SUMMARY

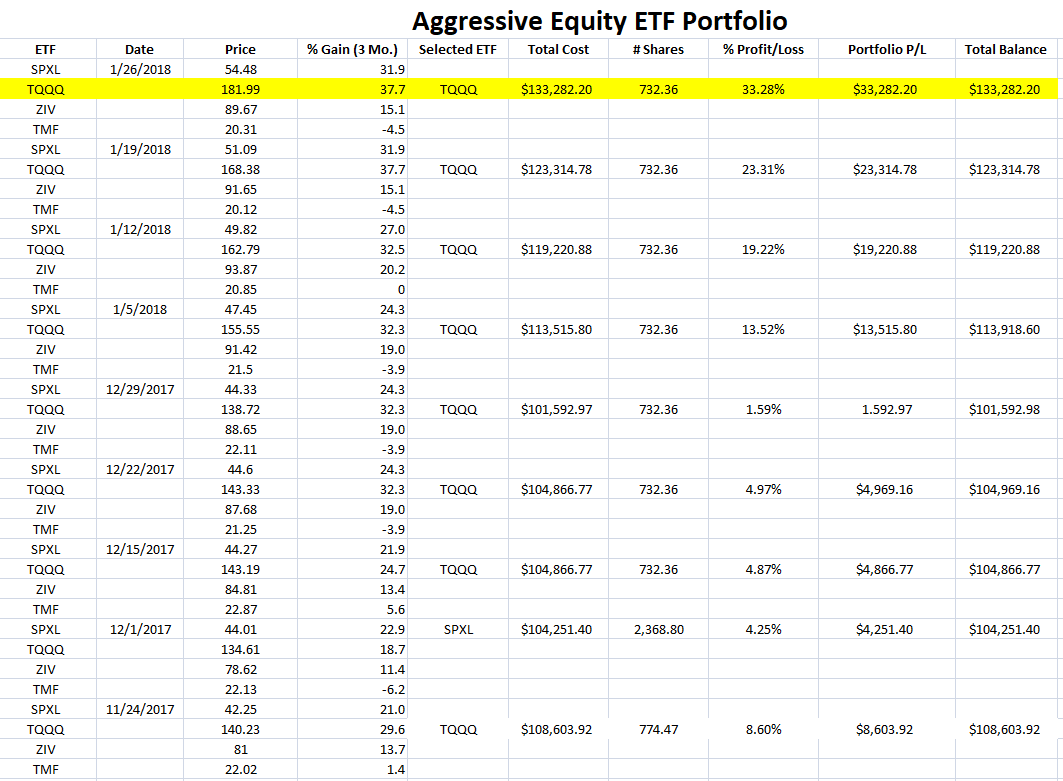

And it's Friday so it's that time of the week! The Aggressive ETF portfolio has now returned 33.28% since Nov. 3, 2017!! This is the portfolio that is based on simply running a 3 month performance check on the following Electronically Traded Funds (ETF): SPXL, TQQQ, ZIV and TMF.

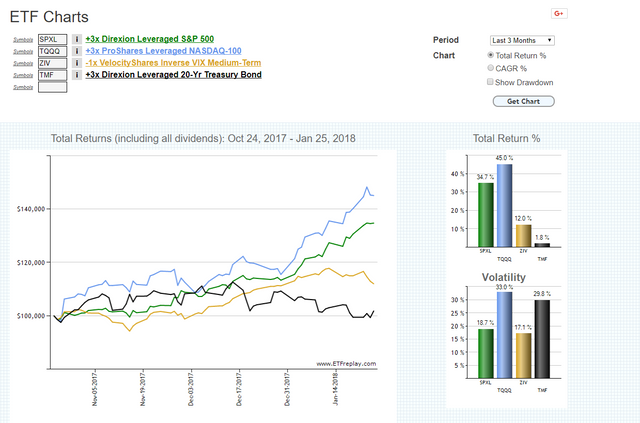

Every Friday, I run the below chart and simply look to see which ETF "horse" is winning with the highest % return. This is now the seventh week where TQQQ has been the return winner and so, I've left my money in it. Thereby, following a simple trend. Yes, this method is a simple trend following method and back testing has shown 47% to 78% returns per year. Wow!

Legal Disclaimer: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

BTC fractals

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hopefully this is the last of these downside fractals!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congrats! Thanks for being so generous with your knowledge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If you own Bitcoin right now your portfolio might be in danger: https://steemit.com/bitcoin/@investingtips/textbook-symmetrical-triangle-on-btcusd

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please can someone explain to me why the inverse VIX is in here? Surely if there is a crash in the market then the VIX will skyrocket, and if this fund is shorting it then it will lose a lot of money? What is the benefit of having it instead of just SPXL, TQQQ and TMF?

Thank you for anyone who takes the time to reply!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lovely statistics well presented pictorially.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Lovely statistics well presented pictorially.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@haejin, I noticed you are posting aggressive ETF results every week now. Are you suggesting rebalancing every week now or do you still recommend rebalancing every two weeks?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

this might help us in our trading decisions :) check below link . . .

https://steemit.com/stocks/@grezsr/your-trend-is-your-friend-stock-market

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your post received one of the top 10 most powerful upvotes in the last 12 hours. You received an upvote from @ranchorelaxo valued at 463.98 SBD, based on the pending payout at the time the data was extracted.

If you do not wish to receive these messages in future, reply with the word "stop".

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @haejin, this post is the eighth most rewarded post (based on pending payouts) in the last 12 hours written by a Hero account holder (accounts that hold between 10 and 100 Mega Vests). The total number of posts by Hero account holders during this period was 397 and the total pending payments to posts in this category was $18822.33. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Those aren't cryptocurrencies. They are leveraged ETFs (electronically trades funds). Trends that in strong in one direction tend to continue. He is just taking advantage of this incredible bull market with triple long funds meaning, if the index the fund follows goes up 1%, then his fund goes up 3%. It applies to the downside as well, so when the trend turns, you have to be quick to get out so you don't lose your gain.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

If the indices tank, the TMF (Treasury long term) will be the new winner and so you put the money into the TMF! That's why I have the TMF as one of the four, it'll take you out of the stocks and into the safety of treasuries during market declines.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@haejin What do you think about adding UGLD (3x Gold) to this portfolio? Could gold prices spike in the event of a larger market correction? Thank you for your time and I appreciate your insight.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

por que están marcando nuestros comentarios com spam

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit