Hello professor @reddileep, this lesson was very informative for me, I learned a lot, thank you very much.

1- Define the concept of Market Making in your own words.

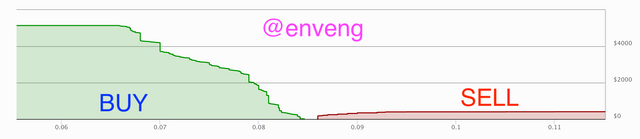

There are makers and takers in both cryptocurrency markets and other markets. If the price of the order entered in the buy-sell section does not match an order equivalent, the order is pending. This situation is called Market Making. In other words, market makers create buy and sell orders that are not directly executed. In short, this is a buy order placed at a lower price than the lowest selling price, or sell order placed at a higher price than the highest purchase price. Continuous buying and selling orders regulate stability and liquidity in the market.

The screenshot is taken https://steemitwallet.com/market

We learned about the spread in the previous lesson. If the cryptocurrency does not have sufficient liquidity, the spread will be large. In order to reduce the spread, which is the difference between the highest bid and the lowest ask, market makers create the liquidity of the market by creating orders. Profit is earned from the difference in the bid-ask spread by market makers.

2- Explain the psychology behind Market Maker. (Screenshot Required)

The market value is calculated through orders. Orders is the part where all buy or sell orders of users are collected. If I tell according to Steem, for example, when the SBD/STEEM ratio is 0.075486, we can order 100 Steem to buy. This order is added to the system and the transaction takes place when the stock market reaches the desired rate.

As I said before, market makers profit from the spread between the bid and sell. For example, if a market maker creates a buy order for $30 and the same person creates a sell order for $30.10 at the same time, it means that the market maker makes a profit of $0.10.

The screenshot is taken https://keyrock.eu/ Also, I added the info on the graph.

Orders stay in the order book until they are matched. There are also manipulators. The whale manipulators are that is people or entities that hold large amounts of crypto. These can be risk. They can lower the market and they profit from this fall by buying coins again. It creates inconvenience for small accounts.

3- Explain the benefits of Market Maker Concept?

- The market maker concept helps traders easily buy and sell in the market by providing liquidity to the market.

- It is important for market makers to act as buyers or sellers. Because they act as counterparties to sell an asset to that person to buy from the sell order or to match the buy order.

- Market makers can push the value of the cryptocurrency higher than it actually is. Market makers can raise the price by simultaneously providing a bid price and a ask price higher than the value of the cryptocurrency. This may indirectly increase the number of investors.

- Market makers help the market by keeping spreads low and stable. It helps in cost savings for buyers and sellers while executing transactions.

4- Explain the disadvantages of Market Maker Concept?

- A market maker that is not properly regulated in crypto markets can put customers at a disadvantage. The market maker is responsible for the status of the price. Therefore, the price may be adversely affected by artificial movements in the spread. I mean, low spread (liquidity) is not permanent.

- Small investors' assets can fall into the hands of market makers. This can be by manipulators.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

- Pivot Points

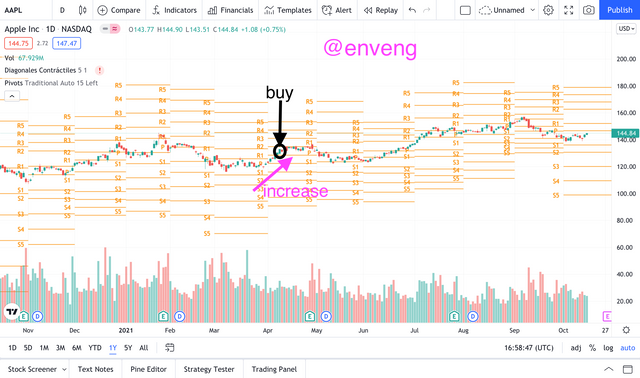

The pivot point is a technical analysis indicator and calculations used to determine the general trend of the market in different time frames. It is a method for determining possible support and resistance levels as a result of price movements. Price movements above the pivot point indicate an ongoing uptrend, and movements below it indicate a downtrend. All this helps traders see where to experience support and where resistance.

Calculated indications of pivot points are shown in the chart. It shows the pivot points with the letter P above the horizontal orange lines on the chart. R1 is the 1st resistance and S1 is the 1st support. R2 is the 2nd resistance and S2 is the 2nd support. It continues this way. When price movements go above the pivot point, it is interpreted as a BUY signal. The stock appears to have broken the pivot point strongly in April. The part I marked above the pivot point is the buy signal.

The screenshot is taken https://www.tradingview.com/

- TDI (Trading Dynamic Index) Indicator

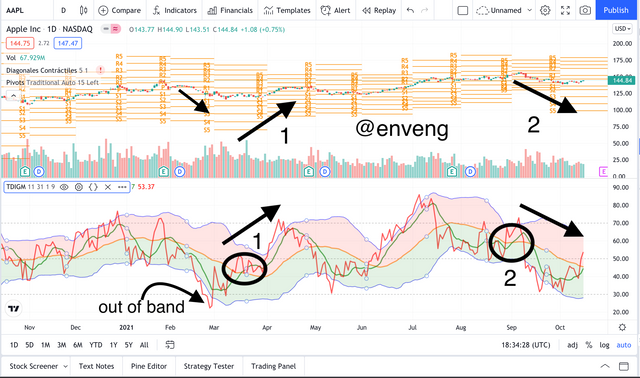

The Traders Dynamic Index (TDI) indicator is designed to assess the market situation. It shows the relationship between the current relative strength of the market and market volatility.

The middle orange line is the middle of bands. The 1st point, where Fast MA and Slow MA cut the middle of the band, indicates the increase. Looking at the chart above confirms this. Likewise, at the 2nd point, there was a downward trend after the intersection. The same is observed in the chart above.

When it goes out of the band, we expect hard movements, a sharp fall or rise. I showed a sharp drop on the chart.

The screenshot is taken https://www.tradingview.com/

Within the scope of this course, I learned that market makers are actually liquidity providers and they can be individuals or organizations. I realized that market makers can benefit from bid-ask spread awareness.

I got an idea about market manipulation. In short, this concept is abuse by creating misleading data on the market.

One of the biggest benefits of market makers is that they provide liquidity to the market. Order book works better as market makers reduce the bid-ask spread.

Of course, market makers also have some disadvantages. The most important of these is the low spread rate, that is, the liquidity is not permanent. The price of the asset can be manipulated by market makers.

I had the chance to get detailed information by doing research about Pivot Points and TDI, which are Market Maker Concept indicators. They are important indicators in technical analysis to see the buy signal and to interpret the uptrend and downtrends.

CC: @reddileep