Greetings friends of Steem Alliance, for me a pleasure to be here again, this time with the intention of sharing a trading strategy for Scalping, which I have been testing for a few days and the results have been quite beneficial.

In general I am dedicated to trading American indices, very specifically to the US 30, and very rarely to another asset, even almost do not do trading with cryptocurrencies, but sometimes I may not get a good entry to trade, since my trading style is intraday, but is based largely on fundamental news, for that reason it is not always feasible to find good entries.

For this reason I have been looking for a Scalping strategy, and very specifically with the Bitcoin, which would allow me to have other options to trade.

I think I have found a fairly acceptable one, which with good risk management could result in good profits, and relatively fast. I am testing with a low capital, logically, I do not want to expose myself to senseless losses.

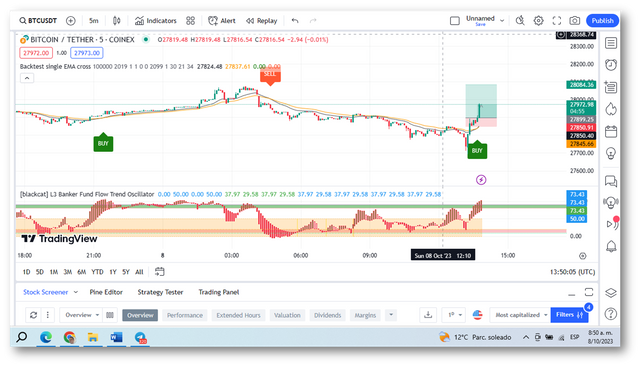

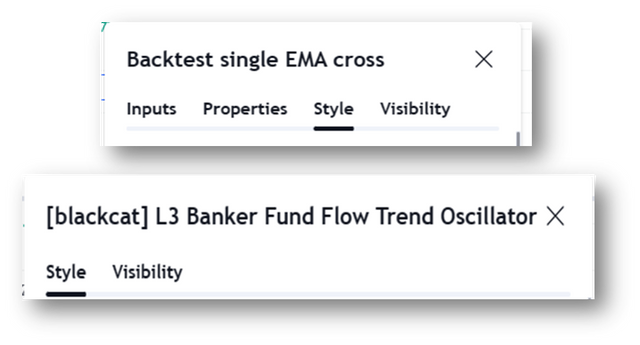

The strategy is in a 5 minutes time frame, using trading view. Two indicators must be placed, such as Backtest Single EMA Cross and Banker Fund Flow Trend Oscillator. I made some adjustments, but the ideal is that each person makes their respective tests and see if it works or not. *(this post is informative and not a recommendation to make transactions with this strategy)

The use of these two indicators is very simple, the Backtest Single EMA Cross when they cross the EMAs leaves a signal that indicates BUY or SELL. That are indicative to enter the position, but of course, this is not enough, we must have another way to confirm the entry.

For this we will use the Banker Fund Flow Trend Oscillator indicator, which indicates whether the downtrend or uptrend is strong. If there is concordance between both indicators the entry could be very effective and of high probability.

I will show you below an entry I took this morning using this strategy.

As you can see, the minute timeframe, and the Backtest Single EMA Cross indicator told me BUY, but additionally the other indicator, placed with green candles upwards, at the upper level, which tells me that the uptrend is strong.

You can notice that I have placed my entry right at the beginning of the candle where the indicator placed BUY, and the StopLoss right at the crossing of the EMAs. The safest take Profit I have noticed is at a Risk Benefit Ratio (RRB) of 1:1.5, i.e. if I risk 1 dollar, I will look to gain 1.5. In my case, that is what I was looking for.

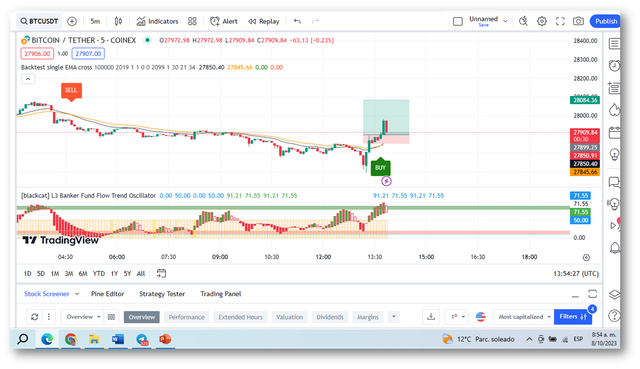

But in particular, with the intention of safeguarding capital, I set as a rule that if it reaches a RRB 1:1 I will immediately place a break even. That is to say, I would roll the SL to the entry point, in case the operation is returned, I neither lose nor gain. In this particular opportunity it reached 1:1.5, but I did not close, I wanted to let it run, because in other tests I did the trade gave up to a 1:5 profit.

But the trade didn't keep going up, it went back and closed me with almost a dollar profit. But I didn't lose, which is important in the end. In the image above you can notice that the bottom indicator, the Banker Fund Flow Trend Oscillator, marked a blank candle, which indicated a decrease in the strength of the uptrend, and a probable change of trend to bearish.

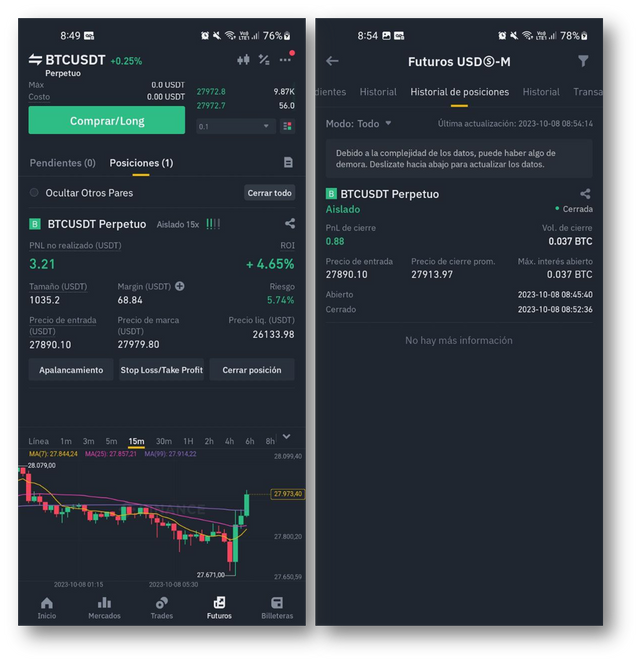

As you can see in the image above, this is a trade that I made today (you can see the date), these are trades that generally will be of short duration, in this case it lasted on average 7 minutes (you can also see the time). At some point I was with a little more than 3 dollars of profit, but the operation finally did not have the strength to continue, and was closed.

Trading is something that I am passionate about, but not only that, it is something that I have taken on professionally, and is what I would like to dedicate myself with large capital, in order to see a much better return. Since those 3.2 dollars that I managed to make in 7 minutes could be 32, 320 or even 3200 dollars. Which is great just thinking about it, and is part of the things I work very hard at.

For my part I say goodbye, I hope this post has been to your liking. And I repeat, this is not an investment recommendation, but an informative post.

This is a nice post but are you a professional trader?

If yes, may I know your trading strategy please

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @jueco, well, on my way to becoming a professional. That is the goal. Last year and this year I have dedicated to trading. I am even submitting a major funding test at the moment, with the intention of raising capital to fund it. It is the main reason why I have abandoned other activities.

My strategy for trading the US30 or Dow Jones index is based on that of the Inner Circle Trader (ICT) team. Basically I trade on New York time, where I look for the price to go above the Lower Low or the highest high of the London session.

In this way I expect some confirmations to enter, such as:

It is actually a simplified version of ICT's Silver Bullet strategy. With the use of 1 hour time frames to look for direction, and the use of 1 or 3 minute time frames to look for entry. I know it may seem a bit complicated, but it is not that complicated. I put the trades in MetaTrader 5.

The strategy I shared here, is one that I am testing since 4 days ago, and so far it is going well, still making adjustments. This one would be in the Binance Futures market. But I am still working on it.

The official channel of this trader is https://youtube.com/@InnerCircleTrader?si=2Ivsr1n_jjvvtstNZ

And he explains the strategy in the following video:

I hope it will be helpful for you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been rewarded by the Seven Team.

Support partner witnesses

We are the hope!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit