Financial fraud poses a significant threat to individuals, businesses, and the overall stability of financial systems. This deceptive practice encompasses a range of illicit activities designed to manipulate financial transactions, misrepresent information, or gain unauthorized access to funds. The consequences of financial fraud are far-reaching, leading to economic losses, damaged reputations, and compromised trust.

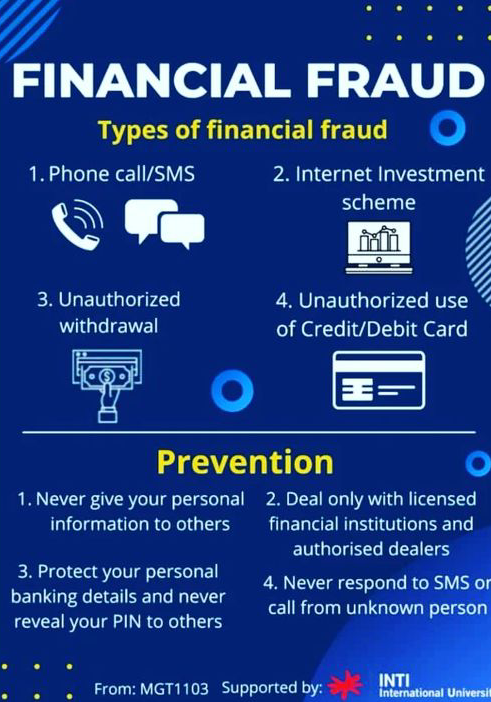

One common form of financial fraud is identity theft, where perpetrators exploit personal information to access bank accounts, credit cards, or other financial assets. Phishing scams, a type of social engineering, involve tricking individuals into divulging sensitive information such as passwords or credit card details through fake emails or websites. Additionally, Ponzi schemes lure investors with the promise of high returns, using funds from new investors to pay off earlier ones until the scheme collapses.

Corporate fraud is another prevalent type, often involving manipulation of financial statements, insider trading, or embezzlement. Enron's notorious accounting scandal in the early 2000s serves as a stark example of how corporate entities can engage in fraudulent practices, ultimately leading to bankruptcy and legal repercussions.

Technological advancements have introduced new avenues for financial fraud, with cybercriminals exploiting vulnerabilities in digital systems. Cryptocurrency-related fraud, ransomware attacks, and hacking incidents highlight the evolving nature of financial crimes in the digital age. Financial institutions continuously invest in cybersecurity measures to protect against these threats, yet the ever-changing tactics of fraudsters necessitate ongoing vigilance.

Regulatory bodies and law enforcement play a crucial role in combating financial fraud, implementing measures to detect and prosecute perpetrators. Public awareness campaigns also contribute to educating individuals about common fraud schemes and preventive measures.

In conclusion, financial fraud is a multifaceted challenge that requires a coordinated effort from individuals, businesses, and regulatory authorities. Vigilance, education, and technological safeguards are essential components of the ongoing battle against financial fraud.