Technology is emerging exponentially over any other important things in human history. With the availability of internet to connect and interact, the worlds are exploiting new business models, and disrupt legacy systems. Crypto enthusiasts are raking in profits via Peer to peer (P2P) lending and it keeps growing despite the current year-long bear market.

Currently, banks require a number of documents from borrowers such as a good credit score, previous bank statements, verification and some form of collateral to receive the loan. Even after producing all these forms of documentation, borrowers still need to wait for some days to receive the money in their accounts accepting heavy processing fees. Lenders also struggle through the current banking systems with very low rates and possible negative interest rates across the globe.

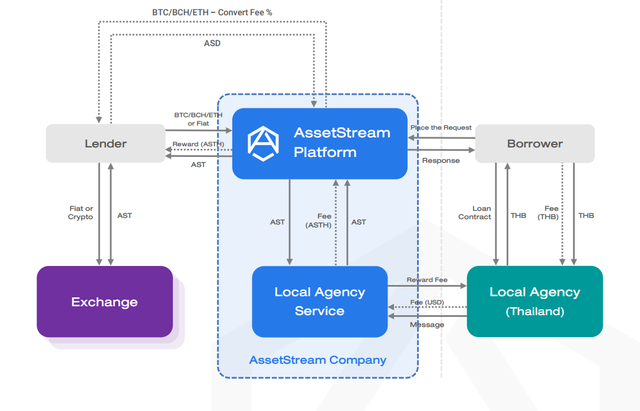

Blockchain technology allows borrowers and lenders to exchange funds without the need of an intermediary. Users "crowd-source" funds/loans. A smart contract records the agreement on the blockchain. Borrowers are then able to receive the funds within hours pending verification with very low transaction fees once they fulfill the conditions to execute the contract.

Blockchain technology has makes the whole processing easy and faster than conventional methods of getting a loan. The peer to peer loans offer better rates than traditional loans. Some of the P2P lending platforms offer a flexible market for loans where borrowers and lenders negotiate the interest rates and timespan for repayments

This is the reason why ASSETSTREAM through the use of blockchain technology will neutralize the use of third-party services in the financial transaction transaction. ASSETSTREAM is a decentralized member to member financial platform which has come to replace the third-party services with the use of blockchain technology.

ASSETSTREAM platform is designed in such a way that it gives upto 4% monthly as reward to lender from their investment. It also helps SMEs to be able to diversify their investment without any negative risks involved. ASSETSTREM also helps the lender to recover their funds at the appropriate time unlike what it’s been experienced at the hands of other financial platforms out there. With ASSETSTREAM platform, lenders funds are always secured and there is risk reduction associated with non-profit loan.

ASSETSTREAM offers the borrowers with the lowest and possible rate they could ever get against the high rate that is been experienced in the other platforms out there. With the help of ASSETSTREAM platform, Borrowers will be able to chose the best interest rate with the best duration for the amount been borrowed. Most of the financial platforms out there always hide the details of the term and conditions away from both the lenders and the borrowers in which this has led to serious problems for the two parties involved.

There is also instant loan approval for users of the platform simply because there is no much documentation needed as against the traditional financial platform always takes ages and months before the loan can be approved. There is also a transparent process for the approval of loan in the ASSETSTREAM platform.

Conclusively, it is believed that with the level of trust and transparency established in ASSETSTREAM platform, it wont be long for the whole world to adopt the use of ASSETSTREAM platform. Considering the available features in the platform Im well convinced that ASSETSTREAM platform is going to be the best project of the year.

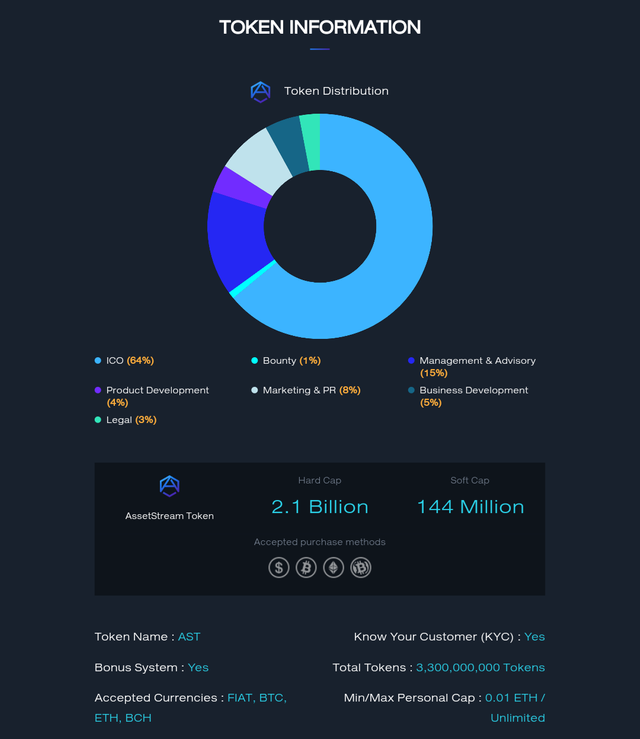

ASSETSTREAM has also launched their own token in the platform which will be used in the platform to carry out several activities and rewards payments.

TOKEN DETAILS

Token Name => AST

Token Supply => 3,300,000,000 AST

Token Issued => 2,100,000,000

Token Price => 0.01 USD

Soft-Cap => 1,440,000 USD

Hard-Cap => 21,000,000 USD

TOKEN DISTRIBUTION

64% Allocated to ICO

15% Allocated to Management and Advisory

8% Allocated to Marketing and Promotions

5% Allocated to Business Development

4% Allocated to Product Development

3% Allocated to Legal

1% Allocated to Bounty

TEAM

To know more about ASSETSTREAM check the links below

Website => https://www.assetstream.co/

Whitepaper => https://www.assetstream.co/AssetStream-Whitepaper.pdf

Onepager => https://www.assetstream.co/AssetStream-OnePager.pdf

ANN Thread => https://bitcointalk.org/index.php?topic=5138325.msg50857889#msg50857889

Medium => https://medium.com/@assetstream

Facebook => https://www.facebook.com/AssetStream/

Telegram => https://t.me/AssetStreamOfficial

Twitter => https://twitter.com/AssetStream

Reddit => https://www.reddit.com/r/AssetStream

Bitcointalk User Profile => https://bitcointalk.org/index.php?action=profile;u=2550421

Bitcointalk Username => Samunto

Author => Lekato

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://moonwhale.io/crypto-collateral-p2p-lending/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit