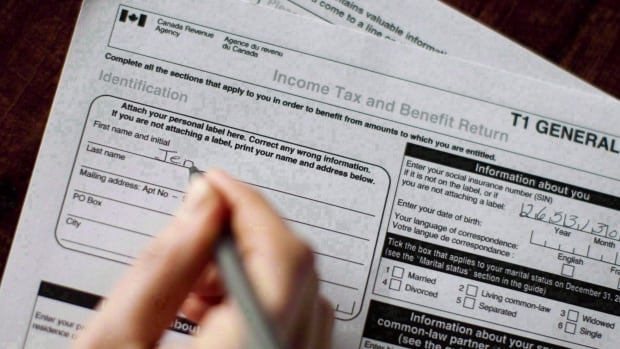

When I cite content on basic aspects related to tax culture, I am referring to the pecuniary obligations derived from the imposition of taxes by law, in the case of individuals the payment conditions consist of: if the division of the installment payments is not exact, the difference will be included in the first payment.

However, in case of failure to file the final tax return within the established term, the total tax must be paid in a single portion. Incomplete payment or payment after the due date of any portion of the tax return will result in the total payment of the appropriate balance.

Tax culture refers to the set of knowledge, valuations, attitudes referred to taxes, as well as the level of belief respecting the duties and rights deriving for active and passive subjects of this relationship.

The experts agree on the following concept of tax culture, defining it as a field of social representations on the State-society relationship that has been little explored by the social sciences.

Within the tax culture, duties and prerogatives granted to taxpayers to pay the economic obligations derived from taxes are exercised.

Thank you so much for opening our eyes to see the need to learn about Taz education

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit