Ford is a mature dividend paying stock. It qualifies as an Asset as it has value and a history of appreciation.

It also can be called a “performing asset” because it pats a dividend to the. Owner quarterly.

It dipped recently, so I bought 100 shares for five dollars a share. It has risen 50 cents since then for a ten percent gain this year to date. I want to add to my holdings by buying an additional 100 shares. But I want to pay $5.00 not the current market price $5.50-$5.61.

How?

I can sell Put options and pick a strike price and premium which gives me an effective price or basis of $5.00

How?

Facts;

Ford current price $5.56 per share at the time of this post.

Put Options

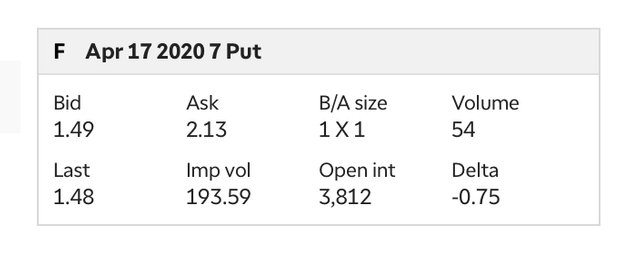

Expiration date April 17th, 2020

Strike price $7.00’

Premium 1.67 to 2.07 , low price today and high price to day

So, if I sell one contract of $7.00 puts on Ford with an expiration date of April 17th,

Then I am selling someone the right to sell me one contract or 100 shares of Ford for $7.00 on April 17th, if the Pruce of Ford is below $7.—.

**How does buying someone’s stock at $7.00 help me by the stock at $5.00, which is my goal?

I get them to pay me a $2.00 premium per share for agreeing to this option contract.

So even thoughI paid them seven dollars per share, since they paid me $2.00 per share to enter the deal, my true basis for Ford is $7.00 minus $2.00 per share, leaving $5.00 per share as the real cost or basis.

Fords Price today:

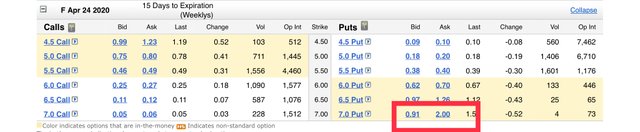

The option chain:

You see the bid and ask price.

I then place an order to sell one contracts at a price below the ask of 2.13, 2.00, because I just need to get paid a premium of $2.00 on the trade to establish my basis at 5.00, so if I get filled I get paid $200.00 cash. Later when I buy these 100 shares of Ford for $7.00 , I will pay $7.00 or $700.00 for 100 shares. But 700 - 200 = 500, divided by 100 shares, gives me my basis of $5.00 per share.

So even though the market price is 5.61, by using options I can buy the stock I want , at the price I was...

Questions?

Leave them in the comments below.

✍🏼 Shortsegments

Trade of the day: Selling Puts on Ford to buy it at a price I want!

This looks like an amazing way to get a good price. Your very creative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy good+job

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit