A Short Report: Independence from the global banking system

Infinite Banking Concept equals decentralization and freedom from the global banking system.

The 50-year-old Infinite Banking Concept, created by R. Nelson Nash, which predates the popularity of both the Internet and the Blockchain, provides clear, simple, step-by-step instructions to free you from dependence on the modern banking system. This is true banking decentralization, both literally and figuratively. It provides credit just like today’s decentralized banks like the MakerDao or DJED/JUST.

I will explain how this legacy product works using an illustration.

Whole Life Insurance, as a financial tool was well know and used by multiple generations of farmers in America for over 100 years. The name “Whole life insurance” is the name a life insurance policy that a farmer took out when he was very young and he used it for his “entire or whole life”, thus it earned the name “whole life”.

A “Whole Life” life insurance policy contains as an integral or core component, a savings account called the “Cash Value” of the policy, upon which the insurance company pays the Policy owner a guaranteed rate of compound interest, which accumulates within the savings account portion of the “Whole Life” insurance policy and it is called the “Cash Value” portion of the policy. The farmer or policy owner is allowed to apply and receive “loans” against the cash value, for which he pays a “pre-agreed upon” and “fixed rate” of “simple interest” for the life of the policy. Which by design is in effect for his whole life. The value of this “cash value” portion is determined by the premiums paid to the insurance company.

R. Nelson Nash, the founder of the Infinite Banking Concept, learned that those premiums can be subdivided into portions which pay the death benefit and portions contributing to the cash value. And the portion of the monthly premium which goes to each can be negotiated at the start, to effectively grow the cash value faster, so as to create a rapidly growing pool of money, which could be used to finance small or large purchases, essentially creating a small personal bank to use. And, because the loan was secured by the cash value the farmer didn’t need to submit to a credit check or provide tax returns or paystubs. He simply requested a loan in writing and he could receive the money in 1-2 days. Sooner if he went to insurance office in person, that way same day service was possible.

The farmer used the cash value portion of his whole life policy as a financial instrument to finance his needs for purchases not unlike the way the modern individual uses financing from a bank to finance his purchases of things he needs every day. The farmer used this financing tool called cash value to finance the purchase of seeds and other essential equipment on a yearly basis while running his business, which was his farm. And this financial tool was an essential part of his financial ecosystem. The whole life insurance policy allowed him to function to various degrees as an individual financier, independently of the banking system because he provided his own financing for his daily needs. Then when the farmer died he left to his wife and children the knowledge of this financial system which allowed him to function as an individual independently of the banking system because he provided his own financing for his needs and he left to them a death benefit which allow them to purchase the farm and pay off his debts when he died.

This is how a whole life insurance policy, carefully structured to promote the accumulation of a usable pool of money is just like a personal debt facility or a bank . But with the loans collateralized by the cash value portion of the policy, which was essentially a personal bank. It is an independent financial system which basically financed his life and business and at the end of his life he made sure that his children were better off then he was financially; by eliminating their main debt “the mortgage on the farm”. Which was paid off by the death benefit of his whole life insurance policy.

These ideas and concepts were well known in America, but appear to have been lost in our transition from a largely farm based economy to a largely industrial one. Ironically, the only part of this knowledge, which remained in our culture was the association of dying with the phrase “bought the farm”. The current understanding of the phrase is simply that someone died. But it is totally stripped of its financial ramification and financial achievement.

Summary

If you understand decentralized credit debt facilities, you now understand that the original “infinite banking concept” is essentially a personal decentralized finance system, which allows you to create your own credit debt facility for your personal needs. A bank is essentially a credit facility built to make money for the bank owners at the expense of the customer/consumer. It’s not personal, it’s just business.

The infinite banking system, as originally created by R. Nelson Nash 50 years ago, uses a financial vehicle called Whole Life Insurance to help you create a personal credit facility, which grows during your lifetime from a small fund, for small loans into a large fund for major financing events like a car purchase, college education, financing a home mortgage or even financing a business startup. The R. Nelson Nash version of Infinite Banking Institute teaches insurance agents how to sell Whole Life Insurance products, which are specifically tailored to provide maximal cash value accumulation to create this cash fund, which is controlled by the policy owner.

I think this is powerful. Knowledge is power, which creates wealth, which provides freedom.

Knowledge->Wealth->Freedom.

Stay thirsty for knowledge my friends.

Stay thirsty.

✍🏼 Written by Shortsegments

A Short Report: The infinite banking concept, created by R. Nelson Nash produced a decentralized credit facility before it was popular.

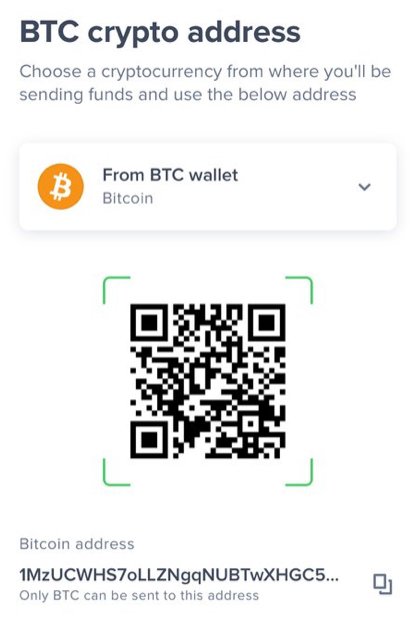

Support my blog by upvoting or sending me cryptocurrency to one of the wallets below

Thank you

**

Please Support my blog by upvoting or sending me cryptocurrency to one of my wallets below

Thank you

BITCOIN BTC

Thank you

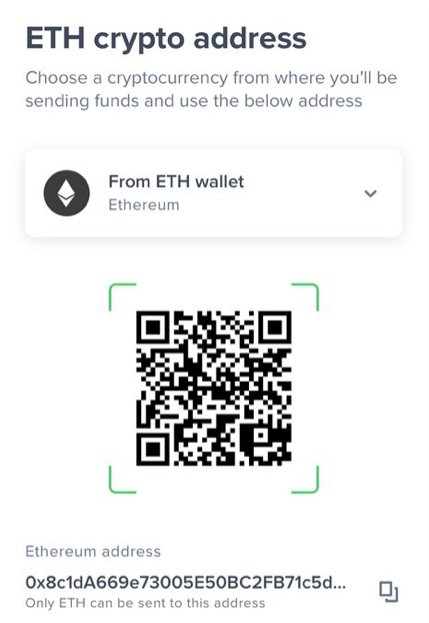

ETHEREUM

Thank you

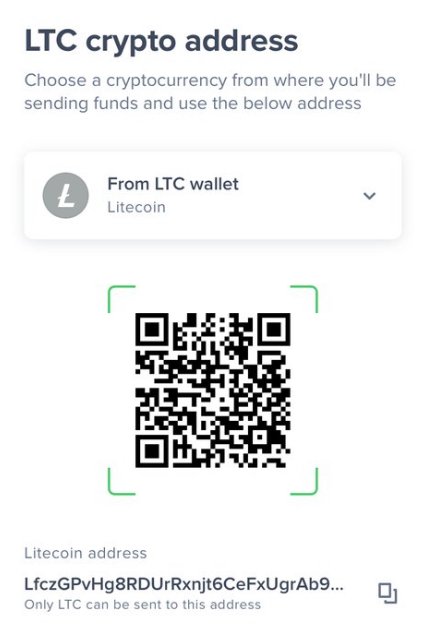

LITECOIN

Thank You

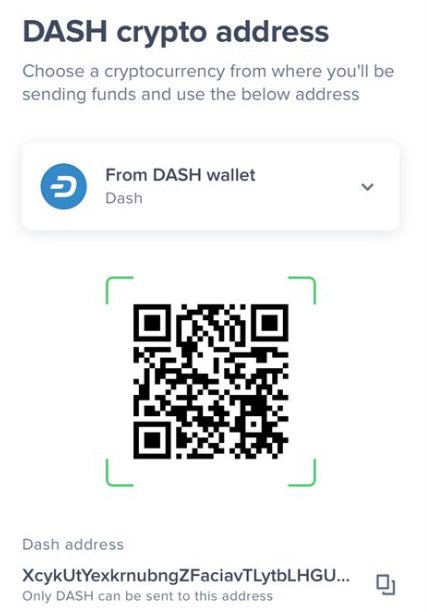

DASH

Thank you

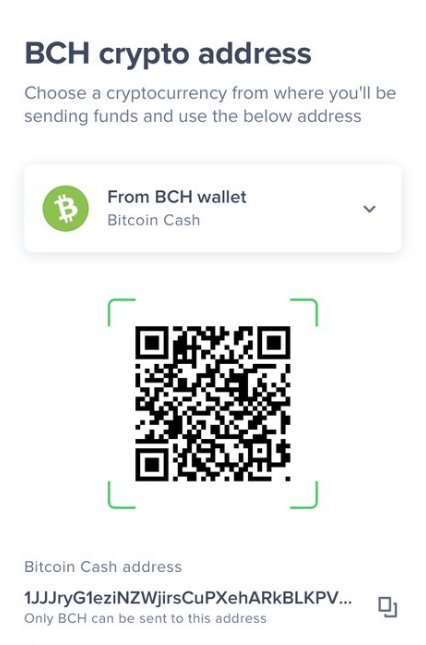

BITCOIN CASH

Thank you

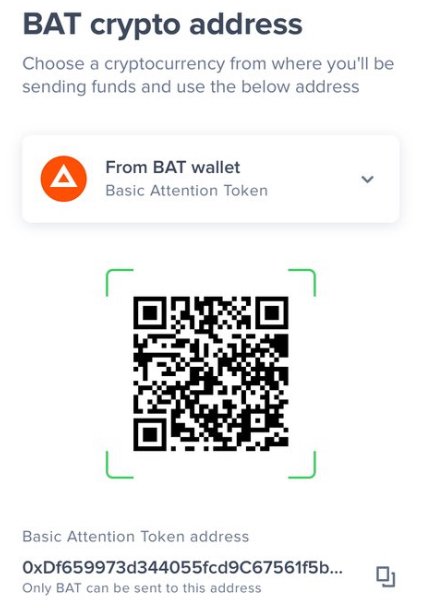

BAT; BASIC ATTENTION TOKEN

Good job. I understand this so much better now. Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome. It’s very powerful.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy thank+you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy thank+you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy thank+you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

!giphy thank+you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

giphy is supported by witness untersatz!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit