We returned to the days of recovery of the price action above $65,000 behavior that somehow has returned tranquility to bullish traders, this because the price managed to get out of the lake that tied it to the lower zone close to losing $60,000.

In an article published today by Marcel Pechman for the Cointelegraph portal Bitcoin advances towards the highs of the range, but derivatives traders remain on the sidelines, from my point of view is a cautious action because the rebound may be a new trap to capture liquidity.

According to data from Pechmar, "Bitcoin gained 8.4% between May 15 and May 16, reaching a high of USD 66,750, which was the highest level in three weeks. Although Bitcoin stabilized near USD 65,000, this price change marks a turnaround after BTC retesting USD 57,000 support on May 1."

Now, "Part of the disappointment of Bitcoin investors can be attributed to the strong performance of traditional assets. The S&P 500 index soared to an all-time high on May 16, with a total gain of 6% in 15 days. Meanwhile, gold gained 4% in the same period and currently trades at USD 2,375, less than 1% off its highest closing price in history."

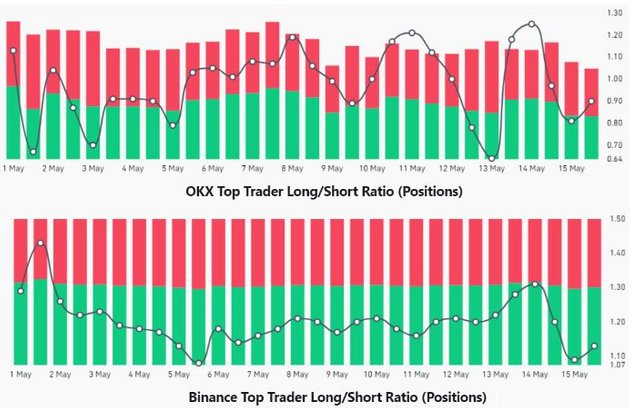

An interesting fact to analyze is that, "To understand whether whale sentiment has been affected by the worsening regulatory environment, one must analyze data from the BTC futures markets. The long-short ratio of top traders consolidate positions in spot, perpetual and quarterly futures contracts, offering a comprehensive view of how bullish or bearish these traders are."

SOURCES CONSULTED

Cointelegraph. Bitcoin moves toward range highs but derivatives traders watch from the sidelines. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph