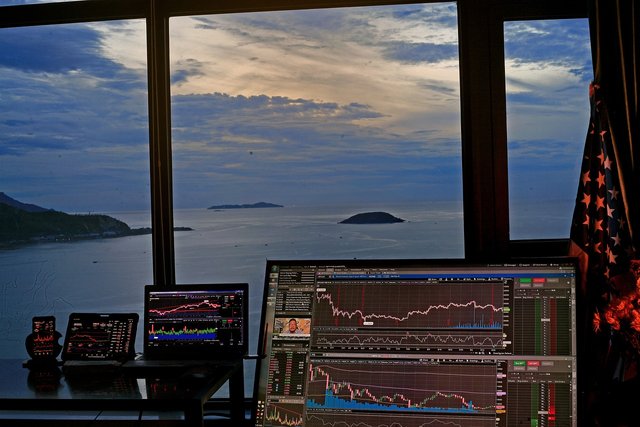

Hello friends of Project HOPE, I hope you are all well and that this week is full of good experiences for you. Today I want to share a reflection on something I have noticed lately in the financial markets: manipulations that cause abrupt falls, followed by sudden rises.

This phenomenon is not new, but it seems to be occurring more frequently, revealing how fragile and manipulable current financial systems can be, and it is likely that with Trump coming to power this will become increasingly constant.

It is evident that the big players, who control a significant part of the market, have the ability to pull the strings strategically. How do they do it? Very simple. They take advantage of the panic that they themselves generate with sharp drops in prices, as we saw recently with Trump's announcement of tariffs, and a trade war began between important countries in the world.

This causes many small investors to sell their assets for fear of losing everything. And when prices are at their lowest, those same big players enter the scene to buy en masse, causing prices to skyrocket again, as we have seen recently. Thus, they end up winning twice: first by causing desperate selling and then by capturing the profits from the increases. It is a cycle that, although predictable, continues to trap those who fail to see it coming.

This not only happens in traditional markets, but also in cryptocurrency markets. Here, where many hoped for decentralization and fairer play, similar practices have also crept in. It is common to see how the value of a cryptocurrency plummets after some negative news or rumors that seem to come out of nowhere, only to then recover strongly when the "big fish" have already positioned themselves. This is no coincidence, at least not according to what I see, and if it teaches us anything, it is that we must be attentive and patient before making impulsive decisions.

In this context, it is clear that information is power. Small investors, who often act from emotion, are the most vulnerable in these situations. Therefore, I believe that the best strategy to avoid falling into these manipulations is to remain calm, carefully analyze what is happening and, above all, have a clear medium and long-term plan. If we allow ourselves to panic, we only end up being pieces on the board of those who really move the market.

It is true that we cannot control these manipulations, but we can learn to recognize them and act intelligently. In the end, patience and preparation are our best tools, it is what we can control. As always, I wish you success in your decisions, whether in the markets or in any aspect of life. Greetings, and have a great week.