Earnings continue to beat estimates but markets are getting a little skittish. Facebook powers ahead to profits. Taking a view on 5G chipmakers. Bitcoin hits another exchange related speed bump.

Portfolio News

Market Rally

More mixed earnings bag leads markets to show their nervous side.

Strong Microsoft and Facebook earnings are not enough to keep driving the market rally. It seems that investors are keen to bank profits rather than let things run.

Cannabis Carnival

Namaste Techologies (N.V) appoints new board member - and share price pops.

I always felt that the business was solid enough and just needed to get to stage 2 professional management in place of the somewhat gung-ho founder model. I had resisted the urge to buy more shares at $0.50 but the ones I bought at $0.73 are now over 20% up - the power of averaging down provided one has done the right due dilligence.

Crypto Craze

Bitcoin price collapses on news of legal problems facing the Bitfinex exchange.

There is a lot of bad sentiment around the Tether coin - which attempts to peg itself to US Dollar as the gateway into the crypto space. Accusations of manipulation are commonplace - and maybe even cheating and money laundering and stealing too.

https://www.newsbtc.com/2019/04/25/tether-bitfinex-legal-imbroglio-bitcoin-price/

Bought

One of the talking heads talked 5G following the Texas Instruments (TXN) earnings announcement. He identified potential winners separating out server-side and handset-side chip makers. Clear winner is going to be Qualcomm - Texas Instruments might be an also ran. Server-side clear winner was Xilinx and a bit of a dark horse is Analog Devices. I will allocate one standard position to 5G as an investment theme. He did mention a few other names which I missed noting. The thought on Xilinx was that price earnings had moved too far to invest at these levels.

Xilinx, Inc (XLNX): US Semiconductors. Xilinx earnings disappointed and price dropped hard down 17% in one step. This stock has been something of a darling stock and the profit takers headed home. I nibbled a small parcel as part of my 5G themed investment (1/2 of a one third position)

Analog Devices, Inc. (ADI): US Semiconductors. Added a small parcel as part of my 5G themed investment (1/2 of a one third position). Adding these two together I am holding a one third position in 5G to add to Qualcomm (QCOM).

Quick look at a chart of the last two years of Qualcomm (orange line) vs Xilinx (black bars) vs Analog Devices (blue line).

All 3 stocks had reached the same point (+120%) until the Xilinx earnings broke. Qualcomm only got there after the Apple settlement of this month. Now this might look like a FOMO trade - my view is it a long term fundamental change. Just think of autonomous vehicles and the demand for 5G to deliver the data.

Viacom Inc (VIAB): US Media. Averaged down my entry price in one portfolio following Jim Cramer idea - getting to half standard position size.

Sold

Facebook, Inc (FB): Social Media. Facebook earnings pleased the markets with price jumping nearly 6% taking it well over the top of the May 2019 170/180 bull call spread I am holding - closing at $193.26. Closed call side of 170/180/155 calendar spread risk reversal. Locks in 144% profit in 3 weeks not accounting for sold put (155) which I will let run to expiry. Chances of price dropping 28% in 4 weeks are remote AND if it does I am happy to buy Facebook at $155 which is below all 2019 lows.

Quick chart update shows price moving ahead harder than the price scenario from the last major reversal in Q2 2018. I do not hold Facebook stock directly but do through a few ETF's.

Income Trades

Viacom Inc. (VIAB): US Media. Sold May 2019 strike 32.5 calls for 0.86% premium (0.82% to purchase price). Closing price $29.02 (new trade). Price needs to move another 12% to reach the sold strike (new trade). Should price pass the sold strike I book a 9% capital gain. [Cost base adjusted to add in new shares bought]

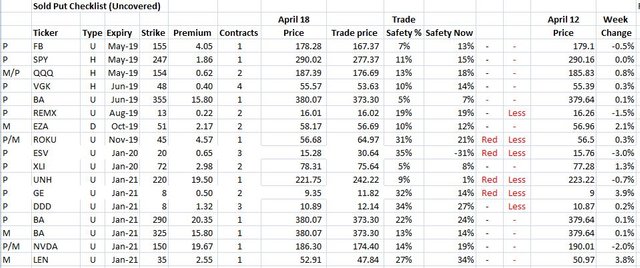

Naked Puts

I did review the state of naked puts as at end of last week. Expired safely on April 18 were Tesla, Nvidia and Cisco and McDonalds. Risk trades are marked RED.

Risk trades of note are UnitedHealth Group (UNH) now only 1% in the safety zone. Price does look like it has established a bottom above the sold put strike (220) and now that the political discussion on "Medicare for All" has eased off. Joe Biden entering the Democrat nomination race will help ease things too.

Other RED trades I am not concerned about - ESV is small; ROKU has 21% to go and 7 months; GE has 21 months to go

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $519 (9.4% of the high). Price did indeed do what it likes to do after making train tracks on a level and headed down all the way to the support level below to the dollar at $4991. The Bitfinex/Tether news was the catalyst that blew away any upward momentum.

Now this is a difficult point to trade as Bitfinex is an influential exchange especially for US-based investors. Truth is the Tether sentiment has been around for some time - the news might be overblown. I waited for the bounce off support to be confirmed on a 1 hour chart and entered a new contract at IG markets.

Ethereum (ETHUSD): Price range for the day was $20 (12% of the high). Price dropped with the Bitfinex news right through the short term support possibility at $159 into "no mans land".

I was right to only pencil in the extension of that $159 level. It did not hold. I added one new contract after confirming price bottoming and reversing on a 4 hour and 1 hour chart. Price target is $177 (the fluoro green line)

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 1 trade on AUDNZD for 0.12% profits for the day. Brave trade to make with both countries enjoying a public holiday. No open trades.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Other headline images are credited below images. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

April 25, 2019

Chip sector looking interesting as I recently saw that they have been one of the last sectors to reach year 2000 levels! Could be the start to a move higher as the 5G catalyst could provide the earnings growth needed to do so!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Am investing that way!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit