1- Define the concept of Market Making in your own words.

Market making is providing liquidity on a particular cryptocurrency by giving out the bid and ask limit orders on an exchange. It is also a process whereby a trader or investor provides liquidity to buyers and sellers of securities, assets or commodity in the market. It creates a mutual relationship between the buyers and sellers leading to the creation of a market for buying and selling assets or stocks.

This also ensures that the orders created by market markers are filled as of when due thereby enably a smooth flow of financial market for both parties (buyers and sellers). It is a strategy employed by market markers to make fast profits from the market as it gives them liberty to set the price of an asset different from the current market price.

Market makers are people or firms that activitely quotes two-way markets in a particular asset , as such, providing bids and asks along the market size of each security. They buy and sell insecurities for their own account and then, provide liquidity and depths to market. They also make trades known as principal trades for their own account and make profit from the difference in the Bid-Ask spread. Generally, it leads to an increase in the amount of investments in the market.

In the crypto world, when a trader or an investor purchases or sells an asset with a preferred quote which isn't the current market price, it is called a market Maker. The price is usually set differently from the current market price and hence, the trade will not be exceuted immediately but will be placed in the order book till whenever there is a matching order and the trade is fulfilled. It simply creates a limit order and provides liquidity to the market.

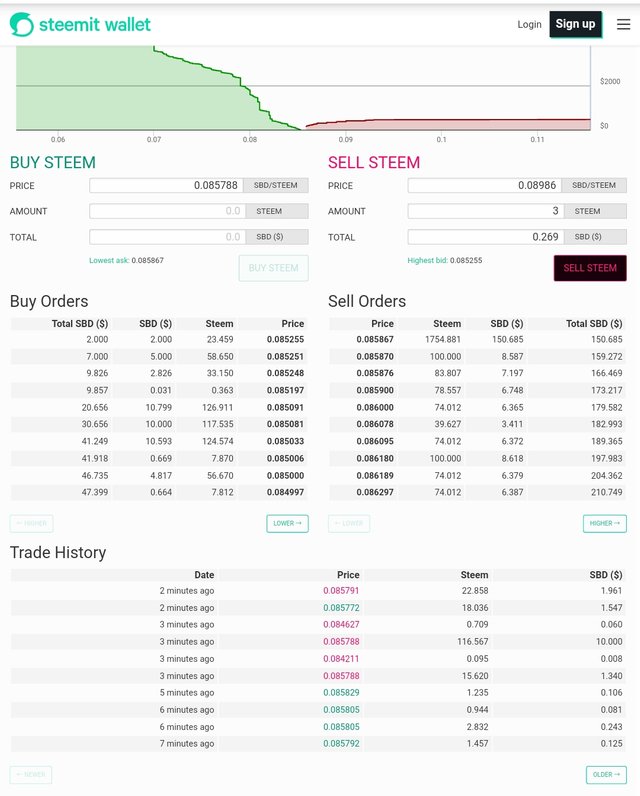

2- Explain the psychology behind Market Maker. (Screenshot Required)

Screenshot from Steemit wallet

The main psychology behind the concept of money maker is creating more liquidity in the market (either stock exchange or cryptocurrencies). It is also to make profits and create a free flow of trades in the market which is done by carefully studying and understanding the market system.

It's obvious that there are two kinds of traders when it comes to the crypto space; there are those who purchase assets immediately at the current price and those who purchase using limit orders. The latter place an order at their desired rates and sell them at specific rates using limit orders. The placed orders are shown in the order books hence providing liquidity.What the market marker does is to set and bid and ask limit order in the market to provide liquidity.

The open order that has been created by the market marker makes the traders trade within a specific range of price which is the highest ask and lowest bid. This creation of buy and sell limit orders leads to the continuous availability of market in the crypto space as well as provides liquidity and reduces volatility of an asset which in turn minimizes the probles of delay in execution of an order. Like I had already established, the market makers make gains from the Bid-Ask spread of the orders.

The screenshot above is a pictorial representation of how market makes have placed orders in prices that aren't to the current price to make more profits.

3- Explain the benefits of Market Maker Concept?

Increases Liquidity in Market

More liquidity of asset is provided in the market as market markers sets buy or sell orders of an asset within a certain range of price. In addition, there is an increase in the depth of order book which makes the assets more available in the market.

Stabilizes the Bid-Ask spread

Market markers helps in stabilizing Bid-Ask spread in the market by providy liquidity which reduces spread.

Reduces Price Volatility and Slippage

The concept of market markers reduces the volatility of price of an asset in the market which sometimes leads to a reduction in slippage and consequently, the maximization of the Bid-Ask spread.

Accommodates larger institutional investors

This concept aids in maintaining a balanced Bid-Ask spread which in turn, creates an avenue for more investors to invest and make profits. It also provides better and more orderly entry and exit points for traders and small-scale investors.

Seamless trading

Market marker concept brings about a seamless running of trade in the crypto market. More assets are made available in the market for traders and more market orders are created thereby making the matching process an easy one. It may be rough trading when there's no sufficient assets to be traded in the market and traders will not be able to perform their trades easily.

Increment in trading volume

The amount of liquidity is the market influences the trading volume of any asset. An asset with low liquidity typically shows a wide Bid-Ask spread which will invariably reduce the volume of the trade whereas a high liquidity shows that there's an increase in trade volune and a tighter Bid-Ask spread. This can be said to be the main psychology of a market marker and why they usually provide liquidity in the market by continually posting tighter spreads.

4- Explain the disadvantages of Market Maker Concept?

Some of the disadvantages of market Maker concept are:

There is usually a conflict of interest in order exceution because the market markers may likely trade against other traders

There is a tendency for market markers to manipulate currency prices to reach their customers' stoplosses or possibly stop them from reaching high profits. They may likely move their currency quotes 10-15 pips away from other market rates.

There may be a huge amount of slippage when the information is published. They usually quote display and order placing may likely freeze when there's high market volatility

Market makers usually feel threatened and frown at scalping practices and hence, may likely put scalpers on manual execution (their orders may not get filled at their desired prices).

There's a tendency for market markers to play tricks on customers especially when they are not duly regulated. They are usually responsible for the price position and this can be negatively influenced by poor price execution.

5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Indicators can be said to be technical tools that are used for the technical analysis of an asset in the crypto market which helps traders and investors to make good decisions when trading. For the purpose of this assignment, I will be discussing Relative strength index indicator and moving average.

Relative length Strength (RSI)

Screenshot from Binance

RSI is a momentum-based indicator which also has the ability to function as an oscillator following the fluctuations of prices of an asset. It is very unique in that it shows a trader when an asset is overbought and oversold. It can easily be added to a trade chart is easy to use even to learners. Marker makers are fulky aware of the use of RSI indicator and they are able to manipulate the market and force the indicator to change it's direction temporarily to suit them.

The RSI indicator is scaled from 0-100. The 0-30 region is called the oversold region whilst the 70-100 is called the overbought region. When it moves downwards from the region 30, it shows a downtrend in the price movement which simply means a buy signal and the oversold point. Conversely, when it moves upwards towards the 70 range, it gives a sell signal and is the overbought region.

MOVING AVERAGE

Screenshot from Binance

The moving average indicator is another commonly used indicators by crypto traders. It aids in the prediction of the price movement by looking at the historical data of the movement of the price. It has two lines of different lengths which aids trader in predicting the next trend.

These two lines cross over each other in what is called the golden cross. This golden cross tells that there will be a trend reversal which can be upward or downward.

It is imperative to note that market makers take advantage of moving average because they are aware that retail traders use them for estimation of trend. They manipulate the indicator by making price movement go the direction they desire.

Conclusion

Market Markers are seen as an important aspect of the cryptocurrency industry because without liquidity for buy and sell activities, the system would be inefficient and access to tokens would be too much. Despite the fact that they are liquidity providers and have been observed to supply liquidity on a temporary basis to support their unregulated activities, they have continued to disadvantage traders due to other traders' ability to make Bid and Ask orders. Two indicators that can be used in the market marker concept are RSI and Moving average and they are very effective.

Thank you @reddileep for this lecture