Crescent Dex’s Order Book Module

Crescent Dex, is visually appealing to traders with its Order Book feature. The aspect of abundant liquidity is arranged in Crescent Dex, as it’s a Hybrid Dex, acquiring liquidity both from its AMM Module and from Market Makers.

My previous article explains this subject which you can read here -

How Crescent Dex manages to provide decent volumes of Capital Efficient Liquidity

Besides providing visuals of data related to price movements of asset pairs in order book, there are other features in the Order Book Module designed for traders to conduct their trades in an effective way as they will be able to do in any CEX.

Features of Crescent Dex that enhances it with CEX like convenience

Some of these features that make Crescent Dex a trader friendly Dex include -

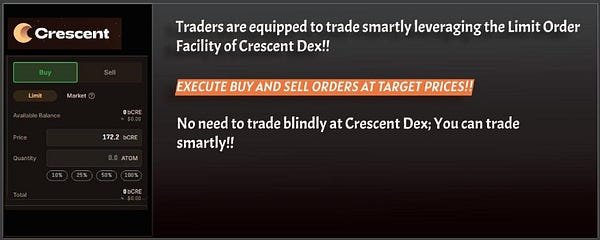

1. Trading using the Limit Order Feature

So, traders can set Buy Limit Order and Sell Limit Order. Here, they can place buy orders to purchase an asset at a specific price so when the asset reaches the specified price, the asset would be automatically bought . Similarly, traders can place sell orders at a specific price, so when the asset reaches the specified target price, it will be sold.

This is a very useful feature for traders who can strategically buy the asset at a specified price(when it’s corrected or is available at a low price range) and sell the asset when it’s reached a high price and book profits.

2. Market Order Feature

Traders can otherwise buy or sell an listed asset at the current prevailing market price that depends upon the buying and selling activity at Crescent Dex. This is the spot market.

3. Tick system

Crescent Dex incorporates the tick system, so the price of assets are represented by ticks in the order book. Tick size, represents the minimum price movement of the asset to the upside and downside. The Tick size of an asset can be modified by the Crescent community through their votes in Governance proposals.

The tick system makes it easy for traders to understand given data. It establishes a recognised standard for Crescent’s Orderbook as traders are used to viewing data this way in traditional finance platforms like Stock Exchanges, crypto exchanges (CEXs) and other trading platforms.

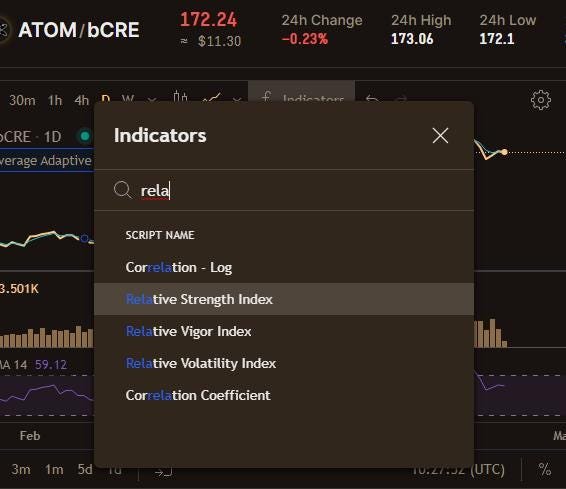

4. Trading Chart to evaluate price movements of asset and conduct TA

Asset pair price movements can be evaluated in the trading graph available in the orderbook interface. Asset pair price movements and volumes are visually represented in the graph.

Further tools to conduct TA (trading analysis) are embedded in the graph. So, traders can analyse price movements of assets applying various indicators like RSI (Relative Strength Index), Moving Averages, MACD etc.

Indicators on the price trading chart on Crescent Dex’s Order module are very useful for conducting TA.

So being a Hybrid Dex with an order book, Crescent Dex has features which most AMM DEXs lack, making Crescent Dex a trader friendly Dex.

LPs earn additional LP rewards with Crescent being a Hybrid Dex that’s capital efficient

Crescent Dex, has a AMM Dex as well, where users can provide liquidity and earn LP rewards and yield farming rewards. This is expected in most AMM Dexs. However, Crescent Dex is a Hybrid Dex and AMM liquidity providers benefit due to this.

The liquidity provided by LPs (liquidity providers) are made available in the Order Book. So, traders who buy or sell using Crescent Dex’s orderbook interface make use of the liquidity provided by LPs in the Crescent’s AMM module, which rewards LPs with LP rewards.

This is in addition to LP rewards users earn as traders swap assets in Crescent Dex’s AMM module using the liquidity provided by LPs in pools.

This makes a LP’s investment more capital efficient as their liquidity earns them more rewards due to Crescent Dex being a Hybrid Dex with Orderbook facility

Thank you for visiting my space crypto enthusiast!!

You can also read my Articles in these platforms -:

Publish0x — https://www.publish0x.com/@greenchic

Medium - https://medium.com/@kikctikcy