Hello SteemitCryptoAcademy community, for me it is a pleasure to be able to share my content with you. I have been reviewing the classes and assignments that the teachers are sharing and I must say that it is really good content. The crypto Professor @stream4u shared with us a very interesting post in which he told us about a very important indicator, especially for those of us who are in the trading world. Here I leave the link so you can go to the publication and read it: Steemit Crypto Academy | Course 4 By @stream4u | Support <----> Resistance | What is Technical Indicator? | Overview Of TradingView | 200 Moving Average.

Well, crypto Professor @stream4u asks us the following:

- What is 200 moving average, how and when can we trade/invest with the help of 200 moving average?

- Show different price reactions towards the 200 moving average?

From these questions let's develop them, stay with me until the end, and let's learn together.

Well, trading is basically buying or selling, yes, but the detail in all this activity is to be able to determine if it is a good time to buy or sell, so the use of indicators can be crucial in this activity. Let's define what an indicator is:

"Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market."Source

In this case we will talk about the MA200 indicator, it is an important indicator that allows us to operate especially in the long term within the markets. I am particularly interested in deepening in it, since I am working with FOREX for a few months and I am interested in knowing more about these strategies in the long term.

This indicator uses as a reference the average close of the last 200 days, and in this way allows us to easily determine if there is a bullish or bearish trend in a given currency, am I clear?. I think it is easier to understand if we look at a chart. Let's go to the next one, which has been extracted from my account in TRADING.VIEW.

We can notice that since October last year the EUR/JPY (Euro/Japanese Yen) currency pair has been in a sustained uptrend, I would even dare to say since before. The chart has a daily time frame, i.e. each Japanese candlestick on the chart corresponds to the market movement in one day. And this is logical, I could even place it in a one week timeframe, since this indicator is excellent for long term investments.

At this point I want to clarify that we could operate in the short term, that is to say, in terms of an hour, and even minutes, for which other indicators and another type of analysis would be required. But, the MA200 is widely used for purchases or sales that you want to make to close operation in even months. It is usually done by large investors, who can tolerate large market fluctuations and who will close their accounts when they reach large profits.

So the 200 moving average can be used at different times and in different ways, either to buy or to sell, but remember, always in the long term. More if we consider that the data it gives us is the last 200 days, we can not think that it will work for us to project to a few days.

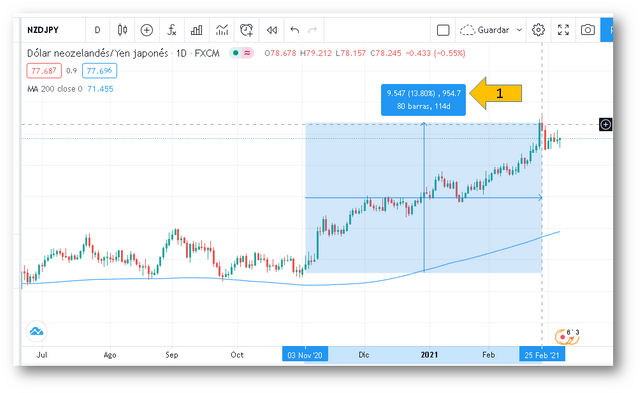

Let's see the image above, in the NZD/JPY currency pair, we can also see an uptrend, with the use of a tool offered by Tradingview I have been able to plot the number of days, and the PIPs that an investor could have earned if he had made a purchase

- 954.7 PIPs of profit if he closed the trade at that time.

- 147 days, from November 3 to February 25.

When we talk about PIPs we are referring to what is actually earned in the Forex market, this will have a dollar value depending on other components such as lottage, which is the subject of something else. But imagine that each of those PIPS is worth 5 dollars, it means that this person will have earned almost 5000 dollars.

Another use we can give to the MA200 is that it can work as a support, as seen in the image above, where the yellow arrows point. We can see that the market reaches the MA200 but does not cross it, because it is an important support. As long as it stays above the line it means that the market is still bullish.

The other detail, marked with the blue arrow, is that the further the market (represented by the Japanese candlesticks) moves away from the MA200 means that the trend is getting stronger. Regardless of whether the trend is bullish or bearish.

The other use of the MA2000 is to serve as resistance, as I point out with the arrow in the image above. In this case the market crosses the MA200 that served as resistance, which means that the change of trend from bearish to bullish is undeniable.

With this I have finished my participation in this course about the MA200 indicator...

Thank you very much @stream4u for the opportunity.

I hope I have been sufficiently explicit and concrete in explanation.

I authorize the use of this banner to everyone who wants to do it.

Visit our partner STEEMSCAN if you are looking for an easy and fast way to convert STEEM to other important cryptom currencies. To access the page click on the following link:

STEEMSCAN

|  |  |

|---|

Hi @josevas217

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 4.

Your Homework task 4 verification has been done by @Stream4u, once you updated this existing task with the pending topics, just reply to me here and I will surely review it again.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @stream4u

Perfect, I understand the point, I will do my best to improve this post and comply with what you have raised.

Thank you very much for the feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Un crecimiento maravilloso @josevas217

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit