- Bitcoin Market Overview

As traditional financial giants Morgan Stanley and visa announced further adoption of bitcoin, the bitcoin market continued to consolidate between $53600 and $61500.Morgan Stanley has launched three bitcoin investment vehicles for its high net worth clients and investment companies.Visa is also following the pace of MasterCard to purchase bitcoin through the visa network.

- Bitcoin is getting more and more attention.

Small holder

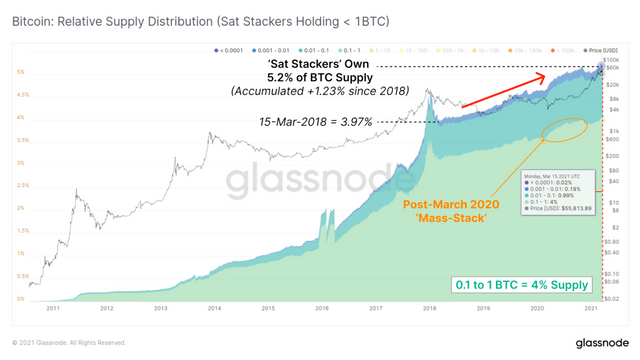

Since March 2018, the proportion of bitcoin addresses with 1 BTC or less has continued to increase.Three years ago, small holders held 3.97% of supply, and since then it has increased by 1.23%.This brings their current ownership share to 5.20% of all mining BTCs.

The continuous accumulation of small holders shows that this trend has not stopped from mid-2018 to 2020, and they are willing to hold through volatility.We also see that 0.1 to 1 BTC holders will immediately inflate significantly after the Black Thursday sell-off in March 2020.

Despite a small amount of spending in the $42000 rally, small holders' positions have returned to record highs.

Real time map of relative address supply distribution

- Whale wallet stable

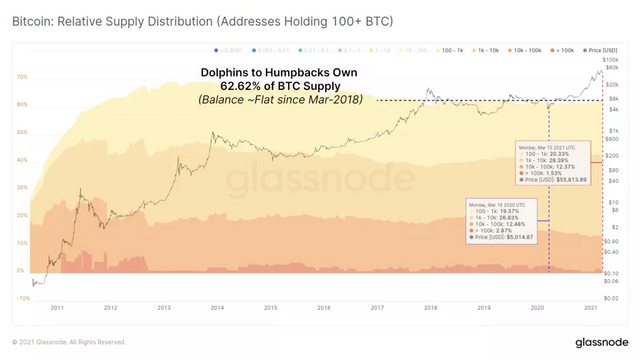

Interestingly, while we continue to see the accumulation of small holders, the net worth of larger wallet Holdings (> 100btc) has been relatively stable over the past three years.The figure below shows the supply held by addresses of 100 BTC or above.Overall, this group currently holds 62.62% of BTC supply, and their total has increased by 0.87% in the past 12 months.

Real time map of relative address supply distribution

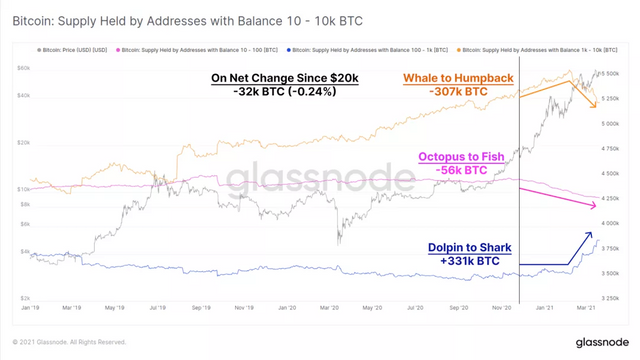

These larger wallet balances have also been shuffled on the denomination, possibly because they are held as trustee agents.Since December 2020, approaching the $20000 ath of the previous cycle, we have seen roughly equal and opposite changes in the larger holder balances.

- Holdings of 0 to 100 BTC decreased by - 56 000 BTC.

- 10 to 1000 BTCs increased + 310000 BTCs.

- Between 10000 and 10000 BTCs, their holdings were reduced by - 307000 BTCs.

Among these groups, we see a slight decrease in net worth, a decrease of 32000 BTCs, only 0.24% of the total supply held by this group.

At the same time, our small holders accumulated 29800 BTCs at the same time, indicating that BTCs are gradually transferring.

Real time chart of supply comparison by address

Holder cycle behavior

Reserve risk index is an advanced cyclical indicator, which tracks the holder's belief in the cycle.The general principles of reserve risk are as follows.

- Every coin that has not been spent will accumulate coin days, which is a measure of its dormancy time.This is a good tool to measure the belief of the holder.

- As prices rise, the incentive to sell and realize these profits will increase.As a result, we usually see holders selling their coins as the bull market progresses.

- Firm holders resist the temptation to sell, and this collective action accumulates "opportunity costs.".Every day, if the holder decides not to sell, the accumulated "opportunity cost" will be increased.

- Reserve risk is the ratio between the current price (selling motivation) and the cumulative "opportunity cost" (hodl).In other words, reserve risk compares selling motives to the beliefs of holders who resist temptation.

The following figure shows the reserve risk volatility index, the current value is 0.008, and the cycle higher than this value is highlighted in blue.The top of past cycles usually occurred at values greater than 0.02.

As prices rise and / or more holders spend their bitcoin, the risk of reserves will increase.This represents a BTC "wealth transfer," moving from long-term holders to new buyers.

Real time chart of reserve risk

- Bitcoin wealth transfer

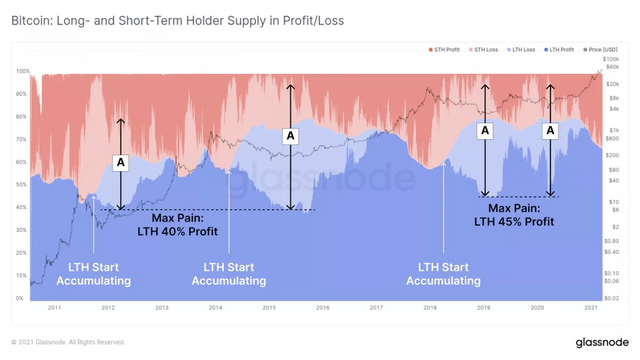

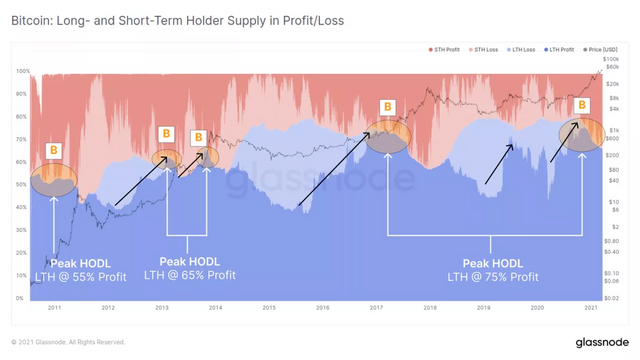

We can also look at the relative proportion of supply owned by long-term holders (LTH, blue) and short-term holders (sth, red); and divide coins into profit (dark) or loss (light) according to the time when the coins last moved.Please note that the following chart shows the proportion of circulating supply that is profitable or losing.

Bull markets generally follow a similar "wealth transfer" path in three different stages.We can use these fractals to estimate our position in this cycle as a supplement to the reserve risk index.

Stage a - the most painful: in the depths of the bear market, the largest cross-section of BTC holders is at a loss (the thickest light area).LTHS began to accumulate around half of the bear market (immediate losses), as shown by the growing light blue area.

In phase a, only 40% to 45% of lth currencies are profitable, which represents the greatest pain until the bottom occurs.

Supply of long and short term shareholders in profit and loss

B stage -- bull market stage: with the development of the bull market, higher prices create greater selling temptation for holders.At some stage, we come across an inflection point. The largest proportion of lth owned currency is profitable.In general, this corresponds to a breakthrough in the previous cycle ath.

After this stage, we see that long-term holders gain faster than new holders come in.

With each new cycle, we see more supply locked in by LTHS.This reflects the strength of the market, the improvement of faith, the maturity of asset classes, the available tools for obtaining liquidity, and of course, the exponential growth of prices and the generation of wealth.

- Peak holding in 2011 = 55% of supply.

- Peak value of holding in 2013 = 65% of supply.

- Peak potential holdings in 2021 = 75% supply.

Short and long term cash holder supply in profit and loss

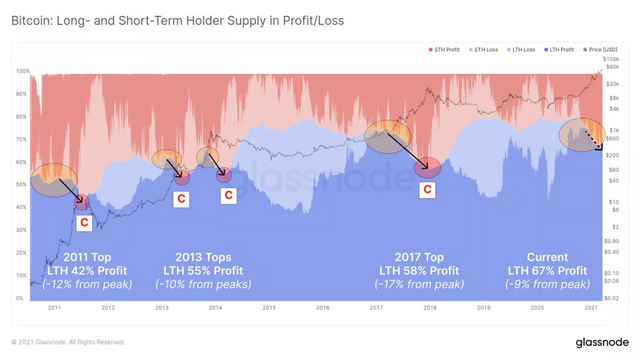

Stage C - the top of the cycle.In the end, the market reached an exciting top, as more LTHS spent their money after the peak inflection point.This represents a BTC "wealth transfer" event, from LTHS to new speculators, and reactivating dormant supply back into circulation.

We can estimate the proportion of LTHS spent in the last period of the bull market by taking the difference between the same indicator measured at the bull stage and at the top.

This can be seen as the reactivated supply required for "topping.".

- Top of 2011: LTHS reactivated ~ 12% of supply.

- Top of 2013: LHS reactivated about 12% of supply.Top of 2013: supply of LTHS reactivated accounted for about 10% of the two peaks.

- Top of 2017: LTHS reactivated about 17% of supply.

- Current in 2021.So far, LTHS has reactivated 9% of supply.

Profit and loss supply of long and short term holders

Similar to reserve risk indicators, these studies show conditions similar to the second half or later stages of a bull market.There is still a large relative portion of the supply still held by LTHS, which currently costs only 9%.

The peak in 2017, before "peaking," the supply of spending was almost double (17%), reflecting a lot of new interest and an increased audience.As the exposure and adoption of bitcoin continue to grow, and the debate over the super cycle continues, this BTC "wealth transfer" is another point of concern.

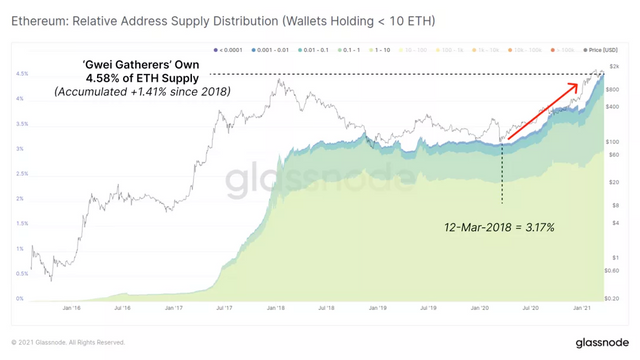

- Weekly topic: Ethereum supply trends

The accumulation of small holders is not limited to bitcoin holders.Since March 2020, small Ethereum holders with a balance of < 10 Ethereum have accumulated an additional + 1.41% of circulation supply.These people now hold 4.58% of supply and are still on the rise.

Real picture of relative address supply distribution of Ethereum

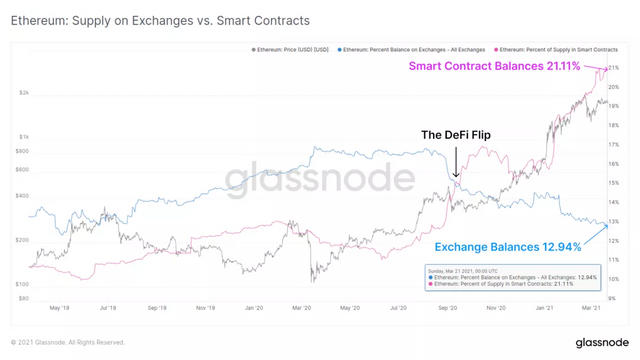

We also see more Ethereum dormant.This chart shows that Ethereum supply has been declining steadily for more than six months since May 2020.It is possible that while some profits are made, some supply may be deployed to the defi smart contract or even Ethereum 2.0 contract (note that it will drop sharply from the end of 2020)

Ethereum holds Inspur real time Atlas

At the same time, the balance of smart contracts will officially exceed the balance of centralized exchanges in September 2020.So far, the balance of the exchange holds 12.94% of Ethereum, while smart contracts currently hold more than a fifth of the supply, at 21.11%.This indicates a clear product market fit as this trend began in the 'defi summer' of 2020 and has continued to lock in since then.

Comparison between smart contract and exchange balance