At the time I am writing these lines the price action of most cryptocurrencies is in a frank correction, something that in my view should not create nervousness as every healthy momentum must report its respective correction before continuing its uptrend.

Now, in an article I read in Cointelegrap it was argued that the recent price correction is due to a fundamental variable related then falls out of confusion with BlackRock's new fund.

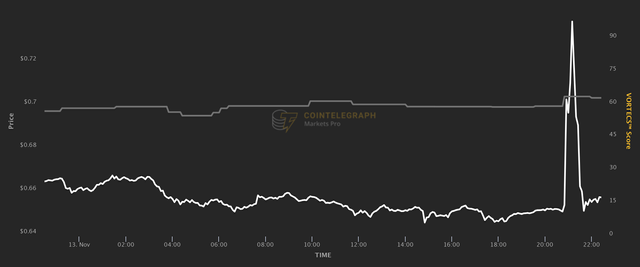

The aforementioned article has stated that "A confusing presentation by BlackRock suggesting that the asset manager was creating an XRP exchange-traded product (ETP) (XRP) triggered a 12% surge in XRP, which it quickly lost after the presentation was confirmed to be false."

It has been reported that "BlackRock signaled its intention to expand beyond bitcoin with its ETF aspirations after the firm filed for an Ether ETF on Nov. 9"

Accordingly "In the face of the false listing, Seyffart reiterated that the real Ether ETF, as it was officially confirmed through a 19b-4 Nasdaq filing with the Securities and Exchange Commission"

SOURCES CONSULTED

Cointelegraph. XRP jumps then dumps on faked BlackRock XRP trust filing. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph