In last week's post, I talked about how most investors were patiently waiting for crypto to go much lower and how that might mean that it is wise to go against the grain. This is simply because of the simple fact that Bitcoin crazily tends to go against expectations. I even recommended deploying 30-40% to buy BTC and alts at the time. So, you can just imagine my relief enjoying this week's pump. However, there is another indicator that has caught my eye recently and I think it is worth talking about. It is Bitcoin's hash rate.

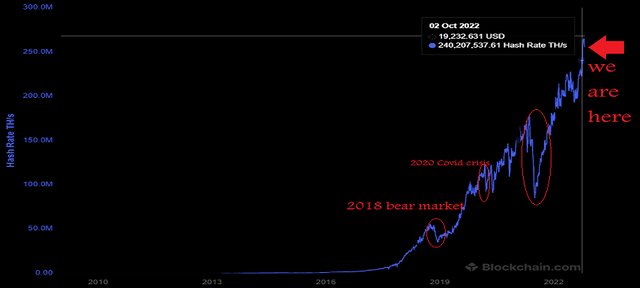

In case you missed the memo, Bitcoin's hash rate is basically a measure of how much computing power is connected to Bitcoin's network. In other words, it expresses how many miners are still interested to keep mining BTC and are willing to employ their expensive hardware and energy sources for doing so. Historically, Bitcoin's hash rate has fallen sharply by 30-40 percent in the deep of the previous bear markets. This makes a lot of sense given that most miners will not be too interested in consuming energy, time, and resources in something that is likely to go lower. As you can see in the image below, miners have reduced their activities multiple times in the past when they felt BTC was about to take dives.

source

source

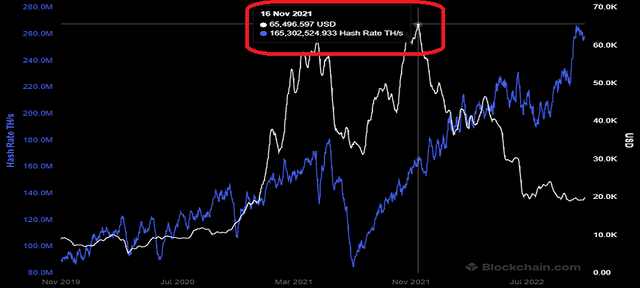

Here's the thing though, can you believe that Bitcoin’s hash rate has just hit a record all-time high this month? Yup, this is happening amid the “crypto winter”, as BTC’s price is about 70% below the crypto asset’s lifetime price high in November 2021 (69k). Moreover, it is taking place in the face of the infamous energy crisis in Europe and elsewhere. According to news.bitcoin, Bitcoin's Total Network Hashrate hit 321 Exahash per Second earlier this month, almost double the 165 Exahash it reached in November last year when BTC's price was about 65k (over treble the current price)!

source

source

What does that mean?

Well, in my humble opinion, if there is one thing that can be learned from miners at the moment is that they are not as pessimistic about Bitcoin as many may believe. Otherwise, they could have stopped mining, or at least, reduced it as they've done in the past and on multiple occasions. Conversely, figures and statistics refer that high-profile miners have never been as optimistic about Bitcoin as they are now. This certainly doesn’t change the fact that crypto still has room to go down, but it also suggests that the time to go up may be just around the corner. It might not be in the short term but I believe it will be in the medium term.

Maybe, we can expect some exciting stuff in the crypto market in the upcoming few weeks or months. Let's not forget that BTC is already down by about 70% of its ATH, and I honestly find a hard time imagining it going much lower at this point. I’m not a hopium peddler nor am I a financial advisor, but I think looking at figures, statistics, and history and acting accordingly is the way to go in the crypto space…

What do you guys think?

I'm keen to read your opinions and thoughts...

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 5/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit