The Elliot wave theory is one of the many tools used in technical analysis to get a detailed overview of the general market behavior. In cryptocurrency trading or investing, the Elliot wave theory is very beneficial because of its ability to predict the movements of the market. The Elliot wave theory is simply a type of technical analysis tool that shows the different market movements based on repetitive and noticeable wave patterns.

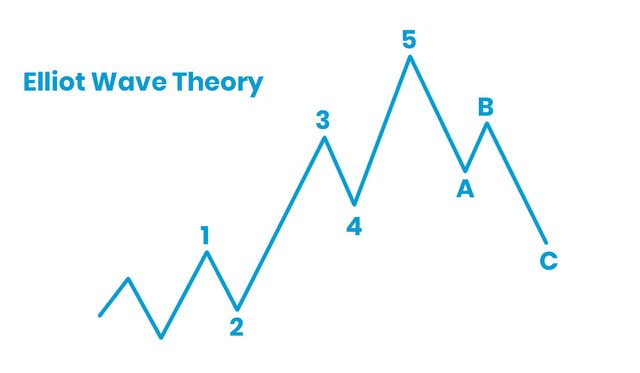

The Elliot wave theory is such a great tool. When it comes to a tool that can accurately predict the next market movements, then the Elliot Wave has no rival, it is regarded as the best when it comes to market movement forecasting. In the Elliot wave theory, the impulsive wave sets up the wave pattern and is followed by the corrective wave which counters the larger trends. The Elliot wave follows a 5-wave pattern namely 1,2,3,4,5… the direction of the market is shown by the wave 1,3,5… which is countered by wave 2,4. In this theory, the wave 3 can never be the shortest and wave 4 can never enter wave 1.

Application of the Elliot Wave theory

- The Elliot wave theory is used for getting a general description of the market movements and behavioral patterns.

- The Elliot wave theory can predicting the future direction of a cryptocurrency based on the repetitive patterns in the market

- The Elliot wave theory helps traders and investors predict the potential price targets of any cryptocurrency

- The Elliot wave theory helps traders know when to enter a trade and when to exist a trade in order to make the most profit

Application of this theory

The Elliot wave theory is used for getting a general description of the market movements and behavioral patterns.

The Elliot wave theory can predicting the future direction of a cryptocurrency based on the repetitive patterns in the market

The Elliot wave theory helps traders and investors predict the potential price targets of any cryptocurrency

The Elliot wave theory helps traders know when to enter a trade and when to exist a trade in order to make the most profit

Impulsive Waves and Corrective Waves

Impulsive Waves

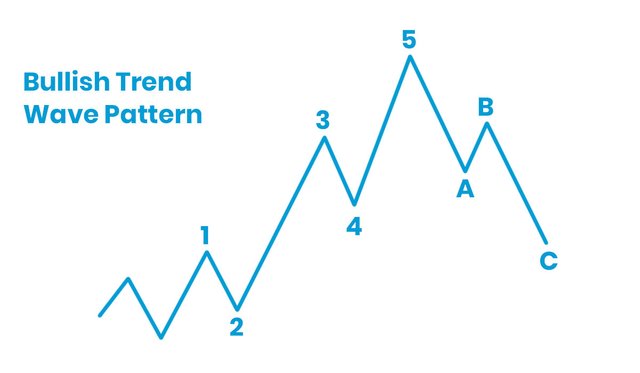

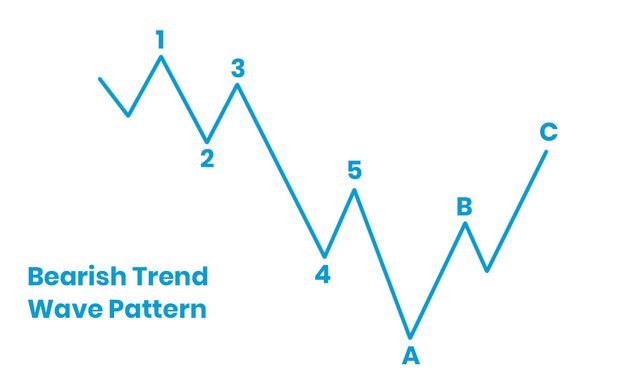

Impulsive waves are simply the first phase in the Elliot wave. The impulsive wave is a 5 wave sequence or structure with numbering 1,2,3,4,5. In the Elliot wave theory, the impulsive wave sets up the wave pattern and are the large waves. In the 1-5 movement, 1,3,5 move in an uptrend direction and 2,4 move in a downtrend direction.

Corrective Waves

Corrective waves are simply the second phase in the Elliot wave. The corrective wave is a 3 wave structure with lettering a,b,c. The corrective waves counters the larger trends in the impulsive wave. The market trend does not matter when it comes to corrective waves as it only goes in the opposite direction of the market trend. What this means is that if the market if the movement of the market is bullish, the corrective waves goes in the opposite direction, likewise if the movement of the market is bearish, the corrective waves goes in the opposite direction.