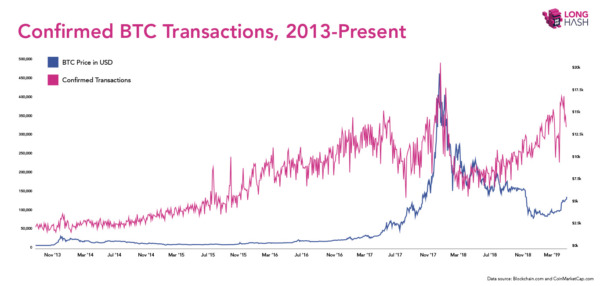

Many people look at the outsized returns of crypto in the last few years and see people making extraordinary gains with relatively little amounts of starting capital invested. This was particularly true for those who participated early in the alt coin rush of 2016 and 2017 with most if not all the alt coins making significantly larger gains than Bitcoin itself.

However, one of the biggest problems aside from allocating money at the peak of the cycle, is the allotment size itself. People expecting to see 10x, 100x dare I say it, 1000x and therefore putting in relatively safe amounts of money and expecting to make life changing money in a short period of time.

I believe this to be a safe strategy but ultimately not the most ideal strategy if your goal is to make truly life changing sums of money especially after the last cycle and subsequent washout of the altcoins in what is going to be known in history as one of the largest boom and bust cycles ever witnessed.

You see, the people who made life changing money and secured a lifetime of financial freedom did not invest with shoestring budgets. I had a friend who asked me about what coin I should be buying in the heat of the bull market of 2017 and I asked him it depends on a lot of things but let's start with your risk tolerance and expectations. He replied saying that he wanted to make the 100x or more that he was hearing from other people and that he was only risking money he was willing to lose - not an unfamiliar answer and I suspect very similar to the legions of people who participated in the last bull market.

However, the most frequent advice you'll ever hear is "only invest what you're willing to lose." How much is that exactly? 1% of your net worth? 10%? The spare green backs in your wallet? It really depends on much more than the amount your comfortable with because human beings are emotionally intertwined with the state of the market such that their allocation can actually vary depending on whether they're feeling panic, despair or excitement and euphoria.

A lot of the people who initially bought in in the latter stages of the bull market and saw some moderate gains ended up regretting not buying more, and at an earlier time. After battling with themselves and ultimately succumbing to their emotional fragility, they ended up piling in near the top with much more than they ultimately should have at the time and paid the price for their greed.

Why didn't they allocate that amount earlier, near the bottom? Because no one else was talking about it, or even many that were interested. Human beings are psychologically wired to follow others exactly like a sheep in a herd. We let ourselves get influenced by what everyone else and the mainstream are thinking because we feel security and reassurance when others are echoing the same sentiments.

This is exactly most of the paper millionaires created in the last cycle have had almost all of their gains wiped out and then some. Sadly, for such a promising and utilised coin such a STEEM, it was no different. Infact, Steem had comparatively smaller gains in the altseason, and collapsed quite a lot more than many other coins in the top 100.

What to do?

Well, first you need to look at what projects survived the exodus and haven't shut down or abandoned the project all together, and look at some of the fundamentals in tandem with technicals. Alt coins are influenced much more by fundamentals than technicals because they are not highly or widely distributed and there hasn't been enough price action history to perform reliable technical analysis.

Fundamentals aside, you have decided on which coins you feel have promising long term outlooks and you now decide on how much to allocate. Remember the story about people who initially allocated what they felt was comfortable at the time and then ultimately ended up allocating more at the top only to lose it all? Yes, those people felt uncertainty initially, and then certainy near the top. In other words, on a spectrum of probability, they allocated the size based on how certain they thought their investments would pay off.

Flip the mindset around and you have your answer. If fundamentally, the coin/project is sound and is doing better than ever -- some metrics might include more active users, higher average number of transactions, consistent updates on development etc. Then the more uncertain the market feels, the more certain YOU should feel.

I'm sure we've all heard, buy when there's blood in the streets? Well that the psychology which allows large interests to make money off the backs of the large majority of people who don't understand market psychology. We are better than that. Take some time to think about this reverse psychology and really try to understand the dynamics at play here.

The same psychology applies with allocation sizes. Allocate the amount that you would have if you were greedy seeing everyone making outsized gains, and left you wanting a piece of the pie. That, is ultimately the amount that will ultimately make you life changing sums of money.

Safety in numbers does not work.

Safety in conservative allocation does not work.

Safe investments do not exist.

Parking your money in a "high" interest savings account is about as safe as you can be with your money, and look at the returns you'll get, 1% ? The reason you get so little is that there is a real opportunity cost to siding with safe and not risky.

You cannot expect to make large rewards, if the allotted amount to risk is not large enough to make the rewards worth your time.

I am not a financial adviser so I will not tell you how much money to allocate, but I will say, $100, $1000, or amounts with similar orders of magnitude are -not- going to make you financially secure for the rest of your life. Not in the west or developed world anyway. You may walk away with a 5 digit gain, but that's not exactly financial freedom is it? And it's certainly not financial freedom for the rest of your life.

Don't regret not buying more. Allocate what you can REALLY live without.

Congratulations @holdo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit