Our comments:

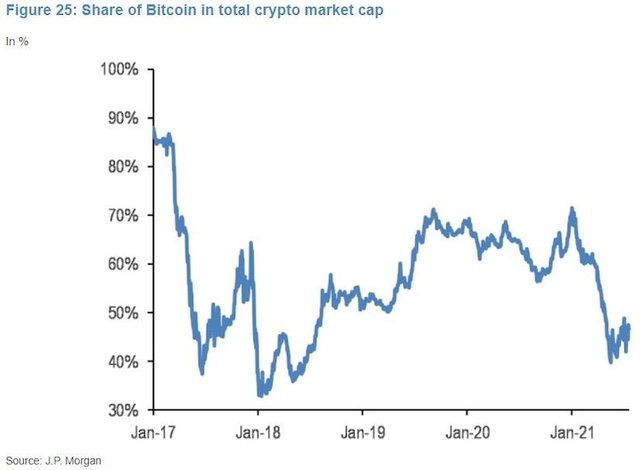

"We believe that the share of bitcoin in the total crypto market would have to normalize further and perhaps rise above 50% (as it did previously towards the end of 2018) to be more comfortable in arguing that the current bear market is behind us," JPMorgan explained.

What has the share of bitcoin in the total crypto market got to do with the bear and bull market? What is the rationale for the belief J.P Morgan holds? It is very disconcerting when a global financial leader makes such assertion without any basis or explanation but simply stating that it is their belief.

Additionally, JPMorgan is looking for increased uptake in bitcoin by institutional investors. And while some institutions like Ark Invest and MicroStrategy have been buying bitcoin in recent weeks, these purchases are not as encouraging as they might appear, according to JPMorgan.

This statement makes some sense. But we are wondering what weight to give such statement when it comes from the financial institution that was against crypto for a long time. Its Chairman and CEO, Jamie Dimon used to make fun of Bitcoin. From 2014 to 2018 Jamie Dimon made disparaging public remarks about Bitcoin on several occasions denying golden opportunities to its clients and followers, who believed in his balderdash. In case you have forgotten what he said, allow us to refer you to an article in the medium which lists out many of his balderdash succinctly: The J.P. Morgan Cryptocurrency Criticisms And Their Cryptocurrency…

"These institutional announcements are far from encouraging as they do not reflect new entrants, but rather existing investors with a vested interest in propping up bitcoin prices," JPMorgan said.

While this may be correct at some level, we are wondering whether all the institutional investors who intend to make investments in cryptocurrencies make announcements of their plans. Typically, we believe, institutional investors like pension funds and insurance companies need to get their board to discuss the investment plans and get their approvals. Further, the issue of whether their constitution allows such investments arises. Where it doesn't, which is likely to be the case, they may need to get approval from shareholders/directors before embarking on their plans. All these takes time especially if they are public listed company and they are unlikely to make any announcement until their plans are almost formalized or already formalized.

Here is the original article:

Here is what it'll take to pull bitcoin out of its bear market, according to JPMorgan

Shared On DLIKE