Cross asset correlation is a type of statistical relationship between the returns of different assets classes and security and in simple way for making the definition more clearer to all of you you can understand that it is simply the measurement of the way of movement of two assets with each other. If you don't know and if you don't have understanding about cross asset correlation then you cannot play your role in portfolio management because it's understanding is important if you want to manage your portfolio because understanding of it would help you and especially would help any investor to approach diversification benefits of combining different particular assets in their portfolios.

There are different characteristics that varies from one asset class to another asset class when we talk about cryptocurrencies that's why now what is the relation in between these different classes of different cryptocurrencies is important to understand.Bitcoin, Ethereum and Ripple are some of the most major cryptocurrencies that are very significant regarding their popularity in the recent years that are going on but still they can subject to rapid fluctuations in their price movements.

If investors want to avail the opportunities of applying and implementing their effective diversification strategies then it is very important for them to analyse correlations between different currencies classes. When I talk about further about diversification and is important to understand that it is sort of risk management technique in which use spread investment across different particular asset groups for checking reduction in the impact of performance of any kind of single that and how it is affecting the over all portfolio after that.

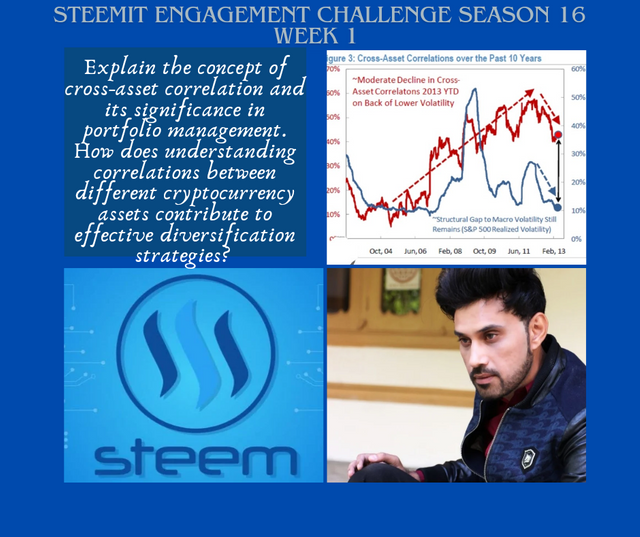

I think when I will give an example to you then it would be more clear to understand my concepts so you can considered that you are going to invest in cryptocurrencies and there are two options which are available for you.Bitcoin and Ethereum are available to you and now it's up to you that in which currency you want to make an investment so if there is positive correlation in between both of these currencies then it means that they are going to move in the same direction in future so now you would receive strong level of diversification benefits when you would invest in both of them or in anyone of them because their prices are most likely to go to peak or going to pump in future.

Keeping in mind the same currencies just if correlation is changed in both of them and there is negative correlation in between both currencies about which I have talked above then it means that prices of both currencies are not going to move in equal direction in the coming days or in future that's why it would be an opportunity for you related to diversification so if you want to invest in both of them then you have a chance to reduce the risk of your portfolio because if there would be one currency which would be down then other currency would be available for the compensation of the loss we can say in laymann's language.

Now in another example you can also imagine that your portfolio have three different currencies which are Bitcoin, Ethereum and Ripple so if Bitcoin and Ethereum suppose have positive correlation but the third one which is Ripple have negative correlation with both then you can add Ripple forgetting and for the enhancement of more diversification in your portfolio because performance of Ripple would be a way to influence the movements of Bitcoin and Ethereum.

When we understand cross asset correlation then it help investors to identify significant trading opportunities. Suppose that in the history there were two cryptocurrencies which most of the time have strong positive correlation but this is very unusual and this is very strange that anytime in future their correlation changes and there is a development of negative correlation in both of them then it would indicate that there is a high and strange shift in the dynamics of the market so it would be a way to create an opportunities for arbitrage or trading strategies that would take advantage of this kind of divergence in prices between both two assets.

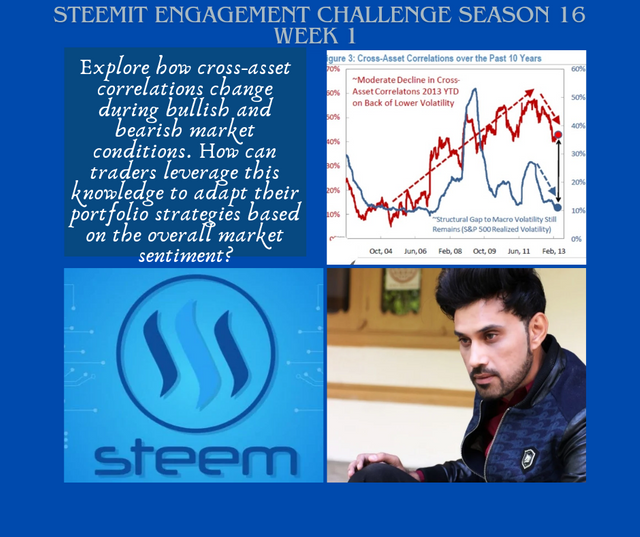

When I talk about positive trend which is also called normally bullish trend in market then most of the time it increase prices of cryptocurrencies in this case so cross asset correlations also increase and in this way different cryptocurrencies also moves most likely in same direction which is bullish direction. There are very simple reasons behind it which are creation of overall positive market sentiment and increase of optimism among investors because they feel very optimistic after hearing such kind of positive news and that's why they also tend to invest more and more in cryptocurrencies.

From the real life example you can consider that there is a recent bullish trend we have seen in market in which Bitcoin and Ethereum prices increases significantly so at that time cross asset correlations between both these tokens was very high and positive and both of them move together due to positive correlation existence between both of them.When I talk about other alt coins then they also take benefit of some substantial gains which reflects that there is over all positive sentiment in the crypto market.

This all was the knowledge that was leveraged by traders and investors in the adjustment of their portfolio strategies and essential measures for gaining significant advantage from the bullish market sentiment overall. In this way traders choose to allocate a high portion of their portfolio to cryptocurrencies which have strong fundamental and significant potential for growth like BTC and ETH.During bullish trend we all know that traders can take benefit from different way and one of the way is to diversify their holdings among different particular altcoins for the maximization of their significant profits.

When I talk about breaish trend then in simple words we all know that it is an indication of something negative happening in the market due to any kind of false news or negative rumour.Well moving towards during bearish trend prices of cryptocurrencies falls down that's why cross asset correlation also decrease in this way so it indicates that there are different cryptocurrencies present with the strong negative correlation and in this way investors diversify their holdings and seek for these opportunities for the protection of their losses that they expect.

Again I am giving a real world example to all of you in which you have to consider that there is a bearish trend occurred in which Bitcoin is experiencing a significant level of drop in its price and their are some alt coins with it also which are Chainlink and Cardano etc and their still relatively stable and even they are gaining some value with the passage of time so in this case crows asset correlation between Bitcoin,LINK and ADA would be of negative kind which would indicates that prices would most probably in future in opposite direction to each other.

This knowledge can be leveraged by traders by the adjustment of their portfolio Strategies for exclusion of losses during this trend so for that reason they would choose to allocate portion of their portfolio to stable coins that are not getting down with a strong track record of market downturns so by the diversification of their holdings and reduction in the exposure to highly correlated assets, it is possible for traders that they can minimize the losses and impact of over all market downturn on their over all performance of portfolio.

It is very important to say that cross asset correlations would be very helpful to provide you some of the most valuable insights for making investment decisions for your future but market conditions, investor sentiment and there are other significant factors that can affect individual cryptocurrencies and in this way correlations can also affect that that's why we can not say that these are static things.

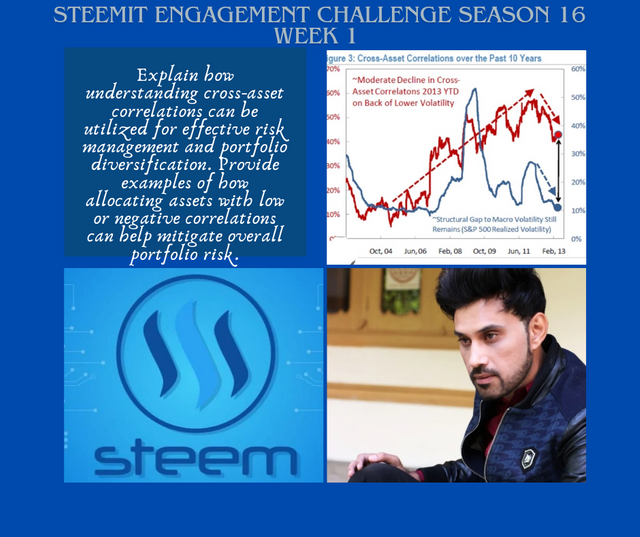

I have already explain that why it is important to understand cross asset correlations for the management of risks and for portfolio diversification in the Crypto world. This is a way to permit traders to allocate assets with the low or negative correlations which can be helpful in the exclusion and mitigation of overall risks in the portfolios so I am explaining with different examples to make it clear more.

When I talk about risk management than crows affect correlations are very helpful for traders in the identification of assets that which have negative correlation with each other so after that by the allocation of their portfolios to these assets it is easy to reduce the risk exposure for traders. If there is one asset which is experiencing unable of down turn or decline due to bad market situation then there would be availability of other assets with negative correlation for the compensation of these losses.

From the real world example you can consider that there is a recent crypto market scenario in which Bitcoin was experiencing a sharp decline but the price of gold remained was relatively stable. Bitcoin was considered at that time that it is an asset with high level of risk while gold was the safe side that's why in that times cross asset correlation between Bitcoin and gold was very low and very negative.

There were different traders who successfully recognized this level of negative correlation in between both of them and act that time they allocate portion of their portfolio to gold for the management of risk and as a sharp strategy for loss and risk management. So you can say that if Bitcoin was experiencing shark decline then stability of gold could be very helpful in this case for the mitigation of risks that are associated with it or for the mitigation of portfolio losses of different traders. The reason was that gold tends to have negative correlation with one of the most riskier assets like cryptocurrencies that was making it a significant hedge against volatility of market.

There is another example that you can take in which there is a correlation between cryptocurrencies and traditional financial assets like stock I am explaining. During the periods in which market was not stable and there was uncertainty in the market then cryptocurrency and stocks have a level of negative and very low population so you can say as an example that during recent stock market downturn cryptocurrencies like Chainlink and Cardano show their resilient behaviour and even they also gained in their value.

Same in this case traders that recognised this level of low correlation have allocated the portion of their portfolios to cryptocurrencies which were LINK and ADA. After that by the diversification of their holdings across different asset classes traders feel very easy to reduce their burden of loss by the reduction in the impact of market downtowns on over all portfolio performance by the implementation of this useful strategy so this diversification strategy permits them to significantly get benefit from uncorrelated or negative correlated movements of different assets.

It is possible that if there is an negative and low correlation then it would be easy to mitigate and excluded but there is no guarantee to protect and prevent these losses.Market conditions and correlations are variable that's why on the base of market dynamics evolvement it is important for traders to adjust allocations of their portfolios.

Correlations can change with the passage of time that's why I am focusing on most recent examples. When I talk about correlation between STEEM, BTC, Ethereum then through historical data there are one of the most interesting pattrens we have seen in them.

We all know that Bitcoin is just like benchmark in overall market because it have overall most significant impact on overall market sentiment.As a result of BTC market sentiment other alt currencies like STEEM tend to show most likely a positive correlation with Bitcoin so it means anything which would happen to Bitcoin other currencies like STEEM and all other alt coins would follow in the same direction so if BTC price is falling or rising then other alt currencies like STEEM would also fall and rise respectively.

If I talk about an example then we can move that in 2020 and 2021 in which there was positive in the overall market so we can say another words that there is a bull run and during that time STEEM price also increase substantially which was the reflection of a positive correlation between these two assets so at that time there were some traders that successfully recognised that there is a correlation existence in between these assets which is significantly responsible for capitalization in bullish Market by holding both Bitcoin and STEEM.

I have told and clear this concept already that not everytime correlations remains constant so if I given example of that then we know that in some cases STEEM has shown deviating behaviour from Bitcoin price movements.For example moving back in history when there was market correction in my 2021 then there was a significant decline in Bitcoin but at that time price of STEEM don't decline or fall and it remains stable at that time so there was a level of divergence which was suggesting that STEEM have low and negative correlation with Bitcoin in that specified period.

From the behaviour of STEEM traders can conclude different insights in relation to broad market by proper monitoring of these correlation pattrens so if STEEM is going to show positive correlation with Bitcoin continuously then it would show that every happening to BTC would significantly affect STEEM also.Based on their analysis of BTC price movements and trends traders use that information for decision making related to STEEM holdings.

If STEEM would start to show it's deviation from price movements of Bitcoin then it would be the indication of different shifts in the dynamics of market.It is important for traders to pay attention on these deviations that wether STEEM is aligning with factors like development of projects, partnership or activities of community so analyzing it would be helpful for traders to identify potential opportunities or risks associated with STEEM price movements.

Understanding correlation between STEEM and Ethereum is also significant. Ethereum is another major cryptocurrency that plays a significant role in the broader market. The correlation between STEEM and Ethereum can provide further insights for traders.I am going to explain recent real world events about Ethereum and STEEM correlation that what happens in it.

As an example it is important to note that in the bull market of late 2020 and early 2021 both Ethereum and STEEM experienced significant increase in their price movements.This positive correlation was indication that as Ethereum gaining price increase and attracting more investors, STEEM also getting benefit from the overall positivity of market sentiment. Traders who recognized this correlation and then they hold STEEM and Ethereum more for more gains.

One recent example is the market correction in May 2021. Ethereum experienced a significant decline in price just in the above example Bitcoin experienced but price of STEEM remained stable and there was no effect on it.This deviation from Ethereum price movement was the indication of existence of negative correlation between STEEM and Ethereum for that particular time period.

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello Your explanation of cross-asset correlation and its significance in portfolio management is well-detailed and insightful. I appreciate how you've clarified the impact of correlation changes during bullish and bearish market conditions providing practical examples. Understanding these dynamics is indeed crucial for effective portfolio strategies. Well done.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for being here at my post and for leaving your such an extensive comment. Thank you so much for your appreciation about my second question in which I tried my best to explain about up trend and down trend with some practical and real world examples and I agree with use for the management of portfolio understanding of these dynamics and analysis is very significant and important

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have done a good job in simplifying the concept of cross-asset correlation, making it accessible for readers who may not have a deep understanding of statistical relationships in financial terms.

You have emphasized the crucial role of analyzing correlations for investors aiming to implement effective diversification strategies, providing practical advice for managing portfolios in the cryptocurrency market.

In my observation, u have effectively linked the positive market trend with the increase in cryptocurrency prices and highlights the correlation dynamics, offering a clear connection between market sentiment and cross-asset correlations.

More success to you .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is looking amazing that you are high lighting some of my points and then you are giving your views about all those points and in a summarised way you like my post so this is much loving for me.

First of all you are talking about my point from the question one in which I have simply described that what is basically cross asset correlation and I tried my best to explain it into simple language and then I tried to explain that what is it in cryptocurrency and after that I have tried my best to explain portfolio management strategies.

I am happy that you clearly understand that what is the role of understanding of cross asset correlation analysis for investors for making their future decisions...

Thank you so much for wishing a lot of success to me and I am also going to visit your entry....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a very detailed and explainable post. You have explained the inter-asset relationship and its importance in asset management. Responses consisting of your examples and actual events are helpful in portfolio building. Thanks and best wishes.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much that you comment at my post and you understand one of the most clear relationship as well as mostly I think you like the real world examples that I tried my best to share in each and every question and especially you like the example that I have shared about portfolio Management and thank you so much for wishing me best wishes I also wish same for you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well done mate! Your write-up has pretty much all the points that one should know about Cross-Asset Correlation. After a;; this is the analysis of how one safeguards their assets by balancing them during up or down, market. I learned a few points from your article. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am happy friend that you have clear understanding of all my points that I have illustrated about cross asset correlation as well as I agree that analysis is just like safeguard because it gives traders understanding that what they should do according to analysis during up trend and during down trend of market and this is pleasure for me if you really understand any single point from my post...

Thanks for being here

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@khursheedanwar Your comprehensive explanation of cross-asset correlation demonstrates a deep understanding of the concept. The real-world examples especially regarding Bitcoin Ethereum and STEEM make the complex subject more relatable. Your emphasis on the dynamic nature of correlations and their impact on portfolio strategies during bullish and bearish markets is insightful. The practical application of cross asset correlation for risk management and diversification illustrated with examples like Bitcoin and gold adds practical value. Your exploration of historical correlation patterns particularly involving STEEM provides valuable insights for traders. Great job in sharing your knowledge!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for one of your most wonderful comment at my post which is very extensive as well as I agree with you that I tried my best to explain real world examples to all of you because always when you explain our topic with examples of daily life and real world then it gives us more clear understanding rather than we give example which is just imaginary and there is no relation of example with reality.

I agree with you that I am emphasizing on the nature of correlations during bullish and bearish market. I am very happy that you got a clear understanding of it also as well as I agree with you about the practical application of cross asset correlation for the management of risks and for diversification which I have explained by the help of an example and I have also tried my best to explain and implement some of the historical correlation patterns about STEEM and I have also given its significance that why they are important and thanks for your encouraging words that my post is great and my knowledge that I have shared is great in it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well my friend how are you and your post is always very inspiring and in the depth of analysis you always question very well and you always tried to you and the key points is written in so simple language that is this easy to understand.

You have a simplify the definition in such a way that it was crystal clear understand and there the last question you have answer it so well I was also worried out about this question.

Over all you did amazing job and best of luck for the participationover all you did amazing job and best of luck for the participation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much for one of your most wonderful comment at my post. I am very happy that my deep analysis is very inspiring for you and you understand the answer of each and every question whatever I have tried my best to convey to all of you because you think my language is very easy in every answer.

Secondly I agree with you that I tried my best to explain the definition in my very simple words and I don't understand that why you were worried about last question maybe before participation you don't understand about it but after reading many post now you have cleared your understanding about it that's why now you are not confused regarding it and thanks for wishing me best of luck.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome 🤗 your post always helpful

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hey bro as always I trust you to create wonderful articles on steemit, this your post is of high quality and I must say you didn't disappoint me but you did more than I expected friend.

Correlation between assets are very important in every tradeble market because some traders uses a comparative Data to make successful analysis during their trades.

Thanks for going through wishing you success please engage on my entry too

https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for leaving your encouraging words at my post and I am grateful to you for your words that I have explained this post more than your expectations...

Secondly you choosed one point from my post and this is really fascinating me .I agree that for decision making and for making successful analysis traders most often use analysis data.

Thank you for wishing me success and I also wish you good luck...

I am very soon going to visit your entry too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit