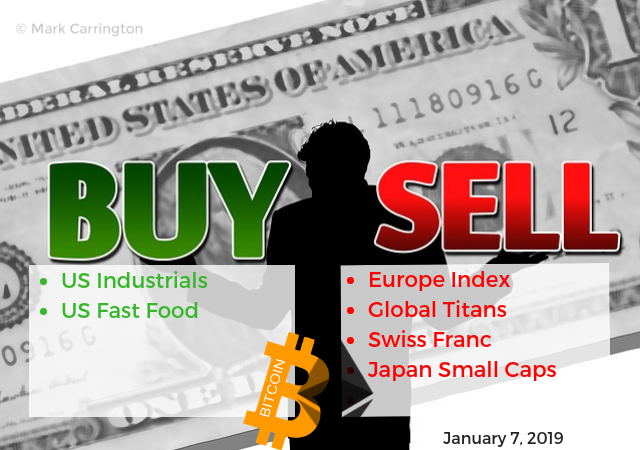

Markets move ahead again. A few sales to release cash - one for profits and one out of impatience with Europe. Testing some new income ideas selling in-the-money puts on stock I am happy to own. Exercise time on Swiss Franc.

Portfolio News

Market Jitters - Tariff Tantrum

US Markets rise for a 2nd straight day as China-US trade talks begin in Beijing

US side of the trade discussions are confident that they will get a deal. I am not totally convinced about the 90 days thing because of the Chinese New Year holiday coming up before the end of the 90 days - it might take longer.

Headlines on yields carry a mixed message between inching higher and bouncing. It is one or the other.

Bought

Been watching a few of the talking heads talking about stock picks amongst the Dow Jones Index stocks - the start of a New Year is always time to dig out the Dogs of the Dow theories. Here is one that has some appeal if China does not come to a deal - Verizon (VZ) as they have no exposure to China and have lagged the Dow.

https://www.cnbc.com/2019/01/07/top-technician-says-dow-dog-verizon-is-headed-for-a-breakout.html

This got me thinking about some new positions. Jim Cramer ran a session on Mad Money at the weekend when he walked through the 5 best and 5 worst of the Dow in 2018 and expressed some views on how to use the best as defensive plays (McDonalds, Pfizer and Merchk in that list) and on how to use the worst as offensive plays because they could catch up. After my successful income trade on McDonalds in October ahead of earnings selling puts, I wanted to explore doing that a little more on two names, McDonalds and Honeywell.

They are both stocks one would be happy to own at a lower entry price. The idea is to sell a put at a strike below the current price a month or two out. If market news moves against the stock, price could fall and one is required to buy the stock at the lower price. If the news moves price the other way or nowhere, one banks the premium and writes again. The big risk in the trade is one gets the news flow wrong and price collapses below the sold strike and one has to buy at an uncomfortable entry.

McDonald's Corporation (MCD): US Fast Food. McDonalds is a defensive stock position when consumer spending is moving along fine. The chances of its price dropping 10% are low. I sold a February 2019, 165 strike put option for $1.14 premium (0.69% of strike). Price has to drop 9.2% from the closing price of $180.22 for assignment to occur. If the stock is assigned, my price entry will be 9.98% below the current price.

Here is the chart showing the last 12 months and the sold put as a red ray and expiry the dotted green line on the right margin. Earnings dates are also showing.I picked 165 strike as this is what I did last time and it was the level before last earnings. I have left in the channel I posted last time with the extension to take in new data. Price has bounced off the bottom of the channel in the latest rebound and is testing the top of the channel right now.

Two key price scenarios exist for the next earnings - a modest pull back (left red arrow) or a sharp pullback (pink arrow). Red arrow price scenario looks comfortable almost no matter what price reaches at earnings. The pink arrow is uncomfortable if price stays around current levels or lower. If it makes a higher high, the pink arrow scenario is fine. The key for me is I am happy to own McDonalds at $165.

Honeywell International Inc. (HON): US Industrial. Big winners from successful trade talks will be US Industrials that are exposed to China, like Caterpillar. Honeywell fits in this category to a lesser degree and is on Jim Cramer's buy list. I sold a February 2019, 125 strike put option for $1.30 premium (0.96% of strike). Price has to drop 8.3% from the closing price of $135.37 for assignment to occur. If the stock is assigned, my price entry will be 9.43% below the current price.

The Honeywell chart looks quite different and shows the impact of the tariff war with a big selloff from October 2018. I picked the 125 strike as it is the level around the bottom of the big selloff and it coincides with the timing that Jim Cramer starting adding to his positions. Again I present two price scenarios following earnings. The red arrow scenario will be comfortable and the pink arrow will depend on how far price moves ahead in the current run up. The important part of the $125 level is it was last seen in Q1 of 2017.

I did go digging to find articles on using this as an income strategy. This Seeking Alpha article looks pretty solid and includes a lot of guidelines on how to pick strikes and how far out in time to go and how to avoid falling knives. I am basing my choices this time around on the defensive nature of McDonalds (and success doing it last time) and Jim Cramer research on the fundamentals for Honeywell. I will dig further as I test out the strategy.

https://seekingalpha.com/article/4178703-printing-money-selling-puts

Note: these trades are backed by cash in the accounts in the event of assignment. The main risk they carry is that of catching a falling knife especially around earnings.

Sold

SPDR Dow Global Titans (DGT): Global Index. 23% profit since July 2013. This trade idea came from my investing coach to kickstart a portfolio approach to investing - the idea is to hold a portion of a portfolio at index level. A 4 to 5% annual capital return is nothing to shout out about but it is better than fixed interest yields - position sold to release cash.

X-trackers MSCI Europe Hedgd Equity ETF (DBEU): Europe Index. 5% loss since January 2015. The trade idea here was for Europe to catch up with US and to do it in a hedged Euro exposure way. Given I just sold a global ETF, I have compared DBEU (black bars) to DGT (red line) and S&P500 (yellow line) and an ETF that tracks the Euro (FXE - orange line).

The hedging protected 5% of the capital loss the Euro made. DBEU lagged behind the Global Titans by 14 percentage points and S&P 500 by 25 percentage points. This was the price of Europe Muddles compared to solid US growth especially given the US's higher technology component.

Expiring Options

Swiss Franc (USDCHF): 12 month strike 0.9825 strike call options reached expiry in-the-money and are exercised. The trade idea was for US Dollar strength based on rising US interest rates. The chart tells a story of a trade that was right some of the time and wrong most of the time but not at the key point = expiry.

Trade has gone to exercise but has not recovered the bought premium. I really need to wait for the safe haven trade to calm down before choosing to exit. I am concerned about the US Dollar risk turning this into a big loser. I do hold more than this contract size in Swiss Franc denominated stocks which makes this position a currency hedging position.

Income Trades

One new covered call bid taken up.

Wisdom Tree Japan Small Caps ETF (DFJ): Japan Small Caps. Sold January 2019 strike 67 calls for 1.33% premium (1.76% to purchase price). Closing price $64.01 (new trade). Price needs to move another 4.7% to reach the sold strike (new trade). Should price pass the sold strike I book a 38% capital gain. Price has moved closer to strike since I set the trade up and there is a good chance that it could be assigned at expiry.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $104 (2.6% of the high). Price fails to pass the prior day high and hovered around the $4000 level all day on an inside bar without much conviction. Yesterday's low of $3964 becomes the new key level - hold above that today and we could see price have a go at passing above $4036 and holding there.

Ethereum (ETHUSD): Price range for the day was $10 (6.4% of the high). Price also makes an inside bar but with a wider range than Bitcoin. Like Bitcoin holding above the prior day low at $147 becomes key for a go at clearing $160.

CryptoBots

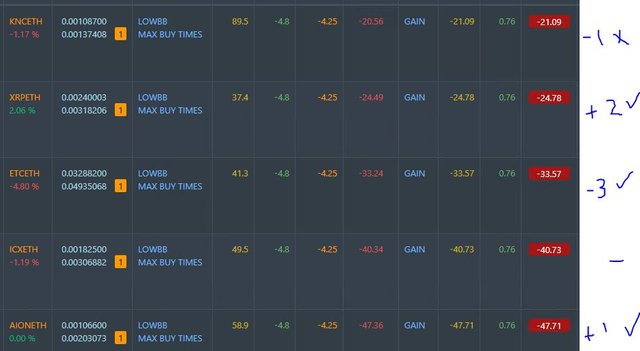

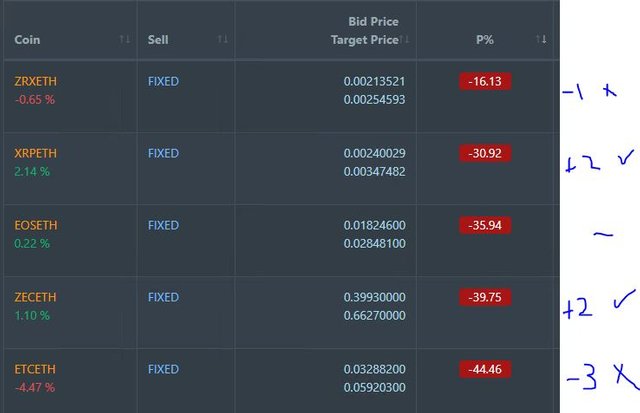

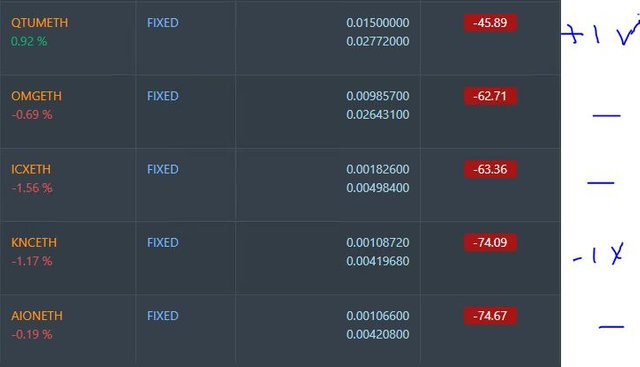

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-72%), ETH (-63%), ZEC (-71%), AE (-44%), LTC (-51%), BTS (-66%), ICX (-85%), ADA (-70%), PPT (-85%), DGD (-84%), GAS (-88%), SNT (-65%), STRAT (-68%), NEO (-84%), ETC (-63%), QTUM (-78%), BTG (-72%), XMR (-51%), OMG (-77%).

Coins moved in a tight band of 1 point either side, mostly up. GAS (-88%) remains the worst coin.

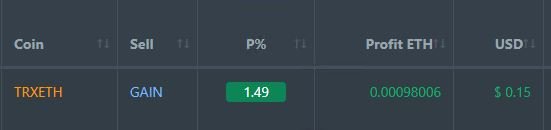

Profit Trailer Bot One closed trade (1.49% profit) bringing the position on the account to 5.24% profit (was 5.22%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 5 coins with 3 coins up and 1 down.

Pending list remains at 10 coins with 3 coins improving, 4 coins trading flat and 3 worse.

PT Defender continues defending 9 coins. No change

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot Not operating at present. Support ticket raised.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

January 7, 2019

McDonalds at $165 is a great buy given the dividen yield! I think support will pick before then which makes that premium a good grab.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I like the set-up on McDonalds.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I do too. Always wary of making statements like this, but it feels like free money. Of course, a bad earnings call and I might hate owning it at $165 less the premium.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Breakeven on USDCHF trade = 0.9825 plus 0.0159 = 0.9984

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit