I was explaining Steem and Steemit to an acquaintance recently, who is a real estate investor moving into the stock market so he can stop dealing with tenants and banks. He is currently invested mainly in optional stocks which pay a dividend and which he can write covered calls on. It’s a strategy we created ourselves called triple dipping. We call it “triple dipping” because we make money on the plan three ways.

First, we buy older established companies with a record of appreciation.

Second, we buy dividend paying stocks, so we collect a dividend quarterly.

Third, we buy optional stocks, which in addition to appreciation and dividends, we also sell OTM out of the money covered calls on to generate monthly income.

I should qualify this triple and state past performance doesn’t guarantee future appreciation, so we are only guaranteed two streams of income. But I think you will admit that “Triple Dipping“ sounds fun.

In addition to discussions of Triple Dipping, my acquaintance is very big on discussions of performing versus none performing assets. So much so that when traveling together we play a game where we pick things we see and classify them as performing or non-performing assets.

We once debated for an hour as to whether it’s best to own a home and use it as a rental property, assuming it’s rent exceeds it’s mortgage, so it’s a performing asset, ergo appreciating in value and paying me income, versus living in it yourself and using personal home deductions to reduce taxes on your personal income, and if these deductions change a home from a non-performing asset to a performing one.

I enjoy our discussions and one day proposed that Steem was at one time a performing asset, which made it much better then most of the cryptocurrencies on the market. I explained that for significant time periods in the past Steem increased in price. In addition to this appreciation Steem also produces income which can be “earned” from content creation or active curation, or “unearned” per USA tax code or “passive” in more common investing terminology, in terms of payments you earn from delegating your Steempower.

My friend was very impressed with the idea and actually decided that he would invest a small amount of his disposable income in Steem, since the price is low, and development on the blockchain is high, appreciation seems likely. Plus he feels he can “Double Dip” by earning passive delegation income. I think I just discovered another onboarding talking point.

Feel free to use it.

✍️ written by Shortsegments

Read other articlesby me on the Steemit Social Media Platform, where writers get paid for their content by the community by upvotes worth the cryptocurrency, called Steem.

Please follow my separate Steemleo investment Blog

Please follow my Twitter Feed Here

😅😊

Passive income - Selling options on your purchased stock is a winning formula, you pick your price you would like to sell you 100 lot stock, plus you pick up the premium of the option as it slowly decays. Like a rotting fish........My latest passive income is agricultural land in the topics....As we enter the Grand Solar Minimum, food products and prices will soar.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks. What is the Grand Solar Minimum?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

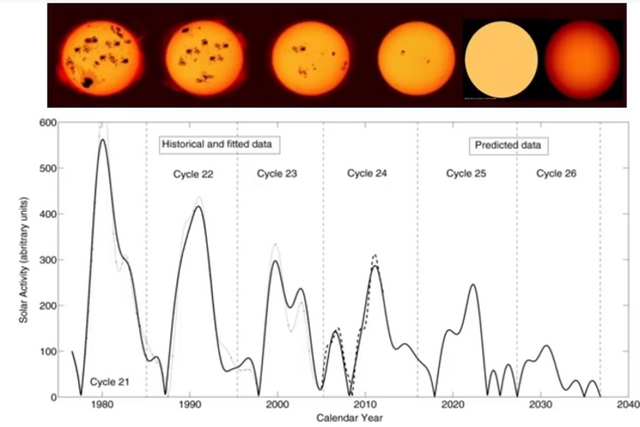

The GSM is the 11 year sun cycle where there are fewer or no sunspots. This weakens the energy that the sun provides to the Earth, which in turn is cooling the planet. Earlier winters, and longer colder springs. This shortens the growing seasons, causing fewer crops available to feed the world. Growing zones drop toward the equator and raises food prices. Inflation is our future. Here is the predicted cycles, 2028 -2050 should be very cold and food will be difficult to produce.

![

![

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I posted this article in my Twitter to spread the word about Steem and Steemit. #posh

https://twitter.com/shortsegments/status/1207903004021518336

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great idea!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I sometimes feel guilty that your giving this knowledge away free. I have paid money for money making strategies that were less understandable then yours.

Steemit is a great community and this concentrated investment expertise on Steemleo is great too.

Thanks

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

perfect time for him to get started with cryptos

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree. Everything is on sale 😂

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy your+great

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Cool picture too 😎

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!popcorn

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been saying this forever as I'm making at least a 10% ROI just upvotes and what I earn through curations.

Glad to see I'm not crazy and some others see the appeal of that as well. Same reason I have plans on stacking splinterland legendaries and renting them out. Passive income while the price on the cards should continue to increase over time as they become more and more rare.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think your Splinterlands card idea is great!

The Steem blockchain offers multiple opportunities to create passive income opportunities.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @shortsegments! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit