Market nerves are growing despite good earnings. Tesla announces a capital raising. More averaging down in Europe and a new entry in lithium and payments software. Profits taken in offshore oil and in growth stocks

Portfolio News

Market Rally

Day two of selling since the "transitory" inflation commentary from Federal Reserve rattled things a bit

The day was quite mixed with waves of selling and then some relief in the afternoon session. One of the drivers was a sliding oil price on the back of rising stockpiles. Got to love headline writers - crude oil price drops sharply says one and the other says slips 31 cents (0.48%). In the grand scheme of things that is hardly a ripple.

Maybe the better benchmark is the Treasury market which held yields steady to a slight rise.

The more notable move over two days has been a stronger US Dollar which has dragged gold price down. All eyes will be on Non Farm Payrolls data coming out on Friday.

https://www.wsj.com/articles/gold-slides-with-dollar-treasury-yields-steady-11556803471

Europe in my portfolios was certainly dragged in two directions with French and German banks up and the rest down.

Tesla Inc (TSLA) announces a $2.3 billion capital raising in a bid to build a more autonomous financial structure.

The raising is a mix of shares (c$600 - 700 million) and convertible bonds. Indicative pricing for the stock offer is $243 which is where price edged up to closing at $244.10. Timing for my portfolios is not good as I am holding a June 2019 strike 250 put option which is in-the-money but not better than breakeven.

The offer price for the capital raising will put a floor under the price. An idea is to wait for the timetable for the offer to see what to do with my trade if the closing date is before expiry. The good news is the premium for the April 250 strike put option I sold is in the bank.

Bought

Société BIC SA (BB.PA): Europe Consumer Products. Averaged down entry price and increased position size in my pension portfolio. Quick update on chart presented in TIB315. Initial purchase was based on Price to Sales screen and price breaking the downtrend.

Well that worked just fine with the trade going against the downtrend showing in Europe (ochre line) for a while and then stock was dragged down in the selloff and has only just showed signs of life off the lows (dotted green line going back to 2015 lows). Bic presented annual results on April 25 and presented unchanged forward guidance as they continue to work through a cost effectiveness transformation. Dividend yield up to 4.34%

ING Groep NV (INGA.AS): Dutch Bank. Averaged down entry price and increased position size in my pension portfolio.

Square, Inc. (SQ): US Payments Software. Square announced earnings which disappointed markets pushing price down more than 5% in early trade. Jim Cramer ran an interview the day before with COO of Shopify (SHOP) and was interested in the way Shopify offers enabling technology for industry disruption. He added Shopify to the possible buy list for the Action PLus Portfolio.

In discussing the Square results, he alluded to the discussion on Shopify and said Square was the same sort of deal - an enabling technology. His view was the earnings drop offered a good discount to buy in. I followed that idea. Maybe I was emboldened by Afterpay Touch (APT.AX) making it to the 56 Percent Club I reviewed the day before. I added a quarter position in one portfolio. I will review Shopify as part of that same theme - enabling eCommerce technology.

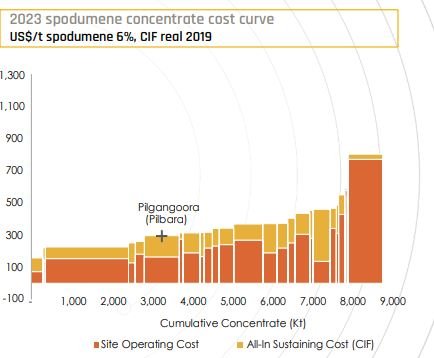

Pilbara Minerals Limited (PLS.AX): Australian Lithium. I wrote in TIB409 about the relationship between Pilbara Minerals and Korean steel producer, Posco (PKX). I read through their latest corporate presentation. What struck me was 23 year life of mine (and still more developments to extend that) and close access to port and transport infrastructure (in Western Australia), with progressive ramping up of production. The projected cost profiles are encouraging - not the cheapest or the largest but in the top 3 on both dimensions. The future direction includes moving into downstream chemical manufacture as well.

Source: Roskill Lithium Cost Model.

I bought a small parcel on an up day. Nice to see price move another 6% on the day after. Now this price move comes as Wesfarmers (WES.AX) bids for Kidman Resources (KDR.AX), another Australian lithium explorer. This is a little frustrating as I was researching Kidman just last week and did not take action as I was short of cash in my Australian brokerage account - just missed a 48% price premium.

Sold

Tidewater was Gulfmark Offshore (TDW): Offshore Oil Drilling. Next partial fill (15 warrants) for 64% profit since December 2017 on December 24 Strike 100 call warrants. A long way to go to clear 1800 warrants selling this few at a time. Broker continues winning nicely = $1 brokerage out of $9.25 profit.

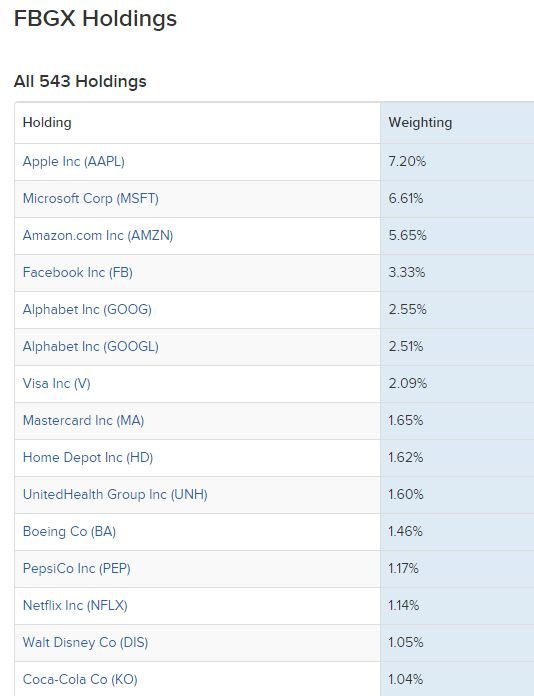

UBS AG FI Enhanced Large Cap Growth ETN (FBGX): Growth Index. This exchange traded note (ETN) invests in a range of growth stocks. The FANG stocks plus Microsoft (MSFT) account for over 25% of the holdings. The holdings looks like a who's who of growth stock plus leading consumer staples, like Pepsico (PEP) and Coca Cola (KO).

https://etfdb.com/etf/FBGX/#etf-holdings&sort_name=weight&sort_order=desc&page=1

With the heavy weighting to FANG plus Microsoft, the fund is subject to swings in outflows based on drops in just a few stocks. Now this current earnings season has been mostly positive for the 6 stocks apart from Alphabet (GOOGL), Google parent. If the market goes soft on these top stocks the fund suffers disproportionately. Time to bank some profit in one portfolio for 17% blended profit since November 2018.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $118 (2.2% of the low). Price keeps moving ahead steadily with what is often call 3 White Soldiers formation. This is often seen as a sign of a reversal especially coming up to a resistance level. So do not be surprised to see price take a breather and look to consolidate before having a big go at $5547.

Ethereum (ETHUSD): Price range for the day was $6 (3.7% of the high). Price action for Ethereum is completely different with price trading lower around the level of the short term resistance line opening and closing within cents of $158. Hard to tell which way this wants to go - momentum indicator (lower window) suggests up as it has just made a higher high while price made a lower high.

CryptoBots

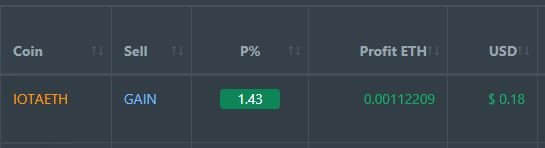

Profit Trailer Bot One closed trade (1.43% profit) bringing the position on the account to 7.11% profit (was 7.09%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 2 trades on USDCHF and EURCHF for 0.08% profits for the day. Trades open on AUDNZD (0.01% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Wall Street Journal. Pilbara cost image is credited below image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

May 2, 2019

For a smart guy, Elon is sure eating his words having to go out and raise capital with these prices and sentiment towards the stock! Seems like a desperate time to seek capital in my opinion.

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had a few partners like him. Super smart but not that astute especially on timing for such things as capital raising. A lot of the price pressure was coming from the modelling of cash flows and slow ramp up of Model 3. When we see what discounts IPOs are coming out at, I think he is smoking something thinking that he will get away with $243. He is playing a game of chicken with existing shareholders who will not want to get diluted after holding on through the last pullback. I will be watching day by day - going to guess implied vol will jump and I can exit at a profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Although Tesla got more cash from the equity markets, I think Tesla is going to test $200.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Timing will be the key for me. I think they are going to run into the IPO train. Too much supply of new investments chasing too few investment funds

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit