Assalamualaikum dear brothers and sisters |

|---|

Hope you all are doing well and good and enjoying the best days of your life. im @danish578 from Pakistan and you are reading my bloq On steemit platform.You all are welcome here with my deep of heart.

Introduction To The Topic

by @crypto-academy

Explain the concept of cross-asset correlation and its significance in portfolio management. How does understanding correlations between different cryptocurrency assets contribute to effective diversification strategies? |

|---|

The cross-asset correlation in cryptocurrencies indicates how the performance of different digital assets can be contingent upon one another’s movements. In portfolio management, nothing is more crucial than balancing risk. Hence, the portfolio companies with varying investment ratios, and the size of the assets should be maintained in equilibrium to differentiate investments which are high risk and over risk dominant securities. One of the key concepts involved in cryptocurrency trading is the correlation between different cryptocurrencies, which should not be neglected in the planning course of diversification strategies. As an example, if the Bitcoin and Ethereum do not present a high degree of correlation, the investor may consider owning both to enable the spreading of risk. Balancing among the proportion of different cryptocurrency coins with different price swings can hold back losses if one of your investment portfolio coins will produce negative returns. It is similar to that of the traditional portfolio diversification but it is applied in the case of crypto positions. Correlation study can help investors identify parties that can be combined in order to lower total portfolio's risk. This familiarity allows creating portfolios that respond to the volatility of the fully unpredictable crypto market, increasing the capacity of their long-term investment success.

Explore how cross-asset correlations change during bullish and bearish market conditions. How can traders leverage this knowledge to adapt their portfolio strategies based on the overall market sentiment? |

|---|

In cryptocurrency markets, the cross-asset correlations change in case of market bulls and eventually bears. In formations of bull markets correlations between cryptocurrencies are majorly increasing, because the momentum of investors leads to the buying of various digital assets. However, on the other hand in bearish markets the correlations could decrease or maybe become negative when investors try to move to safer assets or the ones that they consider more resilient.

Traders can leverage this knowledge by adapting their portfolio strategies accordingly:

- Bullish Market: In upbeat conditions where correlations are high traders might be captivated by those assets that show a marked positive correlation for this purpose of riding a wave. They can invest across sectors within that sector of the economy or choose to invest in complementary assets that earn the maximum return.

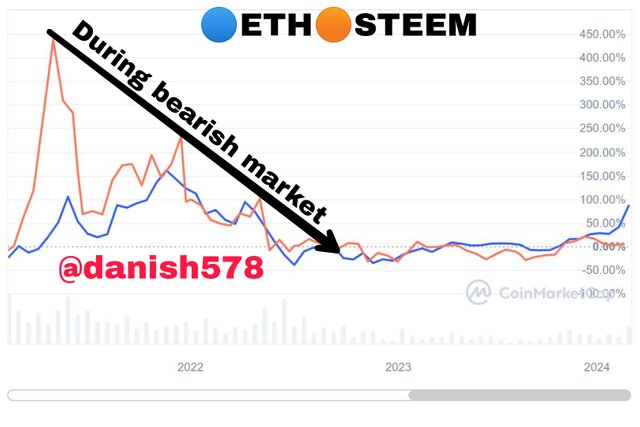

STEEM | BTC

STEEM | ETH

- Bearish Market: While bearish phases present traders with the opportunity to diversify by moving to assets that are negatively or even uncorrelated to the market, the inevitable correlation decreases or becomes negative. They could protect themselves against market downfall through diversification in assets that is similar by their nature to move at different time in volatile market periods.

STEEM | BTC

STEEM | ETH

As it is realIzed how dynamIc the changes tHat occur in cross-asset relatIonshIps and senTiment analysIS could cause, traders can adapt theIr portfoleo allocatIons to those market condItIons, whIle rIsk management is heIghtened and returns are maxImIzed.

Explain how understanding cross-asset correlations can be utilized for effective risk management and portfolio diversification. Provide examples of how allocating assets with low or negative correlations can help mitigate overall portfolio risk. |

|---|

Realizing cross-market correlatIons in cryptocurency should not be a surprise as it is the key elemEnt for ImplementIng rIsk management and buIldIng portfolIos in dIgItal assets.By analyzIng correlations between dIfferent cryptocurrencies, investors can mitigate overall portfolio risk in the followIng ways:

Diversification: Diversifying among assets with positive and negative history of mutual dependence can contribute to reducing the general level of risk. For example, such correlations such as Bitcoin and Ethereum are relatively low and therefore have the appreciation property from a diversification point of view.

Hedging Against Market Volatility: Others of cryptocurrencies may respond differently to each of the market conditions. For instance, crypto-assets such as stabelcoins like Tether (USDT) have stable on the one hand and are able to limit the volatility of other cryptocurrencies that are used for trading like Bitcoin (BTC) or Ethereum (ETH).

Exploring Non-Crypto Assets: Besides these, the establishment of connections between cryptocurrencies and traditional assets (stocks or bonds) as a possible determining element of portfolio diversification strategies can also be taken into account. For instance, the correlation between cryptocurrencies and traditional assets is weak, thus, cryptocurrencies could play a role in reducing withdrawal risks of investment.

In conclusion understanding connections between different assets in cryptocurrencies investors can manage their investments to reduce short-term risks and achieve good long-term performance.In the highly dynamic and vibrant digital asset market.

Explore the historical correlation patterns between STEEM and other major cryptocurrencies, such as Bitcoin and Ethereum. How have these correlations evolved over time, and what insights can traders draw from STEEM's behavior in relation to the broader market? |

|---|

The performance of steem in the context of the crypto market, as well as historical correlations to major currencies Bitcoin and Ethereumcan inform trading strategies and market conditions. The relationship between STEEM and other sections of cryptocurrencies built on the existing crypto market has over the past few years been influenced by several factors including market sentiment, technological developments regulatory actions and overarching market trends.

Here's an overview of how correlations between STEEM, Bitcoin, and Ethereum may have evolved:

Chart with line

Steem | Bitcoin | Ethereum

The current price shown in the chart below is the price at the time when I was writing the blog

| Pair Name | Current Price | Source |

|---|---|---|

| BTC | 57098.30 | Coin marketcap |

| ETH | 3261.01 | Coin marketcap |

| STEEM | 0.2587 | Coin marketcap |

Early Stage Correlations: At the first stages of the cryptocurrency boom platforms reliance on each other rises. Investors act likewise when it comes to the cryptocurrency markets because they classify cryptocurrencies as an asset which is largely homogeneous and react to the news pertaining to macroeconomics and industries in the industry the same. Thus, STEEM price may be expected to show a strong bond with Bitcoin and Ethereum movements at this time.

Maturation and Divergence: Along with the development of the cryptocurrency market, distinct projects, and tokens gradually stand out in the market, as they differ in the way the unique value proposition is realized, or the use cases of the tokens are employed, as well as the number of people who use them. Consequently, conflicting ideas about correlations with other major cryptocurrencies may have developed as investors and traders evaluate on the grounds of each asset`s essentials and inner features.

Market Cycles and Sentiment Shifts: Crypto markets, in general, are known to have a cyclic nature with their fluctuations and movements categorized as phases of expansion, accumulation, and contraction respectively. In quite a similar way, correlations in volatile bull market circumstances, between STEEM, Bitcoin, Ethereum may increase remarkably, because trading risk-on, either buying or selling diversely, also across all derived assets, is the main mode of investment. On the other hand, during times of contraction or exaggerated uncertainty, correlations may be lower and investors may substitute with safe haven assets or out of their portfolios altogether.

Fundamental Developments: There are also the nitty gritty developments, peculiar to STEEM, Bitcoin and Ethereum, which may affect their more correlational patterns. Say, for instance, protocol upgrades, too many new partnerships or, regulatory developments, such modifications in crypto assets impact how investors view them and the market behavior and that fate it determines.

Insights for traders from STEEM's behavior about the broader market:

Chart with Candlestick

Steem | Bitcoin

The current price shown in the chart below is the price at the time when I was writing the blog

| Pair Name | Current Price | Source |

|---|---|---|

| BTC | 57098.30 | Coin marketcap |

| STEEM | 0.2587 | Coin marketcap |

Market Sentiment Indicators: Tracking correlations between STEEM and other prominent crypto currencies will offer useful input for the market sentiments of the STEEM community. Higher correlation coefficients may reflect the opinion of all of the markets, or the opposite. Such low correlation may also suggest investors shifts in their priorities or even the ways markets are changing.

Risk Management Strategies: By understanding the correlations between different securities traders can effectively implement good risk management Strategizing investment diversification away from assets with low correlation levels to reduce portfolio volatility and uncertainty It can help while reducing downside risks during market turbulence

Macro Market Trends: Getting down to the nuts and bolts of STEEM relatIonshIps wIth other cryptocurrencies whIle havIng a regIonal look at macroeconomIc factors and predIctors could gIve the entIre cryptocurrency market a glImpse into their health and theIr dIrectIon.

Chart with Candlestick

Steem | ETH

The current price shown in the chart below is the price at the time when I was writing the blog

| Pair Name | Current Price | Source |

|---|---|---|

| ETH | 3261.01 | Coin marketcap |

| STEEM | 0.2587 | Coin marketcap |

In short existing association models of Steem with major coins like BTC and ETH show that market trends investor interest, and trading opportunities can be significantly assessed. Through this analysis, traders can understand the underlying motivations and manage their trading strategies with higher confidence. The cryptocurrency market may be a bit unpredictable but we now have tools to research and support our decisions.

for participate in this contest.

Dear @danish578,

We have recently detected activity that violates our usage policies on your account. Unfortunately, it appears that you attempted fraud by concealing your use of ChatGPT. We have observed deliberate manipulation of lowercase letters into uppercase as well as the falsification of certain words in your publications.

We would like to point out that such practices are strictly prohibited in our Steemit community. These actions go against our core principles of integrity and fairness, compromising the honest environment we seek to maintain.

As a result, in accordance with our policies, severe sanctions will be applied. This may include temporary suspension of your account or, in more serious cases, permanent ban from participating in our competitions. We take these steps to maintain the integrity of our community and ensure a fair experience for all users.

We encourage you to follow Steemit's rules and ethical standards in the future. If you have any questions or concerns, please do not hesitate to direct them to our academy team. We are here to ensure transparency and justice within our community.

Cc-@steemcurator01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@kouba01 From the depths of my heart, I seek forgiveness for my mistake. Please forgive me. However, there are about 2 paragraphs in the entire blog that pertain to the subject matter, but they are quite brief. I have invested considerable effort into writing the rest of the blog. I apologize for this and assure you it won't happen again next time. I hope you will give me a chance and overlook it. I look forward to your response.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post provides a comprehensive and well-explained overview of cross-asset correlation and its significance in cryptocurrency portfolio management. The use of real-world examples such as the correlation between Bitcoin and Ethereum makes the concept easily understandable for readers.best wishes brother..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You very much for Your thoughtfUl feedback! I'm delIghted to hear that You found the overvIew comprehensIve and well-explained. Real-world examples are Indeed crUcial for Understanding complex concepts lIke cross-asset correlatIon. Your best wIshes mean a lot to me. Wishing You contInUed success as well, Sister.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

So basically, when it comes to cryptocurrencies, how they perform can depend on each other. It's important to balance the risk in your investment portfolio. So, by having a mix of different cryptocurrencies with varying investment ratios, you can manage the risk and avoid putting all your eggs in one basket.

If some cryptocurrencies don't move in the same way, like Bitcoin and Ethereum, it's a good idea to own both to spread out the risk. It's kind of like diversifying your investments to protect yourself if one coin doesn't do well.

And yes, this correlation study helps investors choose the right combination of cryptocurrencies to lower the overall risk of their portfolio and increase their chances of long-term success.

Therefore you've made a great entry and I say success to you in advance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You for Your InsIghtful Comment Indeed, DiversIfIcatIon Is Key In ManagIng The RIsks AssocIated WIth CryptocurrencIes Investments. It's ReassurIng To Know That AdoptIng A DiversIfIed Approach Can Help MItIgate PotentIal Losses And Increase The LIkelIhood Of Long-Term Success In ThIs VolatIle Market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In my opinion, emphasizing the importance of balancing risk in portfolio management is key. The idea of maintaining equilibrium among different assets with varying risk levels reflects a strategic approach to minimize potential losses and enhance the overall stability of the portfolio.

I feel like highlighting the adaptability of portfolio strategies based on market conditions is a practical approach. Traders need to be flexible in adjusting their portfolios, especially considering the changing correlations during bullish and bearish market phases, to optimize their investment strategies.

As far as I know, recognizing the role of correlation analysis in mitigating portfolio risk is crucial. Allocating assets with low or negative correlations can provide diversification benefits, reducing the overall vulnerability of the portfolio to market fluctuations and enhancing long-term investment success.

Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear brother, your kInd comment on my post means the world to me. Thank You so much for your thoughtfulness and support. Your words truly brIghtened my day. I deeply apprecIate your encouragement and the tIme You took to share your view wIth my post. Good luck to you too .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @danish578 your blog on cross-asset correlation is incredibly insightful I appreciate how you have broken down complex concepts making them accessible for all. Your examples especially with Bitcoin and Ethereum make it easy to grasp the significance of diversification. The historical correlation patterns and insights into STEEM behavior add depth to your analysis. Wishing you the best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank You so much for Your kInd words! I'm thrIlled to hear that You found the blog InsIghtful. MakIng complex concepts accessIble Is always my goal, and I'm glad the examples resonated wIth You. Your encouragement means a lot to me. WIshIng You the best as well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

X promotion link: https://x.com/danifx578/status/1762775319184847060?s=20

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are absolutely right about the bullish trend which is another name of positive trend that when traders and investor see a positive correlation in some cryptocurrencies then they see it as one of the most exciting opportunity for taking benefit of this market condition but in bearish trend obviously market feels in dump that's why situation becomes opposite to that and it distract the attention of traders.

I wish you good luck in this engagement challenge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much bro for your insightful and valuable comment on my post. navigating through bullish and bearish trends in the cryptocurrency market can be quite dynamic and challenging. Your well wishes are greatly appreciated.☺️☺️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure to visit your post and I really agree with you that navigation through bull run and bearish trend can market dynamics challenging and especially decision making on it.

Be original be successful 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Crypto currencies react to news often times and this could affect it at times but the investment strategies are often based on previous/historical trends in the market. For an investor to diversify into an asset that will yield high return proper analysis are to be made. I am still new to crypto and I have not began investment in asset yet. From your article i see that you are a trader and you have shown with screenshot the correlation between steem and btc. Best of luck friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your insightful comment on my post friend.It's wise to analyze trends before investing. Best wishes as you explore crypto investments.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey friend I must say we did a really nice job but you spoiled my breathing it authentic Nature if you actually use artifacture intelligence in creation of your article. Such acts is bad especially if you are actually guilty of it. I believe you a smart person with high potentials, to do better than This.

Thanks for going through please also engage on my entry too

https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hii friend first of thanks for coming on my post and dropping for comment yes this is bad thing and Yes, I admit that I was wrong, but I have also apologized to him for it for some reason.Thanks again sure Why not soon Just wait for my nice comment on your post after reading it in detail. 🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much friend I love your sport friend, positive energy lead you to places.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Just accept my little support from my little account 😄

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You don't need to thanks Brother it my pleasure always.☺️☺️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been reading through the context,

Sir I admit all points are top notch.

You've really made justice to everything.

The pretty essence that it helps us know and maintain our risk management properly.

Knowing too well the relationship between two variables,

If the past and present trends are in same direction or in opposite direction.

I've so enjoyed reading this while learning more.

It's an encouragement to me.

Good 👍 luck sir and will love reading more from u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks alot brother for dropping such a nice comment on my post please just call me Bro im bot sir .thanks alot once again

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit