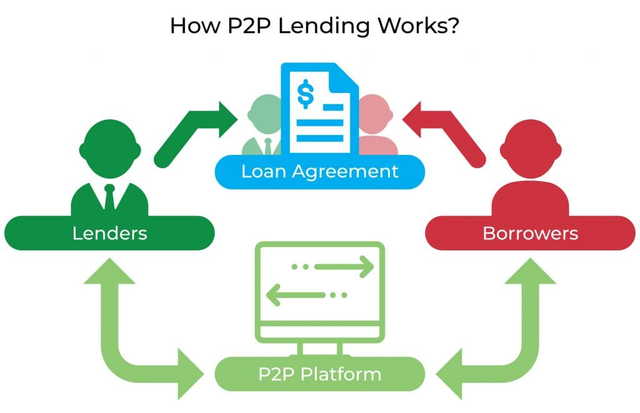

In the ever-evolving world of finance, Direct Lending, often known as Peer-to-Peer (P2P) lending, emerges as a game-changer. No longer are traditional banks the only avenue for securing loans. Today, P2P platforms are reshaping the financial scene, directly linking those seeking loans with individual investors. So, what's the buzz about P2P lending, and why is it becoming a favorite?

Understanding P2P Lending:

Simply put, Direct Lending is an online system where people can either offer their money as a loan to earn interest or borrow funds for personal or entrepreneurial needs. By cutting out the intermediary – usually banks – both sides can potentially enjoy better financial terms. Investors might get returns surpassing regular bank savings, while those borrowing can benefit from attractive interest rates and a more user-friendly application journey.

The Advantages of P2P Lending:

Financial Inclusivity: P2P platforms cater to a broader audience, including budding entrepreneurs, those with minimal credit backgrounds, or those in need of smaller loan sums.

Openness and Autonomy: Investors using P2P platforms can often decide where their funds are invested. They can spread their money across various loans or concentrate on particular sectors or risk brackets.

Quick and Hassle-Free: Bypassing the usual bank procedures, P2P platforms can finalize loans more rapidly. Approvals can come in a matter of hours or a few days.

Attractive Financial Terms: With no bank middlemen, borrowers often find P2P loans come with appealing interest rates. At the same time, investors can achieve returns that frequently beat traditional bank savings.

Potential Hurdles of P2P Lending:

However, Direct Lending isn't without its potential pitfalls:

Investor Risks: P2P loans don't come with insurance like bank deposits. Hence, investors face the possibility of borrowers not paying back. Many experienced P2P investors counteract this by spreading their investments over a range of loans.

Regulatory Questions: The rules governing P2P lending are still in flux. Different regions have distinct regulations, so both lenders and borrowers should familiarize themselves with local guidelines.

Platform Reliability: The success of a P2P loan often depends on the platform's credibility. It's essential to opt for platforms with a proven track record.

Horizon of P2P Lending:

The last decade has seen a surge in the popularity of P2P lending. As digital tools advance and people become more tech-aware, P2P lending's allure will likely amplify. Additionally, global economic shifts, like recent low-interest trends, will push individuals towards P2P platforms in search of better returns and more accessible lending options.

Furthermore, with the growth of AI and data analytics, P2P platforms are becoming more sophisticated. They're better equipped to evaluate risks, provide tailored loan suggestions, and even automate investment choices for lenders.

P2P platforms are indeed becoming highly sophisticated and widespread too. There is a lot of awareness being made about them now than before, and of course, because of the much-needed advantages as listed, it has become something that a lot of people want to be a part of.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit