Introduction

Hello fellow steemians it's another week in the steemit crypto academy season 4. This week lesson by @reddileep is on Arbitrage Trading. In this assignment I will show my understanding on Arbitrage Trading, Types of Arbitrage Trading, Advantages and Disadvantage of Arbitrage Trading and also show practicals on how to use Arbitrage Trading.

LET'S GET STARTED

1- Define Arbitrage Trading in your own words.

From the word "Arbitrage which means the buying and selling of commodities, stock, cryptocurrency in different markets in order to take advantage of the of the price difference between the two markets of the same assets."

Arbitrage trading is the exploiting the differences in price of an asset in different markets in order to make profit. Arbitrage trading involves buying of an asset at a lower price in a market and selling it at higher price in another market. This is possible because of the difference in the listing price of an asset in different exchange/market.

Arbitrage trading does not involve any Risk while performing. Also Arbitrage trading usually involves substantial amount of money. Because the difference in the price of the asset in the two markets are always very small and will have better profit on huge amount of money.

2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

There are several types of Arbitrage trading I will be talking about three of them

- Exchange Arbitrage

- Funding Rate Arbitrage

- Triangular Arbitrage

Exchange Arbitrage This is basically the most common type of Arbitrage trading. When a trader buys a asset in an exchange and sell the same asset in a different exchange. This process is known as Exchange Arbitrage Trading.

For instance I bought asset X in bittrex exchange and sold it in binance exchange market because of the difference in the listing price of assets X in the two exchange.

Funding Rate Arbitrage This types of trading involves buying an asset in the spot market but due to market flauntuation the trade will sell the asset in the futures market in order to make profit from the downtrend.

We all know we can't place a sell entry in the spot market we can only use buy for entry position. So for instance a trader bought an asset Y in the spot market then transfer the asset to the futures market to sell. Sell in the the future market doesn't require totally selling the asset. It's just an entry point like buy. The trader will make profit if the trend goes down and will make loss if the market trend goes up. This process is known as Funding Rate Arbitrage.

Triangular Arbitrage This is also another common type of Arbitrage. This type of Arbitrage involve trading of three cryptocurrency It's like a cyclic process. It involves exchanging the three cryptocurrency pairs in order to make profit.

For instance we have asset X we exchange asset X for asset Y the exchange asset Y for asset Z then finally exchange asset Z for asset X. Now you see that we have gotten our X back but now the asset X would have increased after the exchange. The purpose of this exchanging of cryptocurrency is increase the volume of cryptocurrency in the wallet and t

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

Like I have explained earlier triangular Arbitrage is a cyclic trading. It involves buying and selling of three cryptocurrency for the aim of making profit.

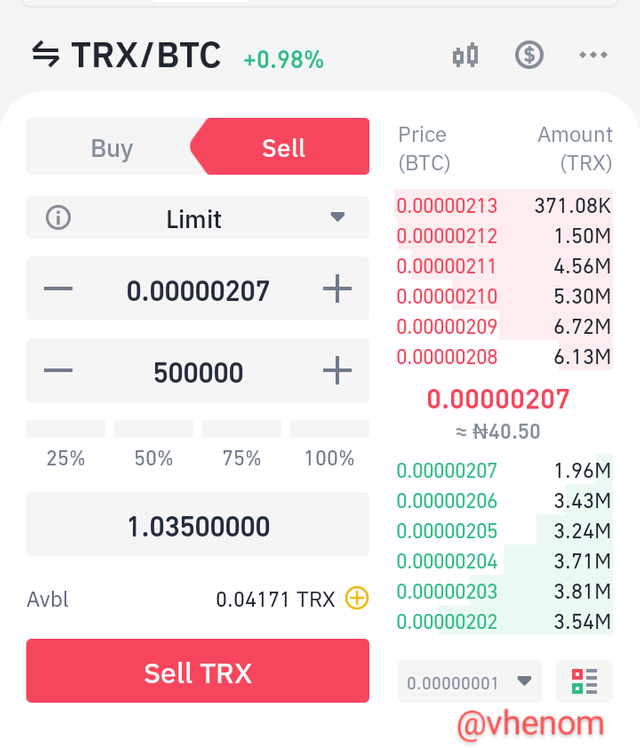

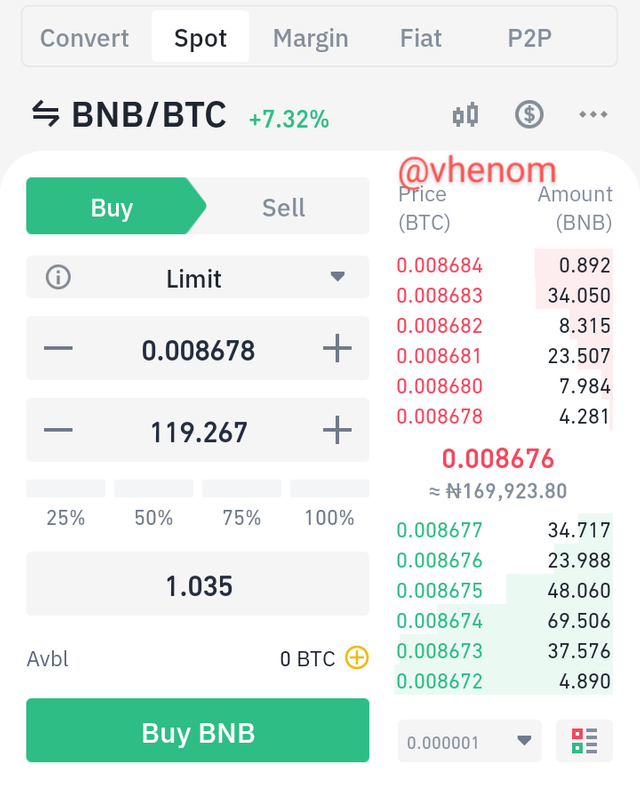

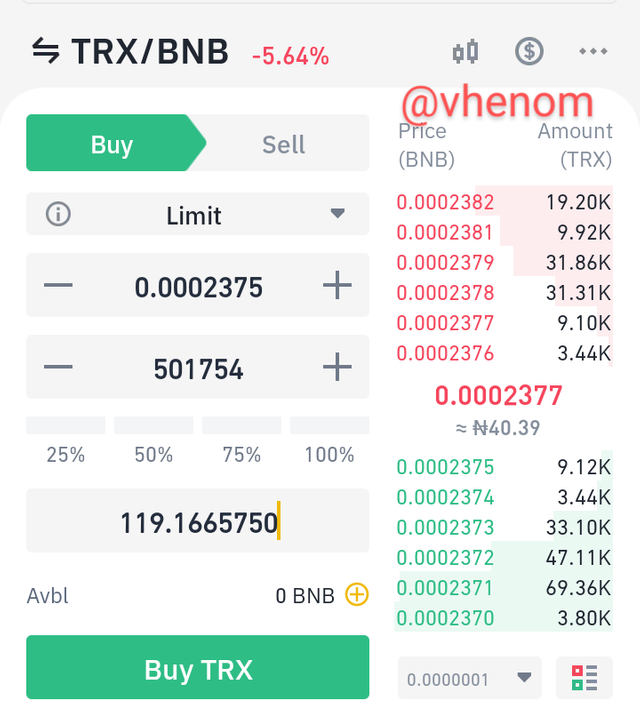

I will use TRX, BNB and BTC for illustration. For instance I have 500000 TRX in my wallet and I want to use it for Arbitrage trading. Then I will sell TRX with TRX/BTC pairs I will get 1.035 BTC. I sold TRX with the lowest bid price. Then I used the BNB/BTC pair I bought BNB with the BTC. I got 119.267 BNB. After having 119.267 BNB I used the TRX/BNB pairs then I bought TRX with the BNB now the volume of the TRX have increased and I have made more gain. I got 501754 TRX. My profit from the triangular Arbitrage Trading is 1754 TRX.

Below are screenshots illustrating the above example.

4- Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price.

For the essence of this question I will use kucoin mobile app and binance exchange for the trade. I will buy the coin on kucoin and will sell it in binance exchange due to the difference in their listing price.

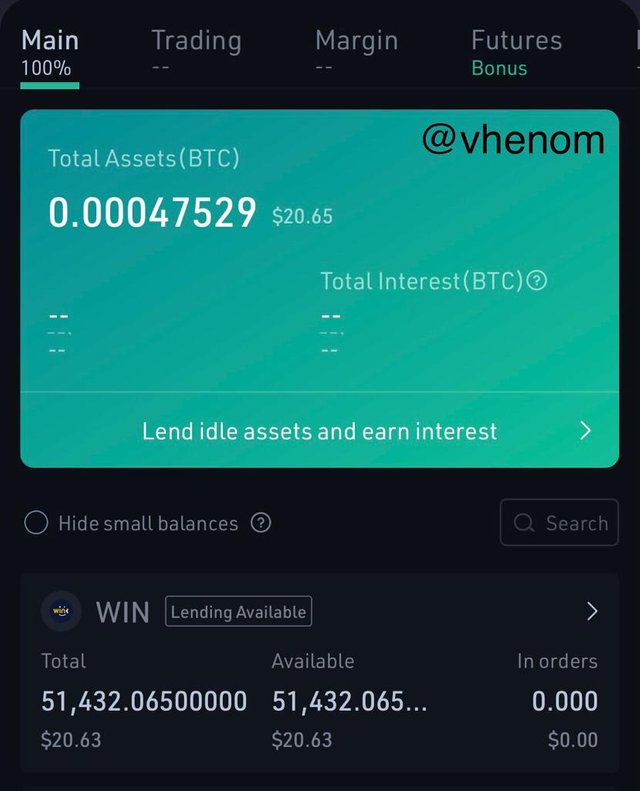

After confirming the difference between then listing price of assets in binance and in kucoin. I decide to buy win token on kucoin because the price is lower compare to the price on Binance exchange.

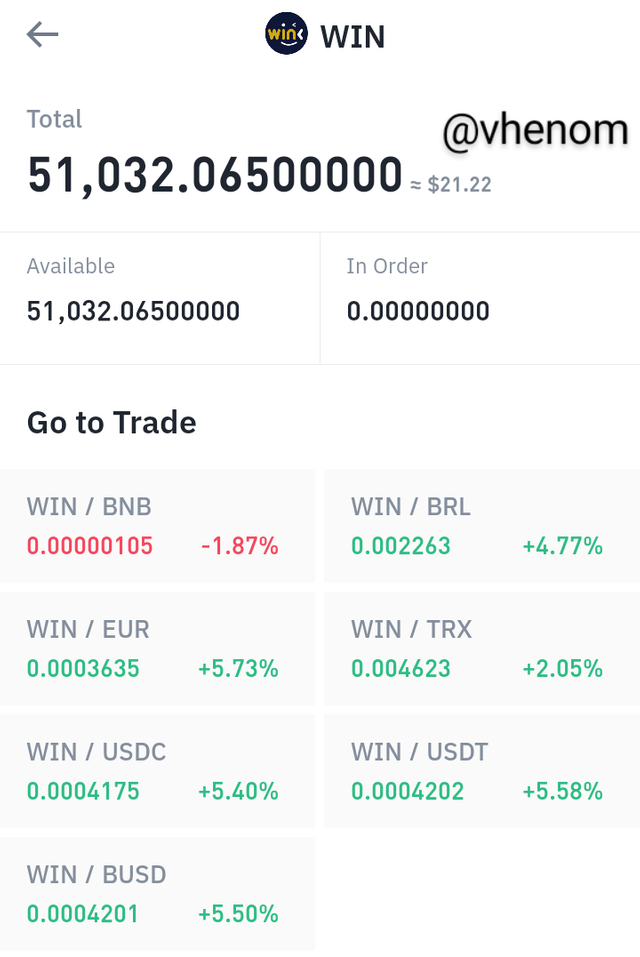

Above is a screenshot showing the price of WIN token I bought on kucoin. I bought 51,432.065 WIN for $20.63 then I transferred it to binance to sell. The transactions is low because win is also on TRX chain.

Upon transferring the coin to binance and 240 WIN was used for transaction fee I still sold WIN token at $21.22 on Binance exchange below is the screenshot of the trade.

I got $0.59 as profit.

5- Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH.

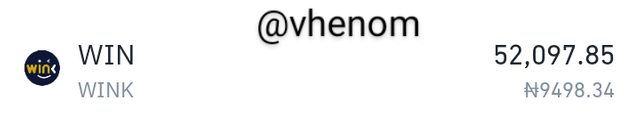

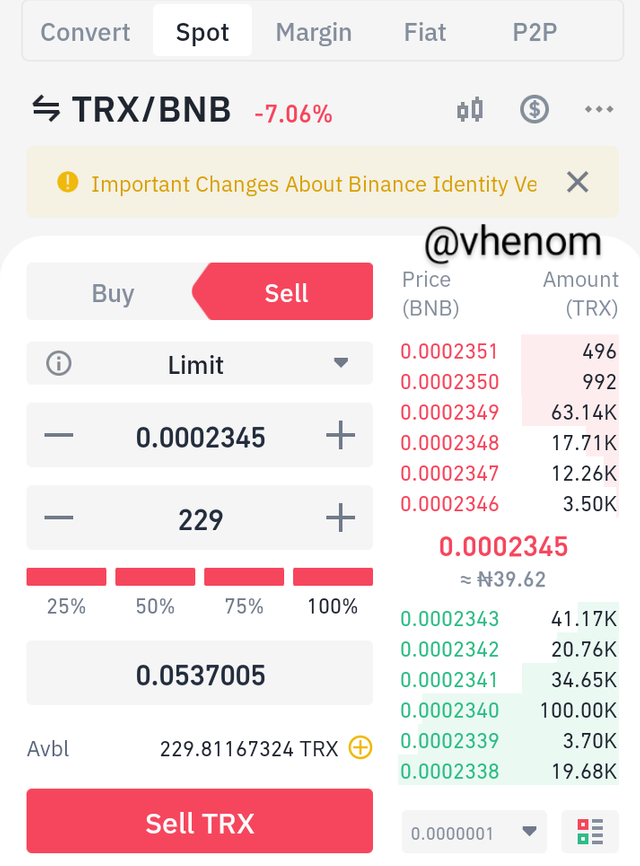

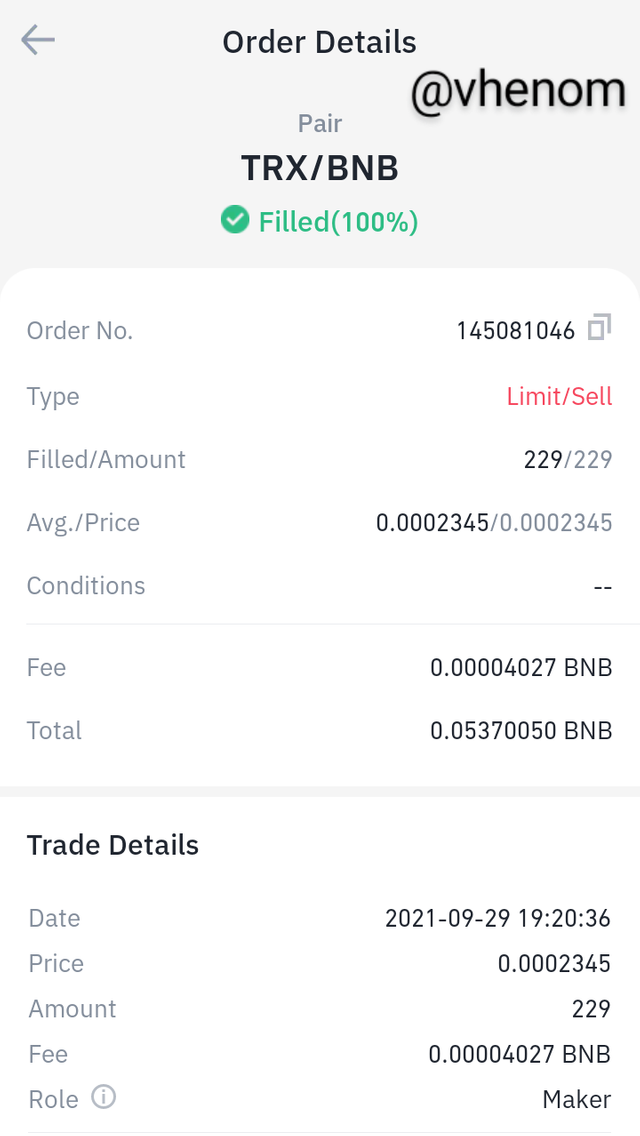

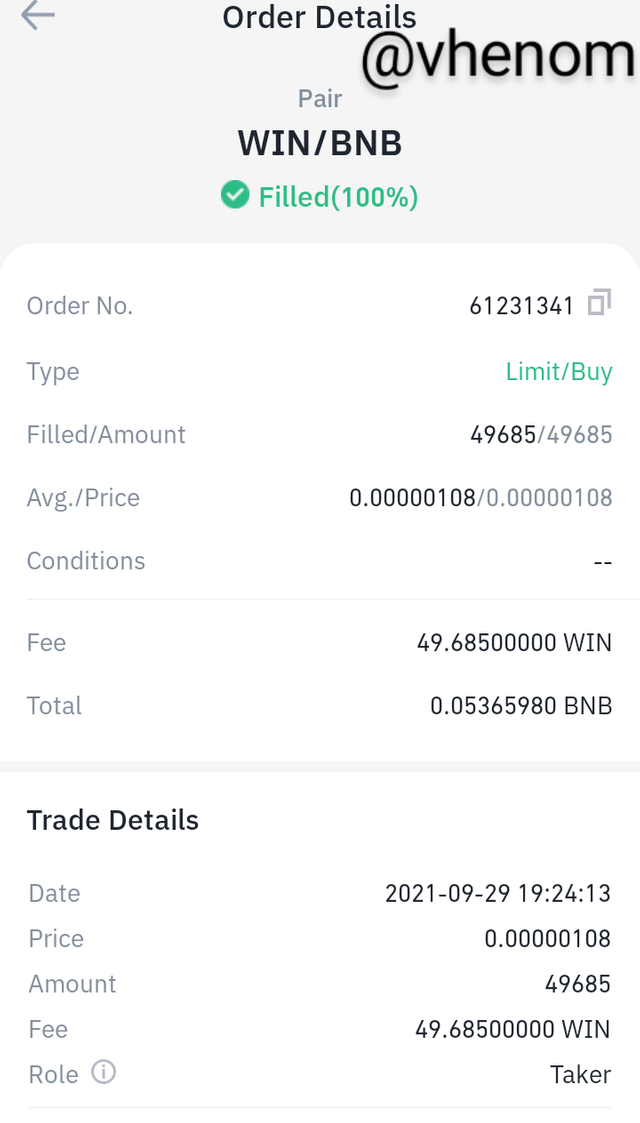

I will use WIN, TRX and BNB to perform the triangular Arbitrage trading. And am using binance exchange. I made a deposit of 52097.85 win on my binance exchange.

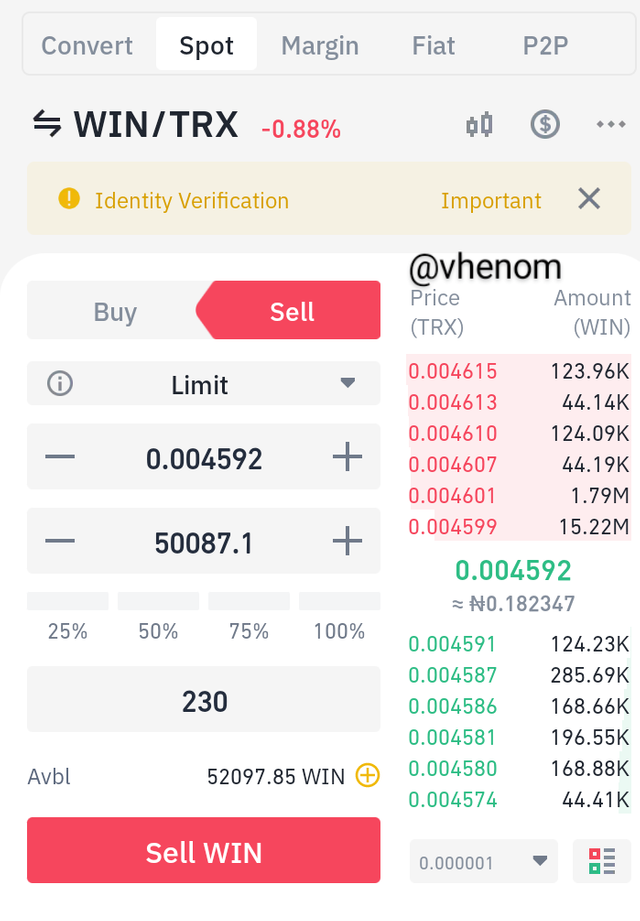

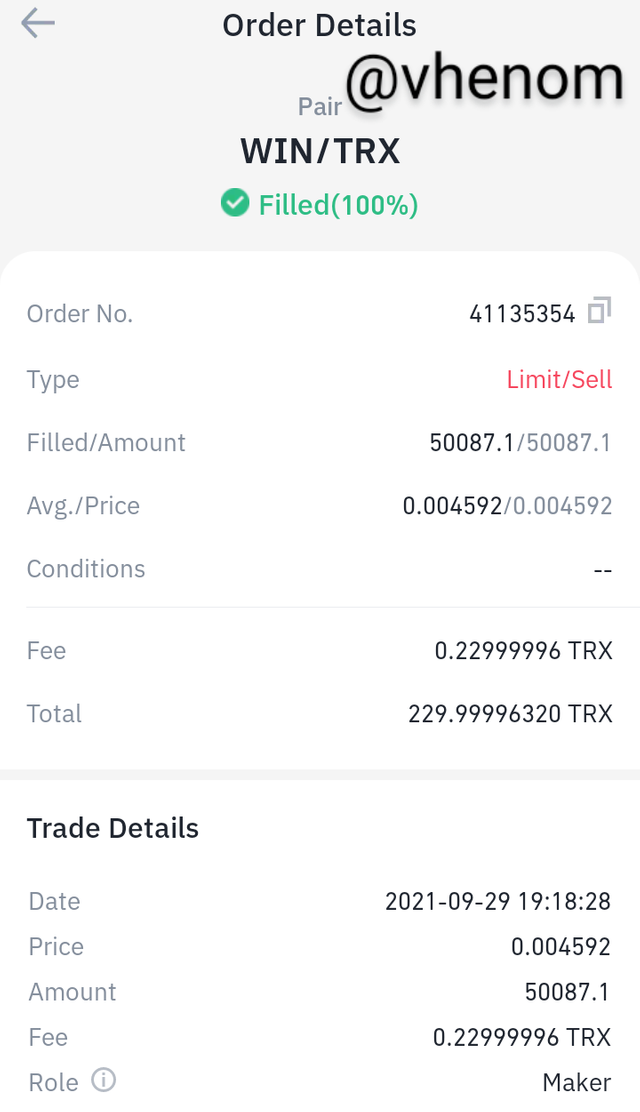

I trade 50087.1 WIN for 230 TRX which is about $21

By the time I finish the trade I lose some win due to transaction fee. You can see the available WIN. I have 49685 win remaining.

By the time I finish the trade I lose some win due to transaction fee. You can see the available WIN. I have 49685 win remaining.

6- Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

| Advantages | Disadvantages |

|---|---|

| 1. The is no or very little risk involve when trading with Arbitrage | Transaction cost and taxes associated with buying and selling of asset cause wrong estimation of profit and may lead to loss. |

| 2. It helps in better price discovery of an asset and sort price variances in assets across different markets | There are very rear opportunities of Arbitrage, it also involves latest technology to be able to maximize enough profit. |

| 3 it is very profitable | it's required alot of money more than $2000 |

Conclusion

Arbitrage trading is the exploiting the differences in price of an asset in different markets in order to make profit. Arbitrage trading involves buying of an asset at a lower price in a market and selling it at higher price in another market. This is possible because of the difference in the listing price of an asset in different exchange/market.

CC @reddileep