Macroeconomic factors and centralization issues are weighing on Ethereum’s post-merger price.

Market analysis

Ethereum’s merger on September 15 proved to be a sales pitch, and it looks set to continue.

Notably, Ether (ETH) fell sharply against the U.S. dollar and Bitcoin (BTC) after the merger. As of September 22, the switch from Ethereum to Proof of Stake (PoS.

ETH/USD and ETH/BTC daily price charts.

What is eating the ether bull?

Multiple catalysts caused Ethereum to drop during the aforementioned period. First, ETH’s price decline against the U.S. dollar, driven by a 75 basis point (bps) rate hike by the Federal Reserve, coincided with similar declines elsewhere in the crypto market.

Second, Ethereum has faced a lot of criticism for becoming too centralized after the merger.

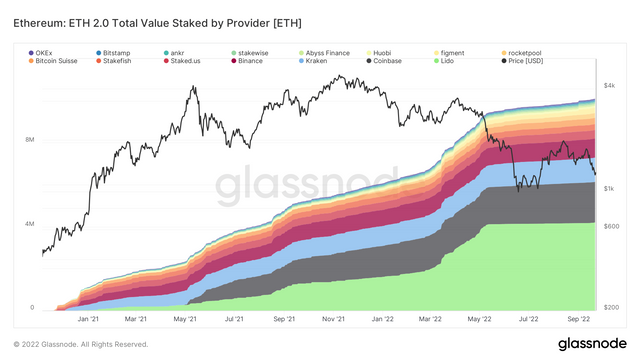

So far, only five entities have produced 60% of the blocks. The largest share belongs to the Ethereum staking service Lido DAO, which deposited 4.19 million ETH, accounting for more than 30% of the total amount of Ethereum's official PoS smart contract pledge.

The total value of ETH 2.0 staked by the provider.

Third, institutional investors or "smart money" also reduced their exposure to ethereum-focused investment vehicles on the day before and after the merger.

According to a weekly report from CoinShares, Ethereum funds saw outflows worth $15.4 million in the week ended September 16. In contrast, bitcoin-based investment funds attracted $17.4 million in the same week, indicating a capital migration following the merger.

Finally, Ether is also feeling significant selling pressure from its proof-of-work (PoW) miners, who sold $40 million worth of Ether just days before the PoS update.

Independent market analyst Tuur Demeester noted that Ethereum could continue to fall in the coming days, citing ETH/BTC's previous reaction to key Ethereum market events as shown below.

ETH/BTC price performance around key Ethereum events.

This chart shows how Ether traders compared ETH to Bitcoin ahead of adoption-related narratives such as non-fungible tokens (NFTs) and the Defi boom in 2021 and the ICO boom in 2017.

Once the hype subsided, all of that backlash evaporated. Demeester highlighted Ethereum’s move to PoS as a similar hype phase that propelled ETH/BTC higher in 2022, with the pair expected to undergo a deep correction in the coming weeks.

“I expect ETH/BTC to crash violently at some point,” he said, adding:

"ETH is a ticking time bomb."

ETH/BTC technicals imply a 10% drop ahead

Comparing these fundamentals to Ether's technicals and Bitcoin reveals a similar bearish setup.

RELATED: Jerome Powell is prolonging our economic pain

On the three-day chart, ETH/BTC is down nearly 25% after hitting 0.085 BTC, a level that coincides with its long-term resistance at 0.081 BTC.

Now, the pair is set to fall further towards its multi-month uptrend line support, as shown in the chart below.

ETH/BTC three-day price chart.

The trendline support fell in tandem with 0.06 BTC, a level that has become a pullback zone in 2022. In other words, there is another 10% drop to come.

The bearish setup for ETH/USD is even worse

Ether could drop as much as 45% against the U.S. dollar due to an ascending triangle pattern in a downtrend.

ETH/USD three-day price chart with an "Ascending Triangle" pattern.

Typically, a bearish continuation pattern resolves after the price breaks below its lower trendline before falling to its maximum height. Thus, by the end of the year, a bearish target is around $700, a 45% drop from today's price.

Conversely, a pullback from the lower trendline of the triangle could send ETH up to the upper trendline, implying a rally to $1,775, or a 35% gain from current price levels.

In the crypto industry, if you want to seize the next bull market opportunity, you must have a high-quality circle, so that everyone can stay warm and keep insight. If you are alone, look around at a loss, and find that there is no one, it is actually very difficult to persist in this industry.

Thank you for reading