Kaepernick dominates the markets. The turmoil bubbles below the surface in emerging markets and rates. A quiet trade action day as I was waiting for US markets to give a lead. Bitcoin wants to march ahead and Ethereum does not.

Portfolio News

Market Jitters - Tariff Tantrum All that mattered after Labor Day was Nike and Colin Kaepernick

I watched the lead up to market open and all the talking heads could talk about was the controversy about the Nike ad campaign featuring Colin Kaepernick. In case you don't know, he was the NFL player who started the kneeling protest when the US National Anthem plays. I did not wait to see the market open as I could tell that it was going to be a quiet day. The reality of it all is carried in the other headlines. Nike have a lot of data about their customers. They would have made a very reasoned decision to run the ads - market did penalize the stock by 3% which might make a good discount if you wanted to run the play.

A muted start after the Labor Day holiday is what happened on the surface.

ISM Manufacturing data came and made a 14 year high. That is what counts - not sentiment about emotional claptrap about kneeling. There were signs under the hoods - 10 Year Treasury yield jumped 4 points to get a lot closer to the 3% level. US Passenger car market share dropped to lowest level ever = not good news for Ford and GM especially = grist to the mill for trade discussions with Canada. Emerging markets were all hit with further declines in Turkish Lira and a big move in South African Rand.

The week ahead is a big data week in US - I fully expect some good data to come out and to be the focus of attention.

South Africa South Africa officially drops into recession.

A big mover in my stock portfolio were put options bought last week on the iShares South Africa ETF (EZA) with the underlying stock dropping 7% on the day. Puts jumped 60%. The currency moved too taking my options trades past breakeven. Here are the currency trades updated

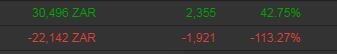

A quick note on the way options pricing works. I have a bull call spread on USDZAR. The in-the-money leg went up 42% while the out-the-money sold leg went up more (113%) - this is a difference in what is called delta. In this case delta is more than 50%. I really need to wait for the price to pass the sold strike to reach maximum profit.

Cannabis Carnival Biggest stock mover in my portfolios was in fact a cannabis company Aphria (APH.TO) up 9% on the day on the back of a US deal.

The news announcement grabs headlines because it is an American company and the talking heads talk about those almost exclusively (when they were not talking about Nike and Tesla).

These deals are happening across the board in Canada. My Australian holding in MMJ Phytotech (MMJ.AX) announced 3 deals today like this by its investment in Medipharm, which is due to be listed in Canada soon. MMJ share price has not moved in the same way.

Bought

Cellmid Ltd (CDY.AX): Australian Pharma. Cellmid develops and markets innovative novel therapies and diagnostic tests for fibrotic diseases, cancer, ischemic diseases of the heart and hair loss. This share purchase was part of a share purchase plan for retail investors following an institutional placement. The chart tells a story of one of my frustrations as a small investor.

The institutional placement was made at a substantial discount to the market price - see the drop in price when the placement was announced. This time retail investors were given a chance to buy in at the same price. One has to buy otherwise one's ownership becomes diluted.

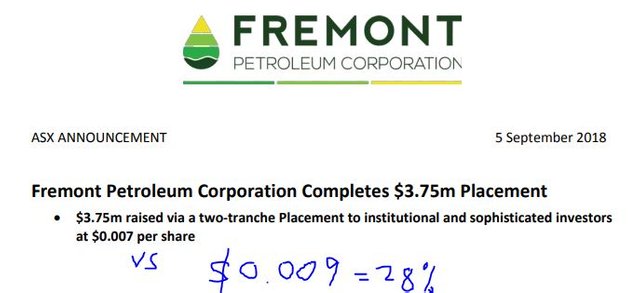

Retail investors are not always given a chance to participate. They just get diluted. Here is an example announcement made today by Fremont Petroleum, listed in Australia.

Institutional investors got a 28% discount on their placement shares - 24% if you take a 30 days view. Worse than that they also received one free attaching option for every two shares subscribed for and issued under the Placement . The options will be listed options exercisable at $0.02 each on or before 31 March 2020. If price moves past the strike price, retail investors get diluted further

Sold

Tabcorp (TAH.AX): Australian Gambling. Signal came in from research house to close the position. The origirnal trade idea was that price had broken above a trading range level and could motor ahead. It did not really do that and I guess that is why they pulled the trade. My exit was at the same level as my entry making for a loss of trading costs only (0.1% each way) but the trade window did capture the dividend of 2% (taxable). Research house does not give reasons for trade closes. As I look at the chart I see price making a lower high after the surge with a bearish engulfing bar. Price started to break higher and then tested lower - that may have scared them off.

As it happens I received a phone call from the research house late last week checking how things are going. The answer is the service has not covered subscription costs for the last 12 months. The problem I am having is the losing trades are bigger than the winning trades and there are not enough winning trades. My coach always says "cut your losers and let the winners run". This trade could have been one of those winners to let run. The dividend provided a buffer to make that less painful.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $227 (3.2% of the low). Price spent two days working up to test the resistance level and pushed through and closed above. Do not be surprised to see a push up and pull back to retest the level as a support level (dark green line).

Ethereum (ETHUSD): Price range for the two days was $16 (5.4% of the high). Price did not follow Bitcoin and instead made lower highs and lower lows.

Note: I used data for the daily price move calc from Bitfinex. The chart comes from Kraken which is the source I normally use. I have marked on the Bitfinex low - i.e., ignore the spike down. I hope none of you were caught out . This is the sort of price action that the SEC does not like. The exchange is supposed to prevent this stuff happening. I noted also that Bitmex announced on the same day that they will be adding Kraken pricing to their Ethereum index some time later in September. Not a good day for Kraken to demonstrate such price variability

CryptoBots

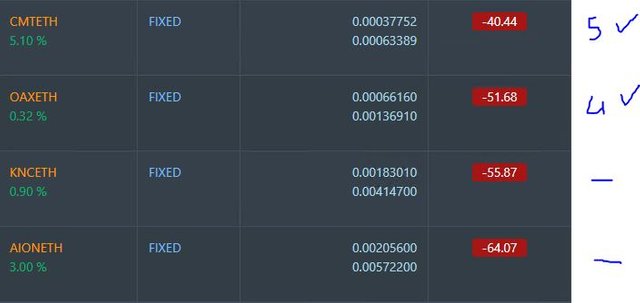

Outsourced Bot No closed trades. (220 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-62%), ZEC (-60%), DASH (-60%), LTC (-45%), BTS (-48%), ICX (-73%), ADA (-64%), PPT (-76%), DGD (-78%), GAS (-76%), SNT (-55%), STRAT (-69%), NEO (-75%), ETC (-46%), QTUM (-75%), BTG (-74%), XMR (-31%), OMG (-59%).

A mostly positive day with coins advancing 1 to 3 points. STRAT (-69%) and OMG (-59%) improved one level and XMR (-31%) improved the most at 8 points. DGD (-78%) took over worst mantle from GAS (-76%).

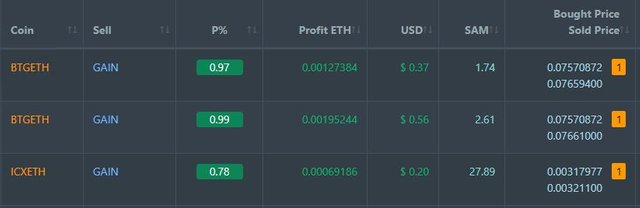

Profit Trailer Bot Three closed trades (0.91% profit) bringing the position on the account to 1.86% profit (was 1.79%) (not accounting for open trades and PT Defender exit trades). All 3 trades came with one level of DCA (the orange shaded 1)

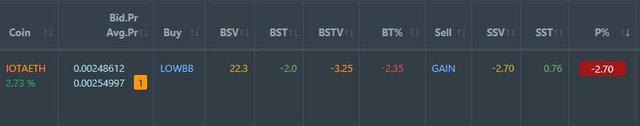

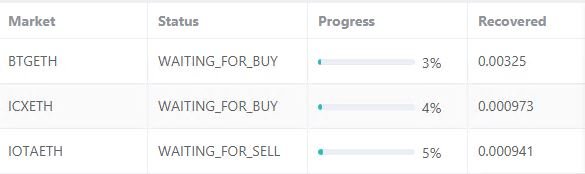

Dollar Cost Average (DCA) list dropped back to one coin (IOTA) with ICX and BTG moving off and onto profit after one level of DCA each. I was happy to see the BTG position close as it was a lot larger than the others.

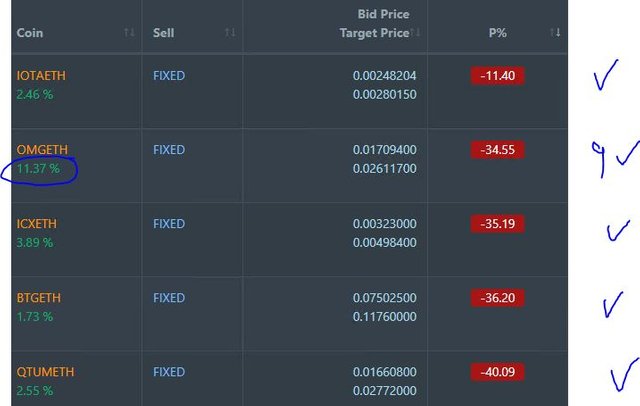

Pending list dropped to 9 coins with ETC hitting its target. Overall there were 7 coins improving and 2 coins trading flat.

PT Defender completed ETC defence leaving a small holding behind. The last tranche of ETC trades were closed out for a 0.53% profit. Trading model is a bit of a black box - part of the defence is a mismatch blend of buying and selling lot sizes. PT Defender is still working on 3 coins. It did get sales away for ICX and BCG.

New Trading Bot Trading out using Crypto Prophecy experiments continue. Two of the outstanding trades hit their targets (LSK for 0.11% and RCN for 2.24%). With lessons laid out in TIB292, I placed 3 new trades (EOS, XRP, NULS) which all closed for 1.3% profits within 2 to 3 hours. The NULS chart shows entry and exit and shows a fair run after exit.

Next phase of testing will be to push up the profit target. One more chart to go back to one of the staged exits on RCN. This was one of the early experimental trades.

Entry is marked I at 312. Lesson one - find a way to trail entry when price is sliding along a falling Bollinger Band. The bot would have gone in on the whipsaw bar around the 300 level (next to the up down red arrows). The exits are shown - half off at 1.3% profit. 2nd exit target was set at the high of the bar before entry (319) which was reached on the third visit to the upper band. There is a target set at 325 which was the high before the fall when the entry was made.

There are 3 partial trades open on XRP, POA and LINK. LINK is now a week outstanding and is now 15% below its target.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 12.4% (lower than prior day's 17.9%). Not great but that feels better

Outsourced MAM account Actions to Wealth closed out 1 trade for 0.33% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and BusinessInsider. South Africa flag is free of copyright.. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

September 3-4, 2018

Great call on the South Africa moves. As I read the news over the weekend I remember you position! Definitely seeing a conundrum in some of the emerging markets with these currency situations against strong growth from developed countries. I still think that the trade war is still the wild card as to what impact it could do to global GDP.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Market is going to diverge. Economies with solid growth and modest current account deficits (or surpluses) and government spending under control will steam ahead of the rest. The trade tariffs are projected to cost 0.5% GDP growth. A big next round does create the chance of an all out trade war which is harder to estimate.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit