Stock Market Trading

Investing in the stock market is the easiest way to get money and vice versa, the great advantage of small an investment depends on the capital you have. Every investment has a certain risk that should be known by investors, not just profits only should you think about when plunged into the world of capital markets, you also need to know how to minimize the least possible risk of loss that you will face when trading, especially if you are a beginner. therefore, before you plunge into the world of the stock market it is good you must first learn the rules and what provision you should prepare before plunging into the world trading to minimize losses you will face and to increase the profits of your balance. Each prospective investor, you should understand the basic fundamentals of trading stocks before you decided to jump into the world of the stock market and also must have a strong desire and diligent diligently read well on the internet just as the posts of others, newspapers, books, magazines, and so the more you read Similarly the more you know and the more mature you also pick stocks that suits you.

There are some things that really need to be noticed

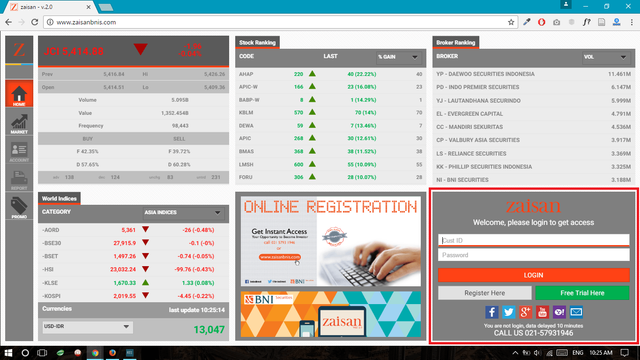

1. Registration of securities

One of the requirements to be able to invest in the stock market is that you have to open an account securities or as another broker, securities or broker is a broker, if in Indonesia securities that has been known as securities bni, securities independently, sekurtas bca and much else, early registration requirement is very easy and cheap to the current Area of the millions, it was very different when I first list about 10 years ago the initial account opening of at least 5 million, it's not For registration is very easy as we open an account regular savings account different this account there should be a tax ID number (resident taxpayer), after our account active later in a savings account we have two options account balances and account checking if the account balance was especially for savings while the giro account specifically for stock trading, if for example you have money in the account balance of two million to trade stocks you should move first account money in the account balance checking, when it entered into the account you are able to do transactions on the stock exchange. Before you buy the stock first you have to frequently ask what stocks are good for you.

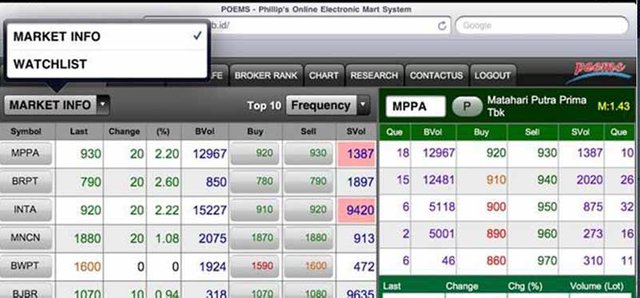

2. Election of stocks

It is an absolute requirement to do well as an investor (who buy shares and keep it within long term) and traders (who buy and sell in the short term to buy the morning selling in the afternoon), choose which stocks are suitable for you if you are a trader and must be careful selecting stocks that fast movement, if you are an investor you should analysis fundamental and technical companies carefully. And not only that but also have to carefully read the situation and condition of the company, whether the company is healthy or not, and do not forget to follow all the information that was going to avoid the risk.

3. Important technical analysis

This is one way of analyzing companies you want to buy is usually the analysis is the most widely used by investors, not traders, the purpose of analyzing the company is that you do wrong in buying shares you want to buy, and also the right moment when you should buy and when will you have to sell it, also you need to know. You must often observe the stock market in order not to go wrong in buying, pay attention to the economic conditions in the country and abroad every government policy, why not? Because the dollar is also affecting the ups and downs of a stock price, the stock you choose which you think will have a bright outlook for the future.

4. Avoid put your maney in one bucket

Avoid put your maney in one bucket said Warrant Buffet, so do not ever put all your money in one type of stock, because at any time the shares could fall or rise precipitously, if the increase was not a problem, the problem when the price fell to the lowest price and will never wake up again, while your expectations only on the shares, if your money is in stocks else though stocks had been down but you still have another stock that gives you an advantage. This is one way to avoid the risk, choose some types of stocks and never too fond of one type of stock that will make you lose your money.

5. Must be meticulous in pick Securities or Broker

It's very important for you to know, because experts is the end of this very many brokers who do not have a license so that people are stuck with a tempting offer, to avoid this make sure every broker or securities you want to open must be registered with the FSA (Financial Services Authority), and check liquidity also brokers that you register as a guarantor of your Exchange or you can visit the official website of the Stock Exchange (Stock Exchange Indonesia) to check a variety of information about the company.

nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

it would help the others people with this post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you for your good comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

GOOD ARTICLE FOR BEGINNING INVESTORS.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good information..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you dude for your comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit