|---|

Above we have discussed the fundamental analysis of the coin Polkadot (DOT), but it is important to have more analysis like technical analysis before we go into trading of that coin. When doing crypto trading, it is good to be careful and do technical analysis because it helps you to understand at which direction the coin price can move but still it is not a guarantee.

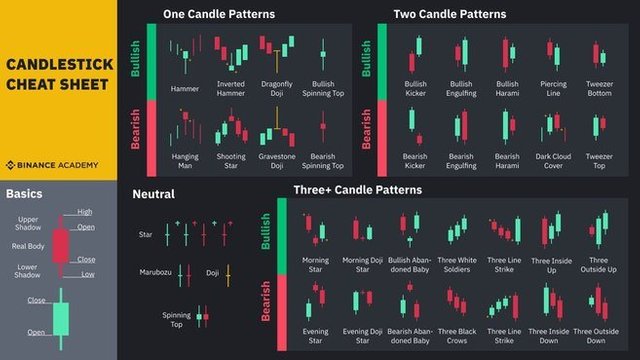

In technical analysis, we look at the historical chart price patterns of the coin and the trend it follows. It is said by forex, stock, and crypto experts that most of the times, the next movement depends on the past pattern movement of the coin. Moveover, the patterns repeat itself and this can be used to predict the future of the coin at some point.

There are two things that we need to do in technical analysis and that are chart patterns and the technical indicators. In pattern, there are resistance and support of the coin's price. These key levels help you know will the trend reverse or it follows old pattern. Most of the traders look at the support and resistance levels to invest in the coin. If the support breaks, it shows the coin price will move down and if resistance breaks, it tells the coin price will move upwards.

In chart patterns, there you can see different types of candles that predict the price movement most of the times. These candles are hammer pattern, bullish engulfing, morning star, hanging man, shooting star, inverse hammer, piercing line, three white soldiers, bearish engulfing, evening star, three black crows, doji, and many more. The patterns also includes head and shoulder pattern that tells price can drop AND inverse head and shoulder pattern tells price can move upwards.

Source Candlestick Patterns

Additional to the patterns and movement, we can make crypto signals using technical indicators such as RSI, Bollinger bands, and moving averages. The most powerful indicator is RSI that gives much better signals than other indicators. If we do proper technical analysis with fundamental analysis, we can easy make good profits from the crypto trading and our loss will be minimized.

Explain the 3 key concepts of Risk Management every new Crypto Trader Should Know |

|---|

As a new trader, it is very important to first learn and do proper research and practice on the crypto market. For practice it is better to take a paper and write down at which price you want to be in if you are investing in it and what will be your strategy for taking profit and minimizing loss. With all these, the most important is Risk management that every new trader as well as experienced trader must consider. Below I have shared three key concepts of risk management that all traders not only new ones should keep in mind for each and every no matter small or big trade.

1. Diversification of Portfolio

We have discussed this key principle above and believe me it is very very important. I am a live example of making mistake of investing all in one coin and converted my $2,200 to $198. Diversification of your portfolio is necessary or you can say must to do because it spreads loss risk but maximize profits. Moreover, diversification includes investing your portfolio in two time frame coins i.e. short term coins like Meme and altcoins and long term coins like Bitcoin, BNB, Ethereum.

2. Take Profit / Stop Loss

The second key concept of Risk Management is to put stop loss on your trades and take profit at right time. For new traders, SL and TP is very important concepts to understand. In Stop-loss (SL), a trader will set limit of price at which he can bear maximum loss and the coin must be sold at that price if moved downwards. In Take-profit (TP), we set level of profits we intended to take at different price points of the cryptocurrency. As we can't always be online, we need to set these limits for better trading experience.

3. Must have a Strategy

Before entering into crypto trading, a new or experienced trader must have a strategy that helps him getting more profit and avoiding loss. You must have a clear idea of your entry and exit point of the coins. Also you must be aware of the Dollar-cost averaging (DCA) if required. If still your strategy fails and you get loss, don't get dishearted and make a new strategy by looking at which point was your fault.

Conclusion |

|---|

The cryptocurrency trading in simple words is buying and selling of digital currencies on a platform to get profit and face loss if you make mistake. To be able to maximize your profits and minimize losses, a trader must do proper fundamental analysis, technical analysis, learn key concepts and principles of crypto trading. As the crypto market is different from all other markets because of high volatility, no one can predict the future of the coin's movement. So it is important that we do research and analysis instead of following some fake experts and invest our hard earn money. In last, I suggest to invest only that amount that you can afford to lose because this market is not for everyone. Thanks!

This is all from me for the "Steemit Crypto Academy Contest / S7W3 - Understanding Crypto Trading". I invite @samminator, @ranartblog, @steemdoctor1, and @theentertainer to participate in this contest and share their crypto trading knowledge with us.

Thank You For Reading

As always boss, you have equally presented another interesting and educative article for us this week. To become a successful investor, you need to know about trading cryptocurrencies, from understanding the technology behind them to the different strategies you can use to make a profit.

Trading in digital currencies such as Bitcoin and other altcoins has becoming increasingly popular due to their decentralized nature and potential for large profits

As you have rightly pointed out, it's always advisable to trade with the golden rules and principles guiding Cryptocurrency trading. Some of which include Following the market trends, making your research, and setting proper risk management strategies.

Thanks for sharing such an educative and interesting content with us boss, I would appreciate if you equally engage in mine.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you my friend for your comment. Yes trading must be done with principles and golden rules if we don't want to waste our money.

I will surely look at your content. Actually I was busy in the morning so didn't replied many and checked other users content but now I am free so I will be there in few minutes :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post, @chasad75! Your explanation of cryptocurrency trading and the principles that traders should keep in mind is clear and well-written. I especially appreciate your emphasis on the importance of research, risk management, and portfolio diversification. These are all crucial elements for any trader looking to maximize their profits and minimize their losses.

One thing that I think you did a great job of highlighting is the volatility of the cryptocurrency market. The prices of digital currencies can fluctuate wildly in a matter of minutes, and this can make it a challenging market to trade in. However, as you pointed out, this volatility also creates opportunities for traders to make significant profits if they are able to make the right trades at the right time.

You also mentioned the importance of understanding market trends and using technical and fundamental analysis to inform your trades. These are both essential tools for any trader, and I agree that a solid understanding of both will help you make more informed decisions.

Your advice on the risks involved in trading on unregulated exchanges is also important. As you noted, these types of exchanges can be risky and traders should be aware of the potential for fraud or theft. It's always best to stick to reputable, regulated exchanges to minimize the risk of losing your investment.

Overall, I think this post is an excellent resource for anyone looking to learn more about cryptocurrency trading. The advice and insights you've shared are valuable and will be helpful for traders at all levels of experience. Keep up the great work!

Regards,

@fabiha

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @fabiha for your valuable feedback on my content. I appreciate that you took time and read my content. Stay Blessed :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Assalamualaikum brother.

Hamesha ki trha is bar bhi apny bohat achi post share ki ha or me apky knowledge ki hosla afzai krta hun. Crypto trading k bary me apka knowledge kabil e tareef ha.

Apny bilkul durust kaha k cryptocurreny assets ko kam rate par buy krna or munasib rate par sale krna crypto trading ha. Me is me ye izafa krna chahu ga k crypto trading ka matlab crypto market ki volatility ka faida utana ha or apna profit secure krna ha.

Bilkul sai kaha apny, hum market k trends ko mad e nazar rakhty huy market me achy decisions le sktyy hain or is sy fauda utha skty hain.

Fundamental analysis or technical analysis dono chezy hi achy decisions leny k liye bohat eham hain or hamy in dono chezzoo sy milny waly signals k mutabik apny decisions leny chahiye.

Apki keemti post ka bohat shukria. Me apki taraki ka duago hun.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Walikum Asalam dear brother :)

Sb sy phely bht shukriya bhai ap ne mera complete content read kia aur itna valuable feedback dia.

Bilkul aesy hi ha bhai k crypto market ki volatility sy hi to faida othana hota ha...mery experience k mustabiq BTC or ETH k ilawa kisi coin ko hold ni krna chahye...sb coins sy short term me faida othaen jb market me volatility zyada ho bcoz yehe time hota maximum profit ka.

G bhai fundamental or technical analysis sy hi aik trader real trader bnta ha bcoz is sy hmen signals bnany me bht help milti aur most of the times signals hit hoty hain...

Last me bhai ap ki urdu ka me fan ho rha hn :p bcoz ap bht respectful aur unique way me likhty ho... meri kosish hogi me b apny Pakistani bhaiyon aur bheno ki post pe aesy hi apni national language me bt krn. Bht shukriya :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha, sun kar bohat acha laga k apko mera comment pasand aya. G bilkul, hamy apny Pakistani bhai or behno sy Urdu me bat krni chahiye ta k hmari national language b is platform par taraki kr sky.

Me b apsy muttafiq hun k BTC or ETH long term holding k liye best hain or baki Altcoins scalping k liye istimal ho skty hain. JazakAllah 💕

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We support quality posts anywhere and any tags.

Curated by : @steemdoctor1

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you @steemdoctor1 brother :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have explain your understanding of the term crypto trading which has to do with the buying and selling of digital assets via centralized or a decentralized exchange. You have also given your understanding of both fundamental and technical analysis. The 3 concepts every trader is expected to know according to your article include diversification, SL/TP and having a strategy. Indeed, these concepts are quite important for any trader who wishes to be successful. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you my friend. Yes these 3 concepts are very important not only for new traders but for every trader because it saves you from loss.

I wish you also best of luck for the contest :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit