When it comes to trading any asset or cryptocurrency asset, market making is a very important concept. Market making is basically the activity of buyers and sellers (usually by large investors and traders in the market) in the market in which buyers and sellers provide liquidity in the market. Trading can only occur where there are buyers and sellers in the market. When a user wants to buy a cryptocurrency asset or sell a cryptocurrency asset, the user would go to an exchange to buy or sell the cryptocurrency asset. The crypto exchange serves as a place where buyers and sellers meet to buy or sell their cryptocurrency assets. The price is greatly determined by supply and demand. If the demand is high, the price increases and if the supply is low, the price decreases.

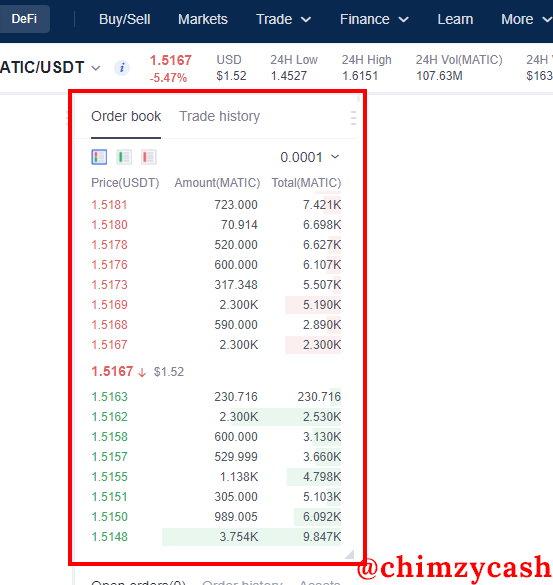

This is represented on the Bid-Ask spread. The “Bid” is simply the price to buy and the “Ask” is simply the price to sell. If there are limited buyers or sellers in the market, then it might not be possible for trading to happen for that particular crypto asset and this makes the crypto asset on the exchange illiquid which means that there isn’t enough liquidity for that crypto asset. Also if there is enough buyers and sellers in the market, then it becomes easy for trading to happen and this means that there is enough liquidity in the market. In order for there to be liquidity in the market, there have to be continuous buyers and sellers providing the bid-ask spread in the market. Hence, these buyers and sellers are responsible for market making.

The psychology behind Market Maker

The main psychology behind market makers is to buy low and sell high in the market and as a result, liquidity is provided. Buyers in the market always want to buy low and sellers in the market always want to sell high. This is represented in the Bid-Ask spread on the exchange. More liquidity in the market which basically means more buyers and sellers in the market, favors the market markets as they make profits. However, because maker makers usually the large investors and traders, it becomes possible for manipulation to happen in the market.

.png)

The market makers aims to buy at low prices and sell at high prices. The psychology of the marker maker can be further expanded using the Wyckoff's "Composite Man” theory. The Composite Man who can also be called the market maker carefully and strategically plans and executes his activities in the market in order to make more profits in the market. This activities of the market makers leads to accumulation and distribution in the market. The market makers do this accumulating at low prices and distributing at low prices.

The market makers can manipulate the order book by creating bid-ask spread in such a way that they can accumulate enough assets at low prices and sell at high prices. The Market Makers create the Bid-Ask spread by placing limit orders at prices that they want to make market in. They place buy orders at lower prices than the best buy order and also place a sell orders at the best sell order. This activity by the market makers creates liquidity in the market. Other investors and traders buy or sell at these prices set by the market makers, causing the market markers to make profit. On the MATIC/USDT pair on the order book, we can see the Bid-Ask spread.