It finally happened. The long-foreseen market crash. Now all of these prophets can tap themselves on the shoulder and say “told you so”, regardless how often they were wrong. Alright, it seems like we entered the bear market and a lot of people are in panic and don’t know what to do or don’t know what is going on. I must admit that this is also my first real big crash and that is why I am trying to explain stuff from my own perspective. In this article I want to talk about the current situation, why it might occurred and what I am planning on doing next.

Current Situation & Reasons

It looks very bad right now and the bad news is that it might not be over yet. Not only the crypto market is taking a big hit, but the stock market as well. This indicates that these two markets are more connected than many people thought. With that being said let’s see what brought us here? All the factors that have been going around are true and I will try to summarize them. Lets start of with the effects of the pandemic and the numerous shut-downs. This brought the global economy to a near stand still. With that a lot of supply chains were shut off and a lot of labor was being laid off. Fortunately for the population the economy recovered very well and very fast but what about the supply chain? These companies could not reactivate a lot of its previous workforce and instruments which leads us to the severe supply chain issues we are having today. Keep this in mind because it will be important later.

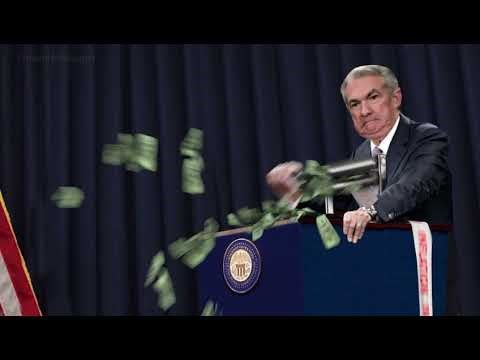

Another big factor are the stimulus checks and the endless money printing that governments have been practicing over the past two years. The market was flooded which so much cash that everything went into the stock market and crypto market. We saw historic all-time highs and over leverage in the crypto markets as a lot of people wanted to get rich fast. The problem with printing money is that it devalues the money that is currently in the flow, also called inflation. Recently, the inflation got very high. This is a downwards spiral because the prices of products will get higher. They are getting higher because there is more money in circulation and because due to the supply chain issues the companies have to pay more to deliver the products in time. This will get passed on to the consumer. Because the consumer is working for one of these companies they quit the job or demand more money which leads to higher spendings by the company which then is passed down again to the consumer. You can see, this is a pretty bad downwards spiral which has to be broken.

Now how do you break this spiral? The FED is trying to do that by tapering. Recently they announced their plans to increase interest rates and slow down with the government bonds buying. Because the markets are reacting to news and not events this triggered a lot of uncertainty in the global markets which started a sell off. This is a normal reaction and can be considered a correction in the stock market. What is far more severe are the dips we are seeing in the crypto market. Here we are currently seeing dips of over 30% and I assume this will get more. This has a lot to do with over leverage of investors. A lot of people have taken a leveraged position which is good if the market is in an uptrend. This means you can make more money with less money invested. Unfortunately, this also means that you lose your money quicker when the market is going down. The latter is currently the case. Many people have to sell of their current holdings to make sure that they don’t get into debt or try to make some damage control. This cascade can lead the crypto market to further lows as we are right now. I would not be surprised.

My Thoughts

As this is my first bear market I am in the position that I am still holding my previous investments. I guess I did not see the writing on the wall and although I already mentioned that I believe that the markets are probably going to dip even more I am more than sure to keep on holding to my investments. Firstly, I invested only money that I can afford to lose which brings me in a situation of not worrying about myself. Secondly, we have to think about the investment. Did anything fundamentally change? I don’t think so. If something is happening, it is the fact that crypto is getting more and more adoption which is a good thing. If we look at the tock markets than we can see that the tech sector was hit the hardest. Is it a sign to worry? No, because nothing fundamentally changed. Humanity will still need new technology to develop themselves, therefore it is not a bad investment.

In my opinion, if you are an investor, you are investing long term, otherwise you just gamble. If we look at the S&P 500 there is a very interesting statistic that over the past 100 years, no 20 year period made a loss. That means that if you invest over 20 years into the S&P 500 you are very much guaranteed to not lose your money. With that being said, there is also crypto. Now this is a very young and risky space as many of you know. Because this my first major crash I was fearful at first but now I am realizing how big of an opportunity this will be. Like I said, crypto is not going anywhere and when the next bull market starts, it is during this time where the real gains are made. Therefore, it is time to now double down. I will consistently buy into projects that I believe in and that I enjoy. Furthermore, I will be developing my exit strategy so that this time I will be able to take gains whenever they occur.

Conclusion

With this article, I really hope to calm down some nerves. Yes, the current situation is looking bad, but looking at the big picture it is nothing but a small step back. Like I mentioned before and in many articles’ prior, the crypto space is on the way to mass adoption. The new technologies are speaking for itself and the amount of workforce that is being drawn into these projects is just rising every month. This means that the next bull market might come sooner that we expect and that this time there will be more people prepared for it making the whole industry very resistant.

Published by ga38jem on

LeoFinance

On 22th January 2022

Hello @ga38jem

I particularly got into steemit in the 2018 bear market, which lasted just over a year, seeing a steem at $0.14, for example, so I know what it feels like. But then I saw steem above 1.3$. so just have to be patient and regardless of the current reality we know it will get better later on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your comment! :)

This is an interestin gpoint of view and I agree with you! I hope it will get better sooner than later though :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit