The velocity of money.

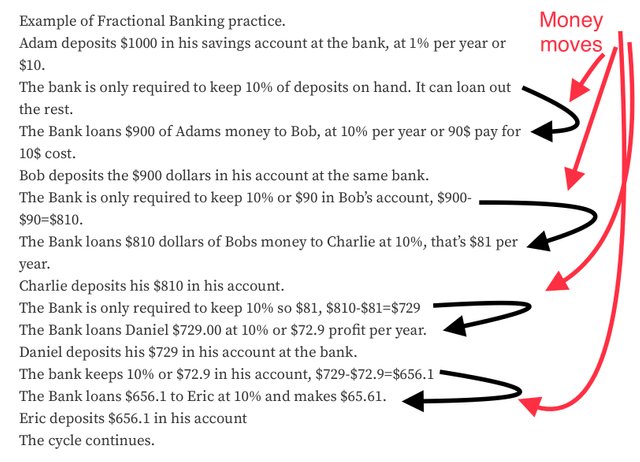

In banking there is a term called the velocity of money, which refers to the movement of money, but more specifically the movement of money from places of low or no yield to places of higher yield. This movement of money, in this fashion, for this purpose, is an important component of bank profits. In my previous post, Fractional-banking-and-the-velocity-of-money-perfected-by-banks-but-available-to-consumers-to-pay-debts, I Explained how banks conduct Fractional lending, but what I also illustrated was how they move money from low yield environments to high yield environments.

For example every time the bank gave someone a loan, the person deposited it in their checking account, which is a low yield environment paying 1% interest usually, and the bank moved 90% of that money to a high yield environment, which was another loan paying the bank 10% interest. In my previous article I also showed how the bank continued to cycle money until there wasn’t enough to loan.

Money is moving out of these checking accounts into loans, into checking accounts and then into loans, then into checking accounts and again moves out into loans. Because of Fractional lending, the bank can put money in and take money out and lend it again. You can do the same thing with credit cards.

Scenario: You have five credit cards, each has a monthly payment of $200, for a total of $1000.00 in payments each month. At the beginning of the month you had an unexpected car repair bill for $400. You need your car, you have no choice, you pay the bill. The problem is your budget doesn’t allow for repairs. So after paying, rent, food, water and electricity you only have $600 left over to pay your credit card bills, but you need $1000. Initially you are distraught because you can’t pay two of your credit cards. But then you remember reading an article on Steemleo about Fractional Banking and the Velocity or movement of money. You know that if you pay those credit card bills you can go out and charge items on them because they are revolving accounts, essentially high priced lines of credit. You decide that if the bank can loan people money, then borrow 90% of it to loan to someone else, you can also. So you decide to pay the credit cards, then borrow the money back to pay the others. You check and make sure your cards are in good standing, your balances are not maxed out, you check the due dates and you figure out which ones you can borrow from and there is one you can’t, but it has the last due date, so you decide to pay it last. This is what you do next:

You start the movement of money by paying $600 to credit card A, it goes into your account, you are credited 600$ to your account balance.

You wait a few days and then you withdrawal $500 from credit card A and use it to pay $500.0 to credit card B, you wait a few days until $500.00 is credited to your balance.

You then withdrawal $400 from credit card B and use it to pay $400.00 credit card C, and you wait a few days until the $400.00 is credited to your balance.

You then withdrawal 300$ from credit card C and use it to pay credit card D, you wait a few days until you are credited 300$ to your balance,

You then withdrawal a 200$ from credit card D and use it to pay $200 to credit card E.

Now with $600.00 you paid $1000.0 worth of bills. This is referred to as the movement of money!

The fine details involve having revolving lines of credit, methods to withdrawal money, and waiting until the payments are due to withdrawal money to benefit from reduced principle balances.

Some of you may feel like this is borrowing from Peter to pay Paul, and it is, but that’s how Fractional lending practiced by banks works and it’s not illegal, and it allows your money to accomplish more then one task. Keeping the money moving is what velocity banking is all about. Money left in your checking account or your credit cards is stagnant and isn’t working to earn you interest or save you interest.

Additionally, this example illustrates another concept called opportunity cost. In this example you were paying off debts, but once you understand the utility here you also can start to understand the concept of opportunity cost. You could have paid three cards $200 dollars each and defaulted on your other two cards and incurred both late fees and additional interest charges, if you let those three $200 dollar payments remain stagnant on those cards, that money would not be moving. By allowing that money to remain stagnant you lost the opportunity to move it around and pay two more bills with it. You would have also lost the opportunity to avoid late charges on two cards and the opportunity to avoid additional interest. Leaving money stagnant has opportunity costs.

Did you know that paying cash or investing all your money in one investment has opportunity cost?

We will discus that in my next article on opportunity costs.

✍🏼 written by Shortsegments.

P.S.

If you didn’t read my previous post: Fractional-banking-and-the-velocity-of-money-perfected-by-banks-but-available-to-consumers-to-pay-debts this is a good time to review it here Link

Good post

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much for your comment

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for posting from the https://steemleo.com interface 🦁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You’re welcome

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit