Assalamualaikum everyone!

Welcome to the post. Hopefully, all of you will be doing well and enjoying the time with the grace and blessings of Almighty Allah. Today, I'm here to be a part of the week 4 contest in the beloved SteemitCryptoAcademy. The topic of discussion for this week is quite interesting and informative, STEEM Ecosystem Resilience. So, let's start the fun without any wastage of time.

How has the STEEM ecosystem demonstrated its resilience to market fluctuations and changing trends over time?

In the blockchain world, the word Resilience means the ability of a chain to face various unfavorable conditions with the help of their internal steps and regulations to control over such situations. The same is the case with the STEEM blockchain and some of the important factors behind it are discussed below.

- Active and Engaged Community:

The STEEM's core strength is its loyal user base. Even during market downturns, a reasonable percentage of users continue to actively engage with the site. This involves producing content, upvoting relevant posts, and powering up and delegating STEEM coins.

Powering up and delegating essentially locks up tokens for a set amount of time, lowering overall supply and in this way stabilizing prices. This active engagement generates a sense of community ownership and keeps the platform going even when the market is unpredictable. So, it is a great edge for the Steem blockchain.

- Adaptability and Innovation:

Another important thing to notice here is that despite changing trends, the STEEM platform has remained dynamic. Developers have created features and activities to keep user base interested and adapt to changing preferences. This could include introducing new reward structures to encourage specific content categories such as artistic pieces.

Furthermore, adding dynamics and innovations such as engagement challenges can increase user participation and content development. By responding to user requirements and trends, STEEM displays its ability to remain relevant in a changing world of the digital realm.

- Decentralized Governance:

Unlike certain platforms with centralized management, STEEM has a decentralized governance architecture. This means that the community may help shape the platform's future through suggestions and voting. While this may result in slower decision-making, it promotes a sense of ownership and decreases vulnerability to external forces.

A single business owning the platform would not be as resilient in the face of heavy changes or market adjustments. However, it's also important to note that effective decentralized government necessitates active community participation, which can be difficult to sustain over time.

How can the analysis of on-chain metrics, such as daily transactions, community participation and token distribution, provide insights into the health and robustness of the STEEM ecosystem?

The meaning of the On-chain metric is clear from the name, it is the determination of the data and happenings of a blockchain, or we can simply say that the track of the transactions, etc. On-chain analytics for STEEM can provide useful information on the ecosystem's health and robustness. Some of the important factors in this regard are given below.

Analyzing daily transactions and total transaction volume on the STEEM blockchain provides an overview of activity levels. A continuous or increasing number of transactions indicates that the platform is being actively used for content creation, upvoting, and even trade. In contrast, a considerable reduction in transactions may signal declining user involvement, which could have an influence on the ecosystem's health.

On-chain statistics can disclose the number of active addresses that communicate with STEEM. This covers the addresses used for content creation, upvoting, and token delegation. A growing number of active addresses indicates a more engaged user base, which is a good sign for the ecosystem's health. A steady reduction in active addresses, on the other hand, indicates a declining user base, which could lead to a less growing ecology.

Examining token distribution tells how STEEM tokens are distributed among various wallets. A healthy distribution, with a big proportion of tokens held by active users and a smaller percentage concentrated in a few wallets, suggests a more decentralized and potentially more robust ecosystem. In contrast, a situation where a major number of tokens are held by a few entities, shows that the ecosystem is not much growing.

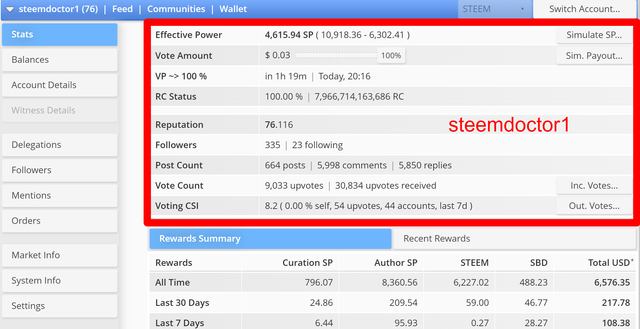

We all know that there are number of such tools which are built on the Steem blockchain to discover and determine the metrics that are discussed above. The most important and the widely used tool for such determination is the steemworld.org. Have a screenshot below,

How can STEEM's Relative Strength Analysis versus other cryptocurrencies help investors identify potential opportunities in varying market conditions? (Provide an example that shows your analysis).

One of the important term which is used in the blockchain technology is the Relative Strength Analysis. It is actually the comparison of the metrics of a blockchain with other potential chains or competitor chains of the market. Relative Strength Analysis (RSA) for STEEM can be used to assess its overall health and potential when compared to other blockchains, not just individual cryptocurrencies. Some of the important factors to consider here are:

Compare the daily transaction volume on the STEEM blockchain to different blockchains. Higher or increasing daily STEEM transactions in comparison to others could indicate more active user participation and possibly higher network utilization, implying a stronger ecosystem.

Compare the number of daily active addresses on STEEM to other blockchains. A growing number of active addresses on STEEM compared to others indicates a more engaged user base, which could lead to a more strong ecosystem.

Thirdly, track and compare developer activity on the STEEM blockchain with others. This can include tracking code commits, updates, and the introduction of new features. Higher proportional developer activity on STEEM shows continued innovation and improvement, which could indicate a better long-term future.

Finding Opportunities in Various Markets...

- Bull Market:

During bull markets, when the total cryptocurrency market is increasing, STEEM's RSA can assist determine whether it is outperforming as compared to the other blockchains. For example, if STEEM's transaction volume is increasing faster than that of other blockchains, it may indicate that STEEM's price will rise even further in comparison to others.

- Bear Market:

When crypto values are generally decreasing, STEEM's RSA can help identify blockchains that are demonstrating relative resilience. If STEEM's user base maintains consistent or even expands in comparison to others during a downturn, it may indicate a more resilient ecosystem with the potential to recover faster in the future as compared to the other networks.

For example, a new blockchain is gaining popularity and focuses on decentralized finance. You can use an RSA to compare STEEM's DeFi capabilities and user activity associated with DeFi functions to the new blockchain. If STEEM maintains a solid relative position despite the excitement surrounding the new entry, it may be a more appealing investment option owing to its preexisting user base and existing DeFi capabilities.

It is also important to take note that on-chain data analysis alone does not provide a complete picture. Consider elements such as overall market attitude, regulatory landscape, and project plan to gain a more complete understanding of the scenario. Metrics can be altered, thus it is critical to study data from reputable sources and combine RSA with basic analysis.

What are the possible implications of fundamental events, such as STEEM protocol upgrades, on relative strength dynamics and market participants' perception of the ecosystem?

Off course, the fundamental events such as STEEM protocol updates can have a substantial impact on the blockchain's relative strength dynamics and market perceptions. Let's discuss some of the facts and figures that can related with the said conditions.

Positive Effects on Relative Strength and Perception...

The upgrades that speed up transaction processing, lower fees, or enhance network capacity can help STEEM compete with other potential blockchains facing scalability difficulties. This may attract new users and developers, increasing overall network activity and user perception.

Introducing new features or functions through updates might increase STEEM's desirability to competitors. Upgrades that include DeFi functionality, increase content moderation and curational tools, or streamline the user experience, for example, can help STEEM establish itself as a more adaptable and user-friendly platform.

Another important thing is that the protocol improvements that address security vulnerabilities or improve network stability can increase investor trust and help the platform's relative position. A blockchain that is seen to be secure and dependable attracts more investment and user adoption.

Possible Negative Effects on Relative Strength and Perception...

Upgrades that are delayed or have errors during implementation can disturb user trust and negatively affect perception. This could result in a decrease in user engagement and potentially diminish STEEM's relative strength vs other blockchains.

Blockchain upgrades that result in hard forks or significant modifications to the fundamental protocol can cause conflict within the community. This might decline network growth and cause a fall in relative strength of the blockchain as compared to all the other competitor platforms of the market.

Upgrades that fail to deliver on promised benefits can disappoint both investors and customers. This could result in a sell-off of STEEM coins and a diminished sense of the ecosystem's ability to innovate effectively.

Market Participants' Response...

Investors are eagerly and attentively monitoring protocol upgrades to analyze their potential impact on STEEM's future value. Successful upgrades can generate more investment interest, whilst bad ones may force investors to turn elsewhere.

Active users of the STEEM platform are immediately affected by upgrades. Upgrades to usability and functionality can improve the user experience and encourage continuous engagement. Upgrades that cause disruptions or bring complexity, on the other hand, may result in user dissatisfaction and a decrease in activity.

Developers have an important role in developing, implementing, and maintaining improvements. Successful upgrades can bring new developers into the ecosystem, but failed ones may discourage developer participation, limiting future innovation.

In short we can sat that the influence of STEEM protocol updates on relative strength and market perception is dependent on their effectiveness and implementation. Successful upgrades can greatly improve STEEM's standing in the blockchain environment, whilst badly executed upgrades can have negative consequences.

How does the integration of on-chain analysis with relative strength assessment provide a comprehensive perspective for investors seeking to understand the overall strength of the STEEM ecosystem and make informed decisions? (Provide an example that shows your analysis)

Understanding the underlying health of a blockchain ecosystem is very much important before making any decision in the market. Combining on-chain analysis and relative strength assessment (RSA) can provide investors with significant insights.

On-chain analysis focuses on the basics of the STEEM blockchain. Investors can assess user involvement and activity levels by observing daily transactions, active user base, and token distribution. Rising transaction volume and an expanding user base indicate a thriving and active community.

RSA takes things one step further. It compares STEEM's performance indicators with those of other blockchains. This enables investors to assess whether STEEM is gaining or losing momentum in terms of user engagement, developer activity, and innovation. For example, if STEEM's user base is increasing faster than a competitor's, it indicates the potential of the STeem blockchain to have an influencing future.

Let suppose, you're examining STEEM. On-chain data reveals a rise in transactions and active users. RSA shows that this growth is outperforming a competitor, and STEEM recently completed a successful upgrade. Combining these observations yields an optimistic picture, a robust STEEM community with momentum and a desire to improve.

Conclusions

It is very much important to evaluate the health of the STEEM ecosystem. On-chain analysis such as transaction volume and user activity provide insight into the inner workings, whilst Relative Strength Assessment (RSA) compares STEEM's performance to other blockchains, exposing its place in the larger landscape. By combining them, investors can have a full knowledge of STEEM's user engagement, development activity, and growth potential, allowing them to make better investment decisions in the market.

I would like to invite my friends @malikusman1, @artist1111, @abdullahw2 and @chasad75 to be a part of this amazing contest.

|  |  |  |

|---|

X Share Link:

https://twitter.com/mrsheraz7588/status/1771914481024790542?t=5kqQLTAd82mixRnXKEqGsg&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

An informative evaluation dropping light on STEEM's durability among market changes and also its vital columns: an involved area, flexibility, and also decentralized administration. Checking on-chain metrics like day-to-day deals plus community engagement uses essential understandings right into the community's wellness as well as effectiveness crucial for its continual development as well as significance. Keep publishing more such valuable articles here. Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot for the nice compliments 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 35%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way, you could have the option of being selected in the weekly Top of our curation team.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks a lot dear @irawandedy friend

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent and informative article You have presented the potential impacts of the Steem blockchain upgrades with great clarity.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Informative analysis of the STEEM ecosystem's resilience and its implications on market dynamics! thanks for sharing 🙂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit