I was speaking to my son about finance, and explaining the difference between consumers, producers and bankers.

Consumers I said, were people who work for producers and are paid a wage, and they spend their money on goods and services. Sometimes, these are goods and services which they often can’t afford to pay in one payment, so they pay over time in the form of loans or credit card purchases, which results in them for them borrowing money from the Bankers to pay for them. Consumers work for a wage, trading their time for money to pay for the goods and services they consume and any interest charges incurred. So it can be said that Consumers leverage time to make money.

Producers create companies, which produce goods and services, often employing consumers as employees, paying them wages, for their time. Producers borrow money from Bankers to produces goods and services, and Producers pass the cost of including interest costs for borrowing money onto the consumer. Producers make money from selling their goods and services for prices above cost for profit. Producers frequently don’t work to produces goods and services, but instead have people work for them. So it can be said that Producers leverage people to make money.

Bankers loan money to producers, so they can create goods and services, and charge them interest. Bankers also loan money to Consumers, so Consumers can buy the goods and services, and Bankers charge the Consumer interest. The Bankers therefore make money from loaning money to both consumers and producers. They loan money out at a price greater then the cost, and the difference is their profit. So it can be said that Bankers leverage money to make money.

An observation on interdependence.

Consumers are dependent on Producers for goods and Services, and Consumers are dependent on Banks for loans to buy goods and services. Producers are dependent on Consumers to buy their goods and services and Banks for loans to purchase and produce goods and services. Banks are dependent on Consumers paying interest for loans to buy goods and services, and Banks are dependent on Producers paying interest on loans they use to produce goods and services.

An observation on interest.

Banks charge Producers interest, but this cost is passed on to consumers as increased price for goods and services. Consumers also pay interest to Banks when Consumers borrow money to buy goods and services. So Consumers pay all the interest in this system.

Summation;

This essay isn’t meant to vilify Bankers and Producers, nor to deify Consumers. It’s purpose was to explain the components of our current financial model, which is present in all countries and cultures. And to show how each person plays a role, all three are needed in society, because many Consumers choose to be employees due to the security it brings, despite the financial shortcomings, many Consumers don’t want to be Producers because while some Producers get rich, many fail or have periods of both feast or famine; very profitable months and months where they lose money. Few people take on the role of Banker because the Banker or moneylender is not a popular role in most societies and they are thought of in negative terms. But all three groups Consumers, Producers and Bankers are needed for an economy and society to function in the modern world. And the knowledge of budgets and other financial principles can help Consumers and Producers lead more financially productive lives and doesn’t hurt bankers, as improved financial knowledge creates prosperity, which increases the need for goods and services, which can improve the lives of all three groups.

✍️ written by Shortsegments

Shortsegments is a blogger or writer on the Steemit platform, where writers, photographers and video bloggers, along with other content producers get paid for posting their content.

Read other articles by @shortsegments on the Steemit Social Media Platform, where writers get paid for their content by the community by upvotes worth the cryptocurrency, called Steem.

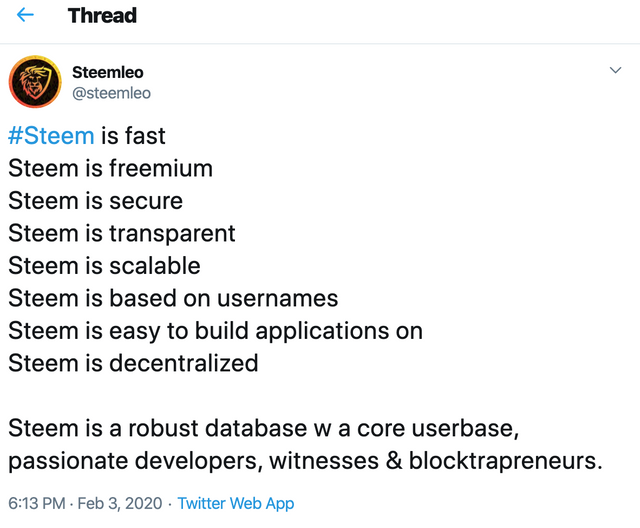

Read shortsegments blog on the Steemleo investment Blog

Please follow @shortsegments Twitter Feed Here

Steemit Steem

Steemit is a decentralized social media platform on a blockchain called Steem.

A very important difference between Steemit and centralized platforms like Facebook, Instagram or YouTube, is that there isn’t a central authority or owner to take your account away from you and your account can’t be deleted. You are the owner of your account. Find out more at this** Link

Steem Onboarding helps you apply for an account and is a series of videos which explains how Steemit works. You don’t need to understand everything about the blockchain to post content and our Onboarding help is available in six different languages.

Posted via Steemleo

This is an interesting description of societies economic dynamics. It looks like Bankers have us all where they want us.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit