Hello dear readers, let this post serve to share some insights on the confidence that investors are regaining, and information related to the data shows that professional Bitcoin traders want to feel bullish, but the rally to $23,000 was not enough.

Bitcoin prices have shown some bullish signs, but traders are reluctant to add leveraged long positions until after the Federal Reserve shows its cards on February 1.

Bitcoin prices had a mixed reaction on January 25 after the U.S. reported gross domestic product growth of 2.9% in the fourth quarter of 2022, slightly better than expected.

Even so, the sum of all goods and services traded between October and December grew by less than 3.2% compared to the previous quarter. Although somewhat optimistic, another data point that limited investor confidence was the news that the U.S. Federal Reserve (FED) would soon reverse its contractionary measures.

Slightly increasing long margin positions in Bitcoin, margin markets offer insight into how professional traders are positioned, as they allow investors to borrow cryptocurrencies to leverage their positions.

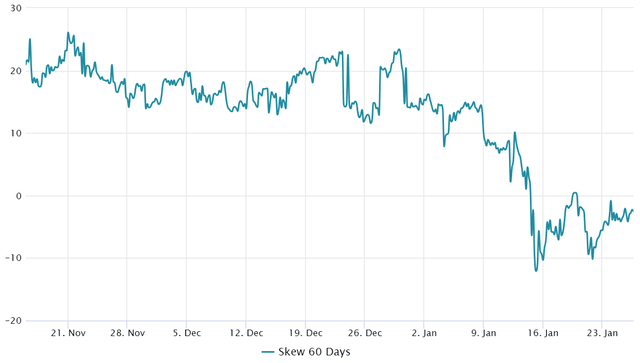

Options traders flirt with a bullish delta, traders should also analyze the options markets to understand whether the recent rally has caused investors to become more risk averse.

SOURCES CONSULTED

Cointelegraph Data shows pro Bitcoin traders want to feel bullish, but the rally to $23K wasn’t enough. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating the public domain image background: Cointelegraph

Not sure how to feel about the BTC sentiment on this post. How do you feel about BTC? Most of the time the emotional side beats the logical thinking and makes us buy or sell. I think that reaching 23K level means that there is going to be some accumulation period and know that may bough it higher levels chances that BTC will move up are very likely. On the other hand the recession sentiment and the bad news could attract new investors and users to bitcoin which possibly will make its price move up ins the short term allowing space for a rally to the previous high of 60k ish, anyways that's what I feel could happen.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @raserrano

We may have an appreciable correction in the next few days, more however, I believe that then the price action will bounce back to the 20K area and at the end of it all the situation will be favorable for the health of the cryptocurrency market.

Best regards, be well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings my friend @lupafilotaxia,

It seems like you have done a thorough analysis on the current state of investor confidence in the Bitcoin market and the potential signals of a bullish trend. You mention that despite some bullish signs, traders are hesitant to add leveraged long positions until after the Federal Reserve's announcement on February 1. You also bring attention to the mixed reaction in the market after the release of GDP growth data, and the potential impact of the Federal Reserve reversing its contractionary measures on investor confidence. Additionally, you mention the importance of analyzing the options markets to understand the level of risk appetite among traders. Overall, your post provides valuable insights on the current market conditions and the factors that may influence investor sentiment in the near future.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @artist1111

Thanks for visiting my blog, there are certainly multiple factors that can influence investor sentiment in the near future. May be the situation will be favorable for the health of the cryptocurrency market.

Best regards, be well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit