.jpg)

This article is my homework elaboration for Beginner Level in Steemit Crypto Academy. Specifically, in the class of professor @lenonmc21 about Capital Management and Trading Plan.

Question 1.

Define and Explain in detail in your own words, what is a "Trading Plan"?

THE DEFINITION OF TRADING PLAN

In trading transactions, it is important for investors to make a neat and good plan so that the investor can ensure that his business remains on the track that he wants. This is known as Trading Plan.

Trading plan is considered as an instrument of business. It is part of money management to run the capital management that investors and businessmen have. As the professor said in the class, the trading plan is congruent as a pillar of a building. When it is weak, the risk of the building collapsing will be great. Hence, the stronger the pillar is, the stronger the business will be. Indeed, no one wants to lose when running a business. Therefore, the trading plan is one of the spectrums that we must learn and understand to avoid big losses from the movements of the market that always fluctuated.

All forms of trading transactions require steps both when opening the market and determining the closing value of the traded capital. The Trading Plan is made to make it easier for us to deal with problems during transactions.

Preferably, the Trading Plan is structured according to our characteristics and the purpose of trading. Because, without a clear goal, we are just wasting time and shared capital that was already spent in the beginning of trading activities.

Question 2.

Explain in your own words why it is essential in this profession to have a "Trading Plan"?

THE IMPORTANCE OF TRADING PLAN

Trading plan is a systematic plan as a reference for investors or traders in managing share capital and decision making to achieve the targets on stock transactions. This trading instrument is designed to make it easier for us to make a right judgment such as “what to do?”, “when should we trade?”, “how much to sell or buy?” or "should we exit the trading or hold it for a moment?".

Without a clear plan, a trader or investor will have difficulty in trading stocks because he is not aware of his condition in the trading sphere. He shall hardly decide what to do when the price in the market increases, decreases or even remains the same. Decision making will always be strenuous for those who do not know the purpose of trading. Not only those who do not own a trading plan, trading is also tough when an investor has a trading plan but is not used as a reference. In fact, the trading plan is made to help us as investors or traders to remain consistent in carrying out trading strategies until we reach the target.

Surveys prove that the most common mistake made by novice traders is to ignore the importance of a trading plan. In fact, by using a trading plan, all the risks and problems that will arise can be overcome immediately.

In any business, everyone has experienced losses which are caused by erratic changes in market prices. However, we can control the disturbance that happens in our own capital if we can adjust well to the dynamics of market prices. The existence of this trading plan aims as our principle in controlling share capital. Therefore, it is very important to make a trading plan and run it well. So, we will not get out of the line which is already structured and lead to big loss.

Besides, in designing a trading plan, there are principles or strategies that must be adhered to, this basic principle is called a basic trading plan.

Queston 3.

Explain and define in detail each of the fundamental elements of a "Trading Plan"

THE FUNDAMENTAL ELEMENTS OF TRADING PLAN

Basic trading plan is basic things that designed in a trading plan as our principles or strategies. Following this, a trading plan can be well structured with accurate data. On the ground of basic trading plan, we can implement the strategy optimally during trading. To make it easy to understand, it should be planned as simple as it can be and contains complete information. It is highlighted that simple does not mean bad. The only thing that determines whether we succeed or not in trading is our attitude towards the trading plan. As long as we are consistent and disciplined in performing the plan, the results will be pleasurable.

There are important components in making a trading plan to help our process well oriented. They are:

1. Risk Management

Trading is always risky, but with risk management, the risk is not too big and can be overcome. We must determine the arrangement of numbers that will be the target of reward or risk as a risk tolerance. In order to be able in analyzing losses and can be easily controlled if we have to deal with that sort of situation. Vital, we also have to avoid overtrading because overtrading will only point us to greater losses

2. Capital Management

To manage long-term trading risks, it is suggested that we ought to make a comparison between the loss risk limit and profit target in each transaction. It is better that the minimum ratio we use is 1:2 to get a positive result. The profit goal must be twice as large as the risk. To illustrate, if I set $2 USD per day as a risk limit, then my profit target is $4 USD.

It should be noted that we must stop doing the target if it has touched the target limit, whether it is a loss or a profit. This will keep us from bigger losses. Although we gain profit, the activities of trading still has to be stopped because we must discipline ourselves to make us keep on the track based on the trading plan that has been designed.

3. Trading Psychology

As I discussed previously, the most common mistake made by beginner traders is to neglect the crucial of a trading plan. One of factors that make the traders doing so is psychology factor. They are full of emotions whatsoever while performing trading activities. It could be because the trader is too happy because he succeeded or too angry and sad because he failed in trading. Immersed in emotions and neglecting the trading plan will lead to failure.

There are several tricks to control our emotions, as follows:

- Act as usual like nothing happened when you earn or lose. Let's say these two things are the most common things that happen to you daily.

- Discipline and consistently perform the trading plan. Make the trading plan that has been created as a reference.

- Frequently, analyze and review the trading strategies since the fluctuation of market price affects the effectiveness of the implemented strategies.

4. Planning and Control

As stated in the task, that the trading plan must be designed within 6 months to be implemented on the "Binance" trading platform. Further elaboration is in the next section.

PRACTICE

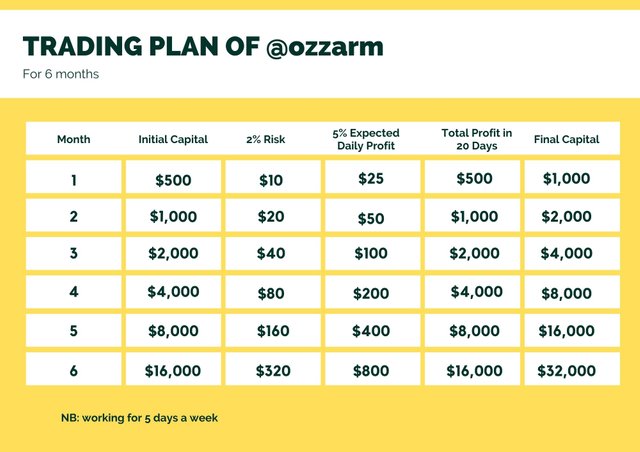

According to the standard of "Binance", the minimum capital investment is started from $10. Despite this, I planned to invest $500 as my initial capital. My ratio that I stated is 1:3, specifically 2% of risk and I expected 5% profit in a day.

I made two records of trading plan in two separate places which are Microsoft Excel and also a cute trading plan that I will print out. For your information, I used templates from Canva and then upgraded it as my preference.

The purpose of this printable cute trading plan is to motivate me in keep recording what I achieved in trading activities.

In light of my mood swings, I cannot work every day. Thus, I designed 5 days a week to work.

In a nutshell, based on my expectation, I will earn doubled of initial capital in the end for the first month and gained $32,000 at the end for 6 months.

REFERENCES

- https://steemit.com/hive-108451/@lenonmc21/gestion-de-capital-y-plan-de-trading-crypto-academy-curso-dinamico-para-principiantes-s4w8

- https://www.danielstrading.com/2018/06/12/3-elements-of-a-successful-trading-plan

- https://www.investopedia.com/terms/t/trading-plan.asp

- https://www.staceyburketrading.com/successful-trading-plan/

- https://www.investopedia.com/articles/trading/04/042104.asp

- https://bullsonwallstreet.com/trading-plan/

- https://tradingsim.com/blog/trading-plan/

- https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/trading-plan/

- https://www.investopedia.com/terms/r/riskmanagement.asp

- https://www.investopedia.com/articles/trading/02/110502.asp

- https://www.forbes.com/sites/brettsteenbarger/2019/08/17/trading-psychology-the-power-of-patterns-and-principles/?sh=6b7fa9327d54

- https://mifx.com/blog-read/risk-management/14/atur-risiko-kerugianmu-dengan-risk-to-reward-ratio

- https://mifx.com/blog-read/trading-pemula/21/pentingnya-mengontrol-emosi-dalam-trading-forex

Thank you for all the professors who enlighten all the students in Steemit Crypto Academy through their guidance and knowledge. Your support always help us present and future.

Signed.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit