Corresponding to an article published by Yashu Gola, MicroStrategy's bet on BTC surpassed Warren Buffett's warning, this if we take into account that MicroStrategy's stock value has risen 1,000% since its first Bitcoin purchase, while Warren Buffett and Berkshire Hathaway have missed the boat.

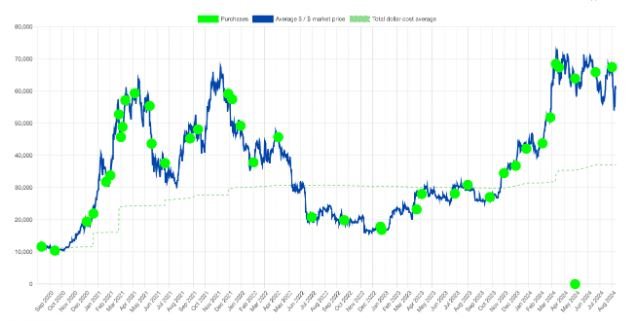

The aforementioned article noted that, "MicroStrategy bought its first batch of Bitcoin on Aug. 10, 2020, becoming the first publicly traded company to adopt the cryptocurrency as its primary cash reserve asset."

It also noted that, "Four years later, this bold decision has morphed into a defining strategy for the company, outperforming even Warren Buffett's Berkshire Hathaway"

Now, "Despite substantial gains, Michael Saylor's company has maintained its Bitcoin holdings, choosing not to liquidate any of its accumulated assets. It has expressed its intention to continue accumulating Bitcoin, which is further evidenced by its most recent purchase on Aug. 1"

The truth is, "The value of MicroStrategy's MSTR stock has responded bullishly to its Bitcoin purchases, having risen approximately 1,000% since August 2020"

SOURCES CONSULTED

Cointelegraph. 4 years in, MicroStrategy’s Bitcoin gamble beats Warren Buffett’s warning. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph