| Hello SteemitCryptoAcademy a warm welcome to you all here. |

|---|

This is me @kathy-cute from Philippines and you are here Reading my Blog. I hope you all are enjoying the current season here. It's an honor for me to participate in this beautiful contest. This is my participation in a contest STEEM Ecosystem Resilience..

How has the STEEM ecosystem demonstrated its resilience to market fluctuations and changing trends over time? |

|---|

As other crypto platform, Steem is a decentralized Blockchain, which is free of any external influence. It has it's own governance system which always try it's best to perform well in every situation of the market. STEEM's ecosystem is successful because it offers diverse applications beyond just cryptocurrency. Even if market is even bearish we can see Steem showing resilience, because of it's most famous blogging website, called Steemit.

This is a blogging website, where users create content and their is social networking in it. This diversification helps maintain interest and engagement even during market downturns. It brings new users to this platform, and hence steem is alive in all conditions of the market.

The Steem Blockchain has a very positive and plus point that, it has a too much active community. The STEEM community is because of Steemit website. This community is involved in the platform's governance and development system. They fosters resilience by enabling swift responses to challenges and changes in market conditions.

In past we have seen various modification in Steem governance system according to the current market condition. The greatest source of generating new steem coins in the market is through Steemit platform. We can say it's a type of steem mining. Now we have seen multiple times Steemit is changing with changing market condition. It changes the reward system within in the platform. Currently we have seen the reward is given to the steemians in the form of SBD. It changes with change in time. Sometime it shift to Trx and liquid steem. This is a kind of counter system of Steemit according to market situation.

How can the analysis of on-chain metrics, such as daily transactions, community participation and token distribution, provide insights into the health and robustness of the STEEM ecosystem? |

|---|

The analysis of on-chain-metrics, such daily transaction, community participation and token distribution can indicate the overall health and efficiency of the underlying blockchain infrastructure supporting the STEEM ecosystem. Let's talk about these terms one by one here and give a brief insight to it.

• A high volume of daily transactions typically indicates the activeness of the users. It shows their is more engagement within the ecosystem. However Fluctuations in transaction volume signify changes due to various factors, such as user activity, adoption, or interest in the platform. Some days ago we have seen a huge raise in Steem coin price, it almost touched $ 0.4. That day we have seen a huge volume in Steem Currency.

In normal days if it's something 2 Millions that day it surplused 10 millions. Now it's not necessary that price will go high if their is more volume. It depends, if volume is because of buying, it increases the price, in contrast if it's because of selling, it will decrease steem price.

Participation of community is another factor that shows us the health of the the crypto project. An active community indicates, a healthy project it is. As I have said earlier that the activeness of of steem holders is just because of Steemit. It has a huge community of content creators, which show activeness most of the time on the platform.

Another important factor is Token Distribution mechanism. If the distribution of tokens is stable and constant, it shows that project is healthy. Examining the distribution of tokens among users provides insights into the decentralization and fairness of the ecosystem. It maintain the supply and demand balance.

Steem coin has another advantage that tokens are held by a diverse range of users rather than concentrated in a few hands. It avoid a manipulation in the market. If all the assets is in a whale's hands they will control the coin and will dump and pump according to their own interest. Steem is a healthier project in this regard too.

How can STEEM's Relative Strength Analysis versus other cryptocurrencies help investors identify potential opportunities in varying market conditions? (Provide an example that shows your analysis) |

|---|

Relative Strength Analysis (RSA) is a famous and valuable tool the investors use it for their Analysis. It is use to gauge the performance of one asset relative to others within a specific market or sector. In short it is use for comparison between two assets. When we apply it on STEEM and other cryptocurrencies, RSA help us identify potential opportunities by comparing STEEM's performance against its peers in varying market conditions.

If STEEM's relative strength is consistently increasing compared to its peers currencies, it indicates growing the investors interest and the Same it gives a positive signal that their is potential in Steem price for further appreciation and gaining value.

On the other hand, if STEEM's relative strength is declining while its peers asset are rising, it could signal us, showing us the weakness and potential lost in steem price. It indicates the price could dump from here.

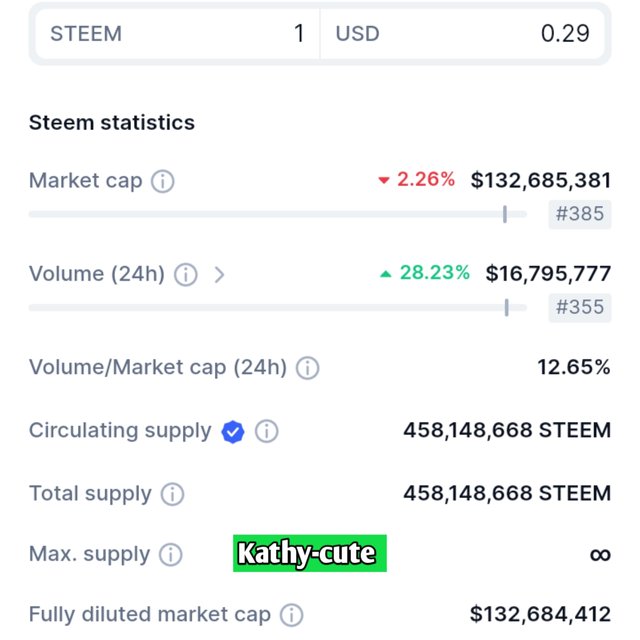

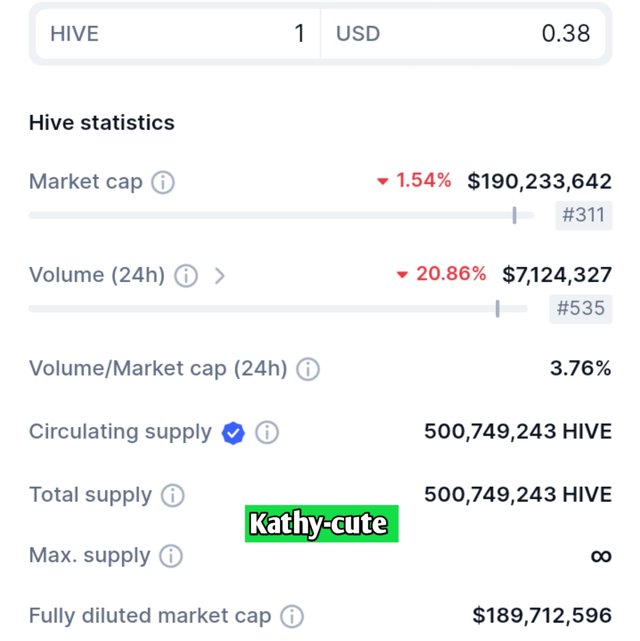

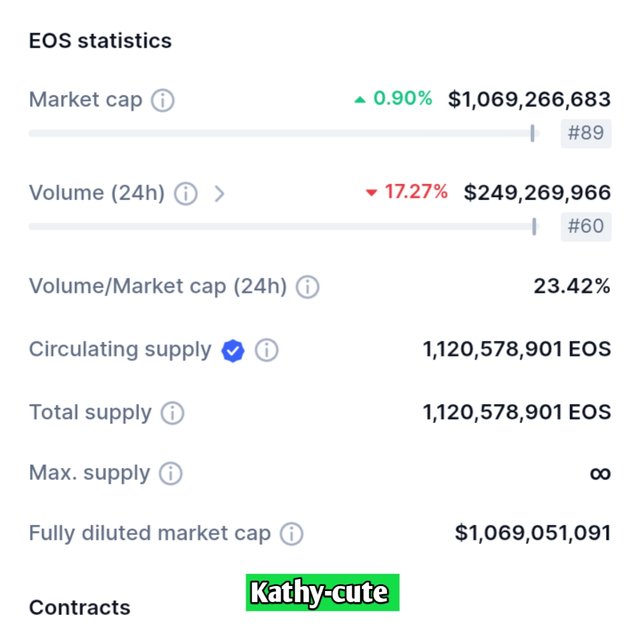

The peers coins with STEEM is HIVE, EOS, BTC and ETH which are most likely see to behave like Steem. You can see I have shown RSA of these coins with STEEM, we see they are UpTo a great level parallel to each other. BTC and ETH have more great relativeness to steem coin too.

What are the possible implications of fundamental events, such as STEEM protocol upgrades, on relative strength dynamics and market participants' perception of the ecosystem? |

|---|

Upgradation will enhance the functionality of the STEEM protocol. It will potentially make it more attractive to the developers and users. If positive upgradation it may improve participants' perception of the STEEM ecosystem, leading to increased confidence in its long-term viability and potential for growth.This will obviously lead to increased adoption and usage of the platform.

Such changes will make Steem platform more competitive in the market. If the changes are quite good and effective we will see steem dominating in it's peers currencies.

However along with that significant upgradation the relative strength could impact the dynamics of Steemit within the cryptocurrency market too. It will leads to increase the attention from new investors and traders. Now steem is an under $1 coin, if their is something big happen, which is fundamentally strong, we can see it's price above $1. According to me STEEM is the best coin under $1 that can give you multiple X profit in upcoming days.

How does the integration of on-chain analysis with relative strength assessment provide a comprehensive perspective for investors seeking to understand the overall strength of the STEEM ecosystem and make informed decisions? (Provide an example that shows your analysis) |

|---|

The integrating on-chain analysis with relative strength assessment is very usual thing to thoroughly analyse any platform. We are talking about Steemit, so it can offer investors a comprehensive view of the STEEM ecosystem by combining fundamental blockchain data with market performance metrics. We can say it's the combination of statistic data from the current market performance, along with current fundamentals in the market.

Let's suppose, on-chain analysis of steem is our target to explore. Here we include metrics like daily active addresses, transaction volume, and network activity. Now for example we observe a significant increase in daily active addresses and transaction volume on the STEEM blockchain over the past month. This is a green signal of growing user activity and engagement within the ecosystem. It's a positive fundamental for Steem platform overall.

Now we will compare steem's over performance with it's peers or relevant benchmarks, this is what we called relative strength assessment. For example here we compare the performance of steem with Hive which is a decentralized social media platform and other platform like Facebook or Instagram or Twitter which are centralized, now If STEEM shows stronger performance metrics compared to its peers, such as higher user growth or better token performance, it indicates relative strength within its niche.

This is very important to know, because by doing such an analysis of two pairs in parallel way, you can gain insights into both the underlying fundamentals of the STEEM blockchain and its competitive positioning within the broader market. It helps you greatly of making decisions in any two assets. Here you can analyse steem with it peers projects if you want to know about the current fundamentals of steem.

|My deep heart invitation to my dear friends :@cive40, @jasa107, @nathalidelgado, @emsonic, @elrazi, @safridafatih, @hotspotitaly, @hardphotographer, @beemengine, @tommyl33, @nushrat, @reetuahlawat, @carlaisl.

|

|---|

Have a nice Day ahead.I know You must be someone beautiful with a beautiful heart. I know you must be someone cute/handsome. I wish you too many blessings in life. |

|---|

Regard kathy-cute

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 5

Congratulations! Your post has been upvoted through steemcurator08.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The ecosystem of STEEM has the potential to be transformed, more users will be drawn to the platform, and it will be better positioned to compete. Fundamental improvements can encourage adoption and investor interest, even though market dynamics play a role. Keep an eye on how STEEM grows because it might surprise us! I wish you success in the competition.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you my friend for a beautiful comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey @kathy-cute your detailed analysis of the resilience of the STEEM ecosystem is impressive! Your insights into how STEEM navigates market fluctuations and engages its community are spot-on. I appreciate your breakdown of on-chain metrics and relative strength analysis providing a clear understanding of STEEM's health and performance. Wishing you the best of luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have great knowledge about crypto too, thank you for a beautiful comment my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

very well Cathy, your examination of how STEEM proved resilience in the face of market volatility was well-organized and relevant. I truly enjoy Your description of how STEEM relative strength research may assist investors find prospective opportunities was persuasive. Your responses demonstrate a thorough awareness of the value of combining on-chain analysis with relative strength evaluation. Visual examples and comparisons to other cryptocurrencies reinforce your case and clearly demonstrate how this strategy may be applied. Wish you great success Cathy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice to see your beautiful words here for me friend. Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

With Pleasure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

STEEM's durability radiates its decentralized administration as well as varied applications, like the blog writing system Steemit. Also in bearish markets STEEM grows, bring in individuals as well as promoting interaction. Its energetic neighborhood drives growth as well as adjustment to market problems. On-chain metrics, consisting of day-to-day purchases, area engagement plus token circulation, deal understandings right into STEEM's wellness. A high deal quantity symbolizes customer interaction, while reasonable token circulation makes certain decentralization. Loved one Strength Analysis (RSA) contrasts STEEM's efficiency to various other cryptocurrencies, leading capitalists in the direction of possibilities in various market problems.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much friend for a wonderful comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are most welcome Kathy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right about active number of transactions everyday that if transactions are too much then it is showing that uses have strong level up participation as well as when I talk about fear token distribution then it is also showing healthy attitude and fair STEEM ecosystem so fairness and transparency make this blockchain more decentralized and be a way to attract more users with time.

Good luck 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for your precious comment dear friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

My pleasure 😊

Stay blessed and keep shinning ⭐

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit