A few days after the Bitcoin ETF was approved the situation has not changed much, or at least not in the bullish projection that many expected, and the reaction so far has a positive reading because even when the price has fallen back we are just observing how investors begin to place resources in the cryptocurrency market.

It is worth noting that according to data being handled Grayscale's Bitcoin Trust (GBTC) experienced an outflow of USD 579 million in its first days of trading after the opening of the exchange with the approval of the US SEC.

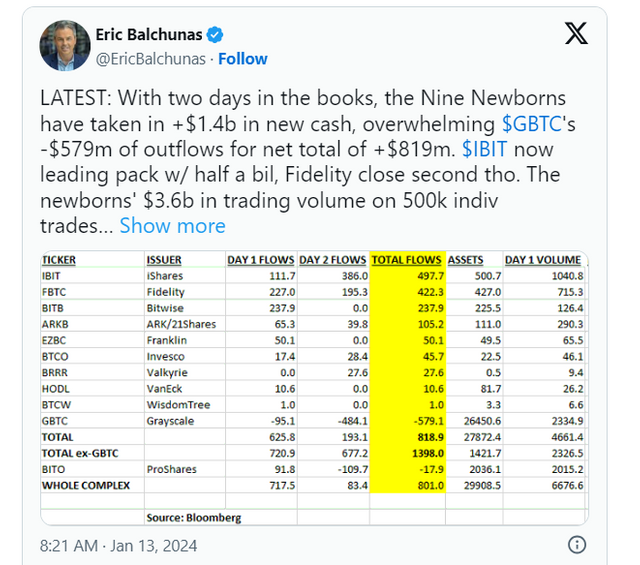

In this regard and according to Ana Paula Pereira of Cointelegraph, "A total of 500,000 trades have been made in the funds, with a total trading volume of USD 3.6 billion, according to Bloomberg data. The trading volume takes into account the funds' outflows and inflows."

On the other hand, "The data reveals that Grayscale's ETF, the Grayscale Bitcoin Trust (GBTC), experienced outflows of USD 579 million during the period. After deducting GBTC outflows, total net inflows across all products stood at USD 819 million."

Finally, beyond the trades that have been executed following the ETF approval the Bitcon stands at USD 42,719 at the time of writing, down an estimated 0.7% in the last 24 hours.

SOURCES CONSULTED

Cointelegraph. Bitcoin ETFs attract $1.4B in two trading sessions. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph

That's true cos at a time I thought the market is being manipulated but there lies hope ahead & I'm gonna put my head strong to reap on my hodling patience on BTC at bitgetglobal.

Hope the return be a good one.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @diamondhand3

The current market phase we should take advantage of it, certainly the patience we have will be the key.

Best regards, be well.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit