Hi, fellow Steemians. This is my entry for Tech Quiz Season 36 run by @malikusman1. I hereby invite @rayfa, @caringmaanasseh, and @rashid01 to participate.

Image is clickable and might show larger resolution.

I always find trading and related topics are very interesting. Contests like this are like refreshing my knowledge and quenching my thirst for trading knowledge. Thank you @malikusman1 for organizing this contest.

What is Golden Cross in Crypto

The Golden Cross in trading is the term for a technical pattern that widely used by traders including in cryptocurrencies trade. The golden cross indicates a potential bullish trend reversal in the markets, including stocks, commodities, and cryptocurrencies. How to obtain it? It is obtained by using two Moving Averages, typically the 50-day moving average (as short term moving average) and the 200-day moving average (for long-term moving average) . It’s called the golden cross when a short term moving average crosses above a long-term moving average.

The basic idea is the trend reversal so it typically happens after market experiences downtrend or bearish condition, the crossover (Golden cross) occurs and reverse the trend to bullish (uptrend).

For combining two moving averages of different periods, the Golden Cross is often seen as a strong, reliable signal. It helps reducing false signals.

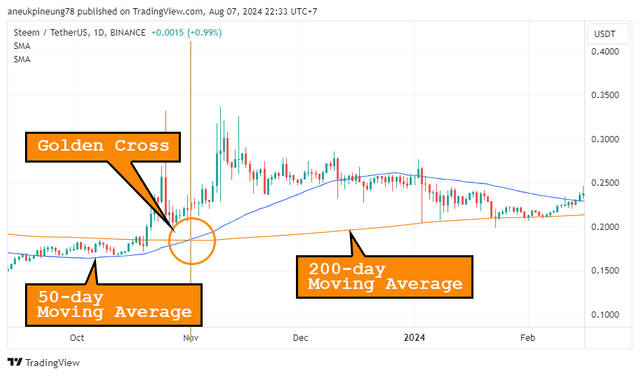

Let's look at an example of a Golden Cross on the STEEMUSDT chart from the Binance spot market on a 1-day trading interval as shown on TradingView below.

Edited with Adobe Photoshop 2021.

Image is clickable and might show larger resolution.

The image above shows us that after the 50-day MA, which had been below for a period of a downtrend market, crosses above the 200-day MA, the market enters a bullish condition.

What is Death Cross in Crypto

In the world of trading (including cryptocurrencies, assets, and commodities), the Death Cross is a technical pattern obtained in the same way as the Golden Cross (using two moving averages, short-term and long-term, typically 50-day and 200-day, respectfully ). However, the Death Cross works in the opposite manner of the Golden Cross. While the Golden Cross brings smiles on traders face, in the form of a signal of a trend change towards an uptrend (bullish), the Death Cross brings a signal of a trend change towards a bearish condition (downtrend).

When does the Death Cross occur? The Death Cross happens when the long-term moving average is crossed from below by the short term moving average. Since the Death Cross is a trend reversal signal, three stages occur around this event: 1) the market is in a bullish (uptrend) condition; 2) the Death Cross occurs; and 3) the market enters a bearish (downtrend) condition.

Let's look at an example of a Death Cross on the TRXUSDT chart from TradingView below.

Edited with Adobe Photoshop 2021.

Image is clickable and might show larger resolution.

The image above shows that after the Death Cross occurs, the market enters a downtrend (bearish condition).

How both can help us in crypto trading?

Both of these technical patterns provide potential signals about market trend changes that can help traders make better trading decisions.

Golden Cross can help traders 1) identifying bullish trends; 2) determining entry point, and 3) - confirming trend reversal from dontrend to bullish (uptrend).

While Death Cross helps traders to: 1) identify bearish trend; 2) determine exit point; and 3) confirm the occurrence of bearish condition.

Although using two moving averages can provide early signals of potential trend changes, these patterns are not perfect. Using them alongside other analysis tools is a smart move to confirm or cross-correcting signals. Another technical analysis tools which are usually combined with Golden Cross and Death Cross are:

- Relative Strength Index (RSI),

- Commodity Channel Index (CCI),

- Moving Average Convergence Divergence (MACD),

- Support and Resistance,

- Bollinger Bands,

- Aaron,

- and so on.

By using the Golden Cross and Death Cross along with other analysis tools, traders can create more comprehensive trading strategies and reduce risk.

Reading Suggestion:

- https://www.investopedia.com/terms/g/goldencross.asp;

- https://corporatefinanceinstitute.com/resources/career-map/sell-side/capital-markets/golden-cross/;

- https://www.investopedia.com/ask/answers/121114/what-difference-between-golden-cross-and-death-cross-pattern.asp;

- https://www.icicidirect.com/futures-and-options/articles/what-is-moving-averages-and-how-does-it-help-in-technical-analysis;

- https://www.investopedia.com/terms/g/goldencross.asp;

- https://www.investopedia.com/terms/d/deathcross.asp;

- https://seekingalpha.com/article/4505264-death-cross;

- https://www.equiti.com/sc-en/news/trading-ideas/golden-and-death-cross-patterns-in-trading/;

- https://www.litefinance.org/blog/for-professionals/100-most-efficient-forex-chart-patterns/death-cross-pattern/;

Thanks.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

on X : https://x.com/aneukpineung78/status/1821366846408241306 ...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Menarik sekali. Kamu makin lama makin banyak ilmu tentang dagang ini. Ayok praktekkan, Aneukpineung.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Pasar sedang tidak bagus. Hahaha.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit