Crescent Dex has plans to become a more User friendly, convenient DEX for users which is highlighted in Crescent’s 2023 Road Map.

Crescent’s Road Map introduces various features aimed to improve User Experience, User Interface (UI) , security, token economy and expand Crescent Dex’s capabilities making it ready to function offering more advanced services.

The already impressive Crescent Network takes the road ahead to get more innovative!!

Crescent Network is ready to further evolve into a more enhanced Dex, after finishing one year in the space.

I have already explained that in its current state Crescent Dex already provides novel, innovative DEFI experience for users than most current Dexs in the space.

User friendly Capital Efficient Crescent Dex is upgrading to evolve into a more enhanced Protocol!!

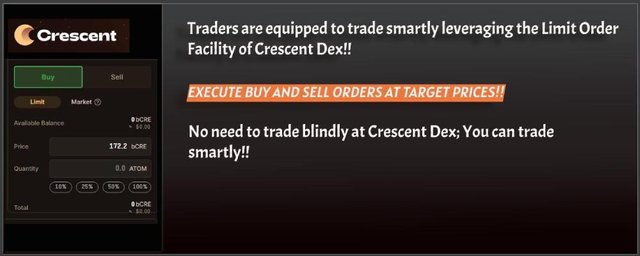

This is because Crescent Dex is a Hybrid AMM Dex with a Orderbook, with limit Order Feature, that makes Crescent Dex a trader friendly Dex.)

Special features of Crescent Dex’s orderbook Module that makes it a convenient trading platform

Liquidity Providers (LPs) have the option of providing more capital efficient liquidity with Ranged Pools.

Here, concentrated liquidity is provided as liquidity is provided between two specific price points rather than providing diluted liquidity by providing liquidity to all price points.

How Crescent Dex manages to provide decent volumes of Capital Efficient Liquidity

I had discussed all this and more in my previous articles so I am diving straight into the new features Crescent Network plans to introduce which are all part of Crescent Dex’s 2023 Road Map.

Crescent Dex is unlike other Dexs being a enhanced Hybrid Dex with an Order book

Crescent Network’s 2023 Roadmap details the innovative road ahead for Crescent Network

1 ) Features improving User Experience

These features aim to make Crescent Dex a user-friendly Dex providing a rich DEFI experience to its users.

So users will find Crescent a convenient Dex to conduct various DEFI activities from LPing, trading, lending, borrowing etc.

a) User Customised LP Pools

LPs can now choose to provide liquidity between price ranges of their choice. So, after Basic Pools and Ranged Pools there will be Custom LP Range Pools.

This gives LPs flexibility and makes their Liquidity providing experience more connecting as they have the freedom to provide liquidity at their decided price ranges.

b) Multi-hop

It will be possible for users to trade across multiple liquidity pools which will bring about more trade volumes balancing price, improving price discovery and trading experience. LP providers also benefit with rewards with such trades.

c) More Liquidity with Market Makers integrated into Crescent Dex

Crescent Network will soon be ready to integrate Market Makers(MMs) into its Order Book Module soon. MMs will provide constant liquidity to the platform, resulting in Crescent having abundant liquidity benefiting traders at all times.

This is important as liquidity that’s provided on AMMs will be fluctuating and limited, during times when trading volumes just spike in response to some major market event.

MMs would be incentivised to provide liquidity to both buy and sell orders with CRE tokens distributed proportionately to the quality of liquidity MMs have provided.

Crescent Dex is unlike other Dexs being a enhanced Hybrid Dex with an Order book

d) Fiat on-ramp feature will make it possible for users to directly on-board to Crescent Dex

It will be very easy for new users to onboard Crescent Network, as Crescent will have a fiat-on ramp that will facilitate users to acquire tokens directly on Crescent with their fiat currency. There will be no need to acquire tokens from CEX first to start off using Crescent Dex.

This enhances the convenience of users and removes the need for them to depend on CEX to acquire tokens to start off their DEFI journey in Crescent Dex.

e) Integration with external DEFI platforms expanding the utility of a user’s investment yields

Crescent Dex will integrate with external DEFI protocols like UMEE making it possible for users to use the yields they earned on Crescent on other DEFI protocols. So, users can lend their earned liquid farming yields on to other DEFI platforms and earn further yields.

Similarly, they may borrow assets from other DEFI platforms depositing their earned yields as collateral.

This makes a Crescent user’s investment a more capital efficient one, as it’s used most optimally to derive maximum possible utility from it.

2. Enhanced UI showcasing useful data for users to make informed investment decisions

Crescent Dex will introduce new features that will enhance Crescent’s User interface. The UI will now provide analytics data about the economic, trading related activities of the DEX for users to make smart and informed decisions on their investment.

a) Complete Information page -

Here there will be valuable details providing information relating to the trading activities of the Dex with data on pool data, trading volumes etc.

b) Featured Pools section -

It will be easy for users to discover the most popular and best performing pools in the new UI.

c) Complete Portfolio Management Page -

Users will get a complete overview of their holdings and activities, so they can keep track of their investments in Crescent.

Tracking of Portfolio, will enable users to evaluate their holdings, gauge the performance of their assets, besides keeping an organised account of users Portfolio for users convenience.

d) Flexibility for LPs to adjust their positions according to varying Market conditions

LPs will have flexibility to tweak their positions to proactively respond to shifting market conditions. So, LPs can prevent their investments from losing out value or make moves to reap more profitable rewards adjusting their positions suitability corresponding to the market trends.

3. Enhancements of Crescent bringing about it’s Horizontal Expansion

Crescent Network will acquire more advanced capabilities as certain upgrades happen allowing for Crescent Dex’s Horizontal Expansion.

a) Crescent to acquire advanced Smart Contract functionalities with its integration with CosmWasm

The most significant upgrade that embeds Crescent with advanced capabilities to perform advanced function is Crescent Network’s integration with CosmWasm. This will power Crescent’s Smart Contracts with more advanced capabilities for performing complex functionalities.

b) Crescent’s Bootstrap Module to enable new Cosmos Based Chains to built liquidity and community

Crescent will have a Bootstrap module that will aid new projects get listed and find support to grow their liquidity and community.

Here, Crescent aims to provide invaluable service for growing the Cosmos ecosystem, helping small projects acquire community and accumulate liquidity.

This will be Crescent’s Liquidity Advisory service for Cosmos based chains, a public common Cosmos goods service from Crescent Network adding value to the Cosmos ecosystem.

4. Crescent is set to build a sustainable token economy by starting to levy swap fees…

Crescent is ready to start charging swap fees to earn revenues to support a sustainable token economy.

So, a module to handle swap fees is upcoming!! This will benefit users who have staked CRE and provided liquidity in the Crescent Network as they will get a portion of Crescent’s revenues from swap fees.

During the first year, Crescent was not ready to implement swap fees, since the team felt that enough liquidity should be there first to start charging fees on swap trades. Now, in the second year, Crescent is ready to charge fees as there are enough users and liquidity in the platform to make this process viable.

5. Crescent plans to maintain robust security continuously with Bug Bounty Programs

Security of Crescent Network is given high priority which is why the Crescent team would host Bug Bounty programs. Here the open developer community would be rewarded for identifying and reporting the potential vulnerabilities in the DEX that can be exploited. Crescent would invest amply on Bug Bounty programs to ensure the Dex platform remains secure for users.

6. Crescent will launch a Perpetual futures DEX platform, Crescent FLIP that would deal in decentralised derivatives trading.

Conclusion

Crescent Network has plans to evolve into a more advanced DEX, with the above mentioned features and upgrades that would enhance User Experience, User Interface, build token economy, and expand the Dex’s functional capabilities.

All this further builds on the Dex’s capital efficiency as the Dex makes more provisions for users to earn further yields.

Check out Crescent Network’s Road Map

https://commonwealth.im/crescent-forum/discussion/11282-proposal-the-crescent-roadmap-2023

You can check out Crescent Dex here -

App -: https://app.crescent.network/staking

Learn about Crescent Dex - :

https://docs.crescent.network/introduction/what-is-crescent

*Read updates about Crescent on Twitter -: *

https://twitter.com/CrescentHub

Join Crescent’s Discort Channel -:

https://discord.gg/crescentnetwork

You can read my Articles in these platforms -:

Medium - https://medium.com/@kikctikcy

Publish0x - https://www.publish0x.com/@greenchic