Cryptocurrencies are here to stay and even though the journey was slow and filled with pitfalls, Cryptocurrencies are now gradually being seen as a force to be reckoned with. In Early 2018, the cryptocurrency market capitalisation hit over $800bn. But with all the leaps and bounds that cryptocurrency has made, there are still some obstacles that are still to be scaled because presently, most traditional financial institutions like banks do not see cryptocurrency as an asset. This simply means that you cannot use your cryptocurrency as a collateral to access credit.

For Example, Julie is a cryptocurrency trader who seems to have a knack for the trade, she always seems to know when and where to invest for maximum profit, her cryptocurrency portfolio was quite impressive and she was quite proud of it and didnt want to sell any single coin she had because she knew that keeping it for some period of time would yield her a nice profit, One day she needed money urgently to solve a personal issue, she knew that her best shot of getting that money would be to apply for a loan in a bank, unfortunately when she tried to do it, they refused to accept her cryptocurrency portfolio as a collateral for the loan, Julie knew she would have to sell some of her coins in other to raise the money, this made her sad.

Have you ever wished for a plaform where you can use your cryptocurrency as a collateral for loans? Have you yearned for a platform where you can access credit anywhere and anytime no matter your location in the world? Have you ever wished for a platform that would not put you through a rigorous Customer verification process that might drag out for weeks before your loan is approved and disbursed? If your answer to these questions is Yes, Then i have very good news for you, such a platform does exist and it's name is Libra Credit.

How does it work?

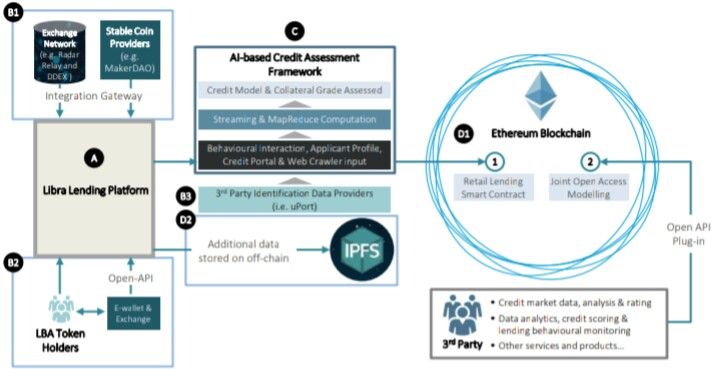

Libra Credit is a decentralised playform where you can access credit from anywhere and at anytime, because it uses the distributed ledger network called Blockchain, Transactions are open,fast and transparent, it is powered by the Ethereum network. Libra Credit is poised to revolutionise the way we access credit, The platform aims to revolutionize the Global credit market by introducing a new solution to all the problems are facing traditional credit access.

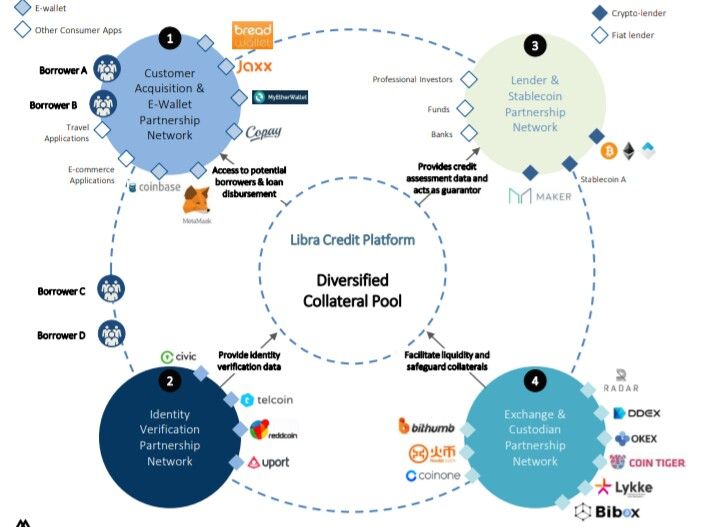

Through strategic partnerships with KYC providers, Libra Credit is able to expediate the process of customer verification and through partnerships with exchanges, Libra Credit would easily be able to provide instant liquidity between fiat and cryptocurrency. And Because of Blockchain technology, it can provide a true peer-to-peer lending experience using smart contracts in the Ethereum blockchain.

Problems encoutered in traditional credit markets and how the Libra Credit Ecosystem would solve them:

• Access: you can access credit anywhere and anytime no matter your location.

• Collateral: With Libra Credit, you can be able to have the best of both worlds, you can access credit without having to sell your cryptocurrency assets, you can just use it as a collateral.

• KYC: In traditional institutions, customer verification process can be very tedious and time consuming, with Libra Credit's strategic partnerships, the KYC process is very fast and easy.

• Liquidity: With Libra Credit's strategic partnerships with exchanges, switching between fiat and cryptocurrency is a problem of the past.

Token & Tokensale Details

The Libra Credit Token would be used to pay all fees in the platform such as Platform access fees, loan application submission fees & transaction fees and it would also be used to pay all rewards in the platform as well such as referral bonus.

Token Ticker: LBA

Token type: Ethereum (ERC20)

ICO Token Price: 1 LBA = $0.1

Hardcap: $26,400,000

Total Supply: 1,000,000,000

Available for Token Sale: 40%

The Libra Credit Team & Advisors

Partnerships & How they would contribute to the Ecosystem

RoadMap

Investors

If you want to find out more about this revolutionary project, check out the links below:

Website: https://www.libracredit.io

Whitepaper: https://www.libracredit.io/page/Libra_Credit_Whitepaper.pdf

Telagram: https://t.me/libraofficial

Twitter: https://twitter.com/LibraCredit

LinkedIn: https://www.linkedin.com/company/18560125/

Medium: https://medium.com/libracredit

Is token sale still ongoing?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes sir,it has been successfully cincluded and it hit it's hardcap.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

How do i get an assurance that this isn't like the rest of other ICOs

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You can read the reviews about it, this is definitely a very good project ranging from the team to the product. As you can see it solves a real life problem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow! What an awesome project. Thanks for the detailed explanation.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hope am not late to invest?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

They have powerful paetnerships

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

When is this coin going to be launched?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A spectacular project to be watched put for

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Impressive, remarkable write-up and an exceptional project!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit