I just finished this video on broken wing butterfly’s.

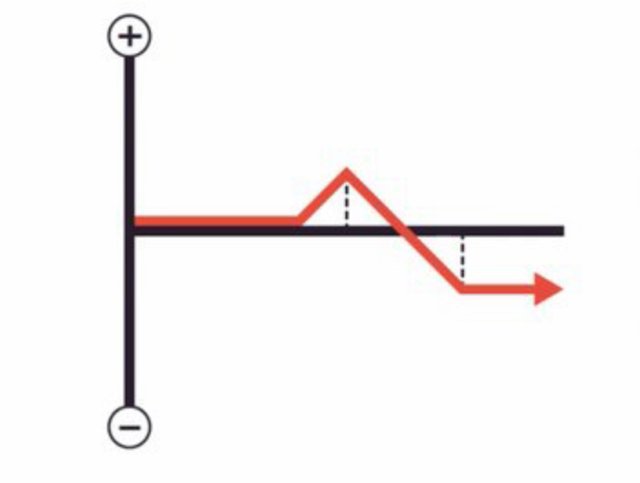

This is a option spread created like a regular “Butterfly” spread, except skip one strike to create an unbalanced spread. You buy one ITM call, you sell two OTM calls and you skip a strike and buy one OTM call. The Strike prices are one dollar apart and you receive a 0.30 credit, thus the maximum loss is 0.70. This is a trade made during high volatility, so the prices fall as volatility falls and time decay further reduces the value of the positions. This creates a good opportunity through a high probability trade with very little risk to the down side and a small chance of a lottery ticket type win of the spread between the strike one point, plus the credit.

The option trade diagram looks like this:

You can watch the video here:

Author Bio

Kirk Du Plessis

Founder of Option Alpha, a Private Options Investing Company and Options Educations Source. Kirk Du Plessis, Founder Options Alpha. Formerly an Investment Banker in the Mergers and Acquisitions Group for Deutsche Bank in New York and REIT Analyst for BB&T Capital Markets in Washington D.C., he's a Full-time Options Trader and Real Estate Investor. He's been interviewed on dozens of investing websites/podcasts and he's been seen in Barron’s Magazine, SmartMoney, and various other financial publications. Kirk currently lives in Pennsylvania (USA) with his beautiful wife and three children.

This post written by ✍️ By Shortsegments

Read other articlesby me on the Steemit Social Media Platform, where writers get paid for their content by the community by upvotes worth the cryptocurrency, called Steem.

Please follow my separate Steemleo investment Blog

Please follow my Twitter Feed Here

Options trade education looks good

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit